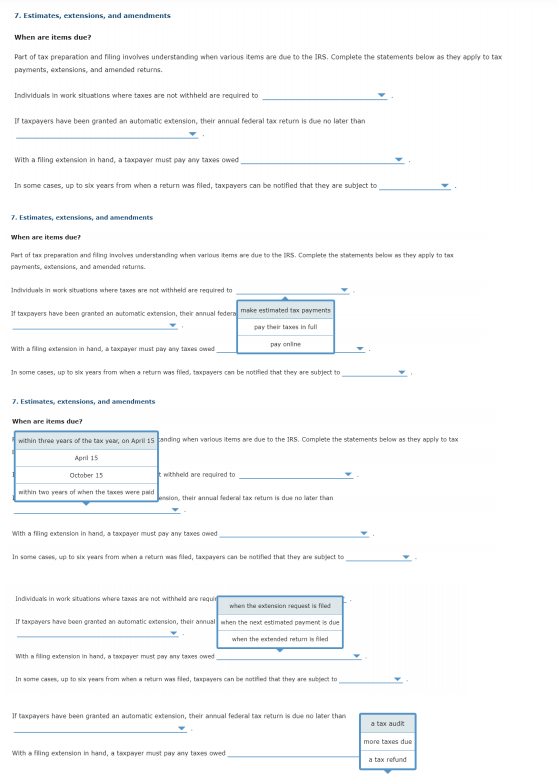

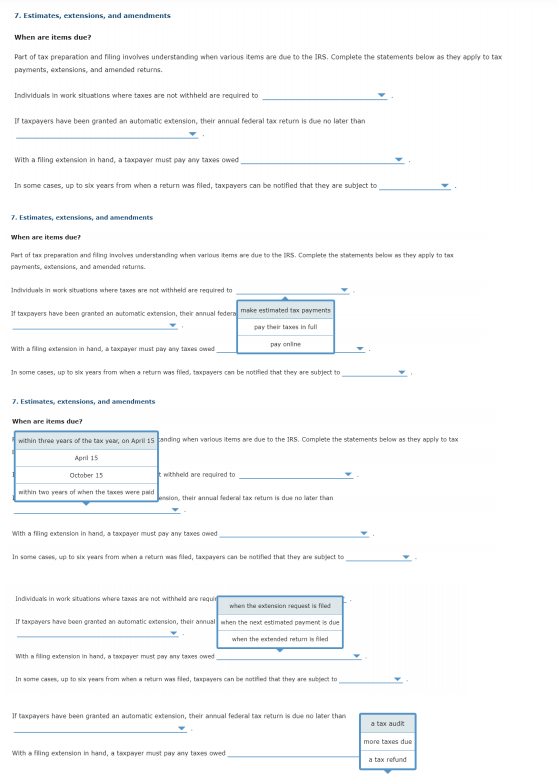

7. Estimates, extensions, and amendments When are items due? Part of tax preparation and filing involves understanding when various items are due to the IRS. Complete the statements below as they apply to tax payments, extensions, and amendedreturns Individuals in work situations where taxes are not withheld are required to If taxpayers have been granted an automatic extension, their annual federal tax return is due no later than With a filing extension in hand, a taxpayer must pay any taxes owed In some cases, up to six years from when a return was filed, taxpayers can be notified that they are subject to 7. Estimates, extensions, and amendments When are items due? Part of tax preparation and filing involves understanding when various items are due to the IRS Complete the statements below as they apply to to payments, extensions, and amended retums. Individuals in work situations where taxes are not withheld are required to It taxpayers have been granted an automatic extension, the annual federal make estimated to payments pay their tanes in full with a filing extension in hand, a taxpayer must pay any taxes Owed Day online In some cases, up to six years from when a return was filed, to payers can be notified that they are subject to 7. Estimates, extensions, and amendments When are items due? within three years of the tax you, on April 15 panding when various items we due to the RS. Complete the statements below as they apply to tax April 15 October 15 withheld are required to within two years of when the wes were paid on, their annual federal tax retum is due no later than with a fling extension in hand, a taxpayer must pay any taxes owed In some cases, up to six years from when a return was filed, taxpayers can be notified that they are subject to Individuals in work situations where taxes are not withheld are requir when the extension request is filed Ir taxpayers have been granted an automatic extension, their annual when the next estimated payment is due when the extended return is filled With a filing extension in hand, a taxpayer must pay any taxes owed In some cases, up to six years from when a return was filed, taxpayers can be notified that they are subject to I taxpayers have been granted an automatic extension, their annual federal tax return is due no later than a tax auda more taxes due with a fling extension in hand, a taxpayer must pay any taxes owed a tax refund 7. Estimates, extensions, and amendments When are items due? Part of tax preparation and filing involves understanding when various items are due to the IRS. Complete the statements below as they apply to tax payments, extensions, and amendedreturns Individuals in work situations where taxes are not withheld are required to If taxpayers have been granted an automatic extension, their annual federal tax return is due no later than With a filing extension in hand, a taxpayer must pay any taxes owed In some cases, up to six years from when a return was filed, taxpayers can be notified that they are subject to 7. Estimates, extensions, and amendments When are items due? Part of tax preparation and filing involves understanding when various items are due to the IRS Complete the statements below as they apply to to payments, extensions, and amended retums. Individuals in work situations where taxes are not withheld are required to It taxpayers have been granted an automatic extension, the annual federal make estimated to payments pay their tanes in full with a filing extension in hand, a taxpayer must pay any taxes Owed Day online In some cases, up to six years from when a return was filed, to payers can be notified that they are subject to 7. Estimates, extensions, and amendments When are items due? within three years of the tax you, on April 15 panding when various items we due to the RS. Complete the statements below as they apply to tax April 15 October 15 withheld are required to within two years of when the wes were paid on, their annual federal tax retum is due no later than with a fling extension in hand, a taxpayer must pay any taxes owed In some cases, up to six years from when a return was filed, taxpayers can be notified that they are subject to Individuals in work situations where taxes are not withheld are requir when the extension request is filed Ir taxpayers have been granted an automatic extension, their annual when the next estimated payment is due when the extended return is filled With a filing extension in hand, a taxpayer must pay any taxes owed In some cases, up to six years from when a return was filed, taxpayers can be notified that they are subject to I taxpayers have been granted an automatic extension, their annual federal tax return is due no later than a tax auda more taxes due with a fling extension in hand, a taxpayer must pay any taxes owed a tax refund