Answered step by step

Verified Expert Solution

Question

1 Approved Answer

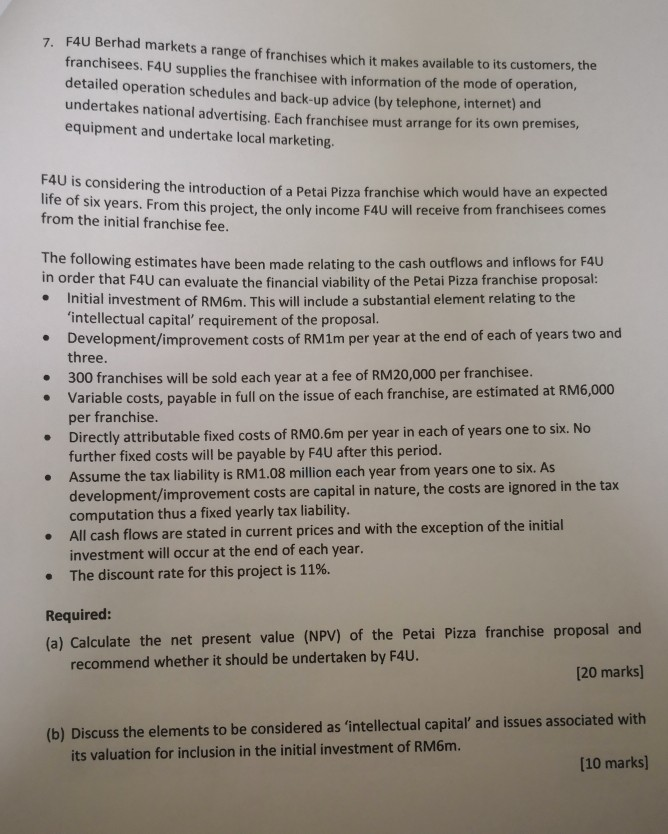

7. F4U Berhad markets a range of franch Markets a range of franchises which it makes available to its customers, the franchisees. F4U supplies the

7. F4U Berhad markets a range of franch Markets a range of franchises which it makes available to its customers, the franchisees. F4U supplies the franchisee with information of the mode of operation, detailed operation schedules and back-up advice (by telephone, internet) and undertakes national advertising. Each franchisee must arrange for its own premises, equipment and undertake local marketing. 4 is considering the introduction of a Petai Pizza franchise which would have an expected OT SIX years. From this project, the only income F4U will receive from franchisees comes from the initial franchise fee. The following estimates have been made relating to the cash outflows and inflows for F4U order that F4U can evaluate the financial viability of the Petal Pizza franchise proposal: Initial investment of RM6m. This will include a substantial element relating to the 'intellectual capital' requirement of the proposal. Development/improvement costs of RM1m per year at the end of each of years two and three. 300 franchises will be sold each year at a fee of RM20,000 per franchisee. Variable costs, payable in full on the issue of each franchise, are estimated at RM6,000 per franchise. Directly attributable fixed costs of RM0.6m per year in each of years one to six. No further fixed costs will be payable by F4U after this period. Assume the tax liability is RM1.08 million each year from years one to six. As development/improvement costs are capital in nature, the costs are ignored in the tax computation thus a fixed yearly tax liability. All cash flows are stated in current prices and with the exception of the initial investment will occur at the end of each year. The discount rate for this project is 11%. Required: (a) Calculate the net present value (NPV) of the Petai Pizza franchise proposal and recommend whether it should be undertaken by F4U. [20 marks] (b) Discuss the elements to be considered as 'intellectual capital and issues associated with its valuation for inclusion in the initial investment of RM6m. [10 marks) 7. F4U Berhad markets a range of franch Markets a range of franchises which it makes available to its customers, the franchisees. F4U supplies the franchisee with information of the mode of operation, detailed operation schedules and back-up advice (by telephone, internet) and undertakes national advertising. Each franchisee must arrange for its own premises, equipment and undertake local marketing. 4 is considering the introduction of a Petai Pizza franchise which would have an expected OT SIX years. From this project, the only income F4U will receive from franchisees comes from the initial franchise fee. The following estimates have been made relating to the cash outflows and inflows for F4U order that F4U can evaluate the financial viability of the Petal Pizza franchise proposal: Initial investment of RM6m. This will include a substantial element relating to the 'intellectual capital' requirement of the proposal. Development/improvement costs of RM1m per year at the end of each of years two and three. 300 franchises will be sold each year at a fee of RM20,000 per franchisee. Variable costs, payable in full on the issue of each franchise, are estimated at RM6,000 per franchise. Directly attributable fixed costs of RM0.6m per year in each of years one to six. No further fixed costs will be payable by F4U after this period. Assume the tax liability is RM1.08 million each year from years one to six. As development/improvement costs are capital in nature, the costs are ignored in the tax computation thus a fixed yearly tax liability. All cash flows are stated in current prices and with the exception of the initial investment will occur at the end of each year. The discount rate for this project is 11%. Required: (a) Calculate the net present value (NPV) of the Petai Pizza franchise proposal and recommend whether it should be undertaken by F4U. [20 marks] (b) Discuss the elements to be considered as 'intellectual capital and issues associated with its valuation for inclusion in the initial investment of RM6m. [10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started