Answered step by step

Verified Expert Solution

Question

1 Approved Answer

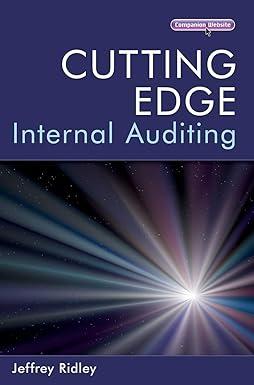

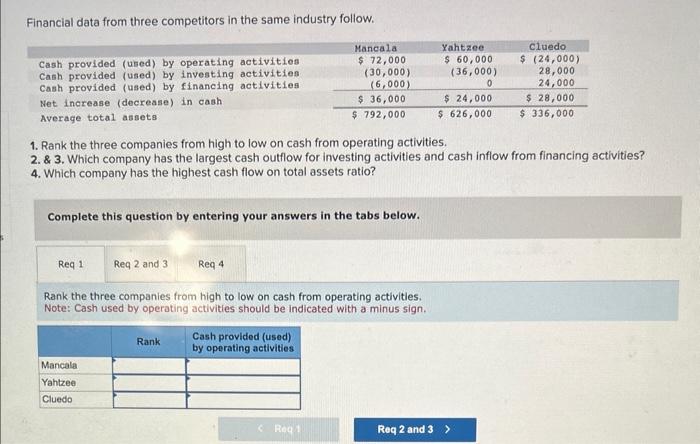

7. Financial data from three competitors in the same industry follow. 1. Rank the three companies from high to low on cash from operating activities.

7.

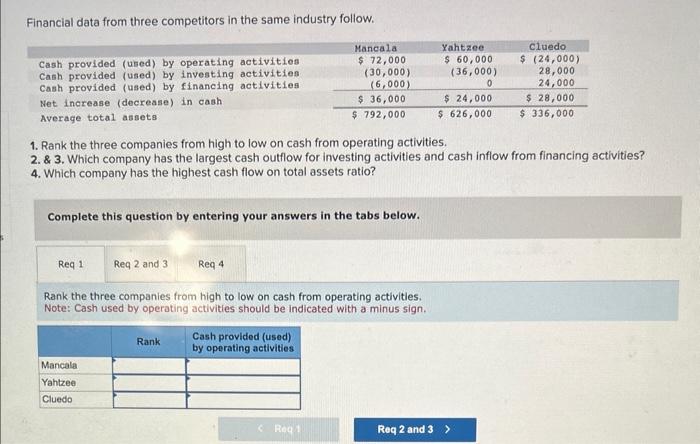

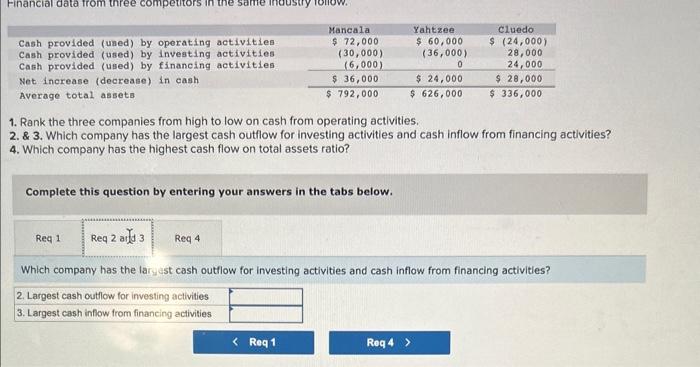

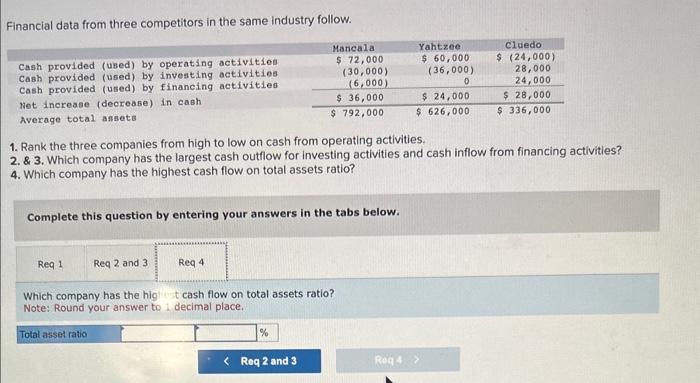

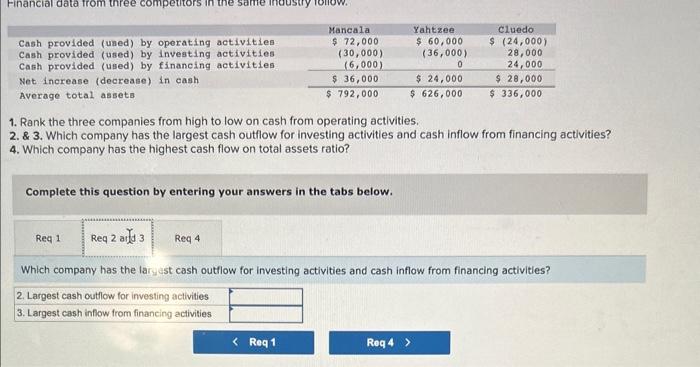

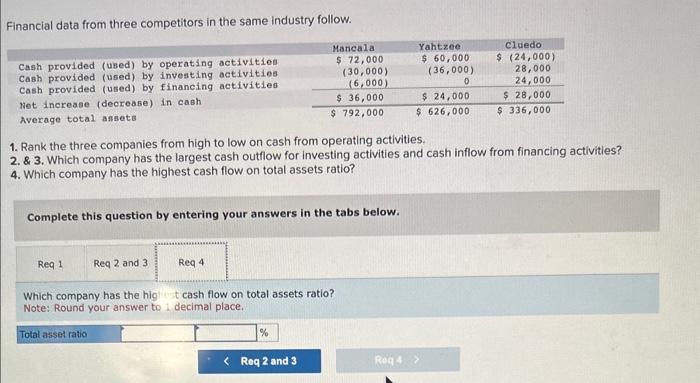

Financial data from three competitors in the same industry follow. 1. Rank the three companies from high to low on cash from operating activities. 2. \& 3. Which company has the largest cash outflow for investing activities and cash inflow from financing activities? 4. Which company has the highest cash flow on total assets ratio? Complete this question by entering your answers in the tabs below. Rank the three companies from high to low on cash from operating activities. Note: Cash used by operating activities should be indicated with a minus sign, 1. Rank the three companies from high to low on cash from operating activities. 2. \& 3. Which company has the largest cash outflow for investing activities and cash inflow from financing activities? 4. Which company has the highest cash flow on total assets ratio? Complete this question by entering your answers in the tabs below. Which company has the laryest cash outflow for investing activities and cash inflow from financing activities? Financial data from three competitors in the same industry follow. 1. Rank the three companies from high to low on cash from operating activities. 2. \& 3. Which company has the largest cash outflow for investing activities and cash inflow from financing activities? 4. Which company has the highest cash flow on total assets ratio? Complete this question by entering your answers in the tabs below. Which company has the higl t cash flow on total assets ratio? Note: Round your answer to 1 decimal place

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started