Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7. Gerald and Pat are buying a condominium for a selling price of $195 000. They are deciding between making a down payment of

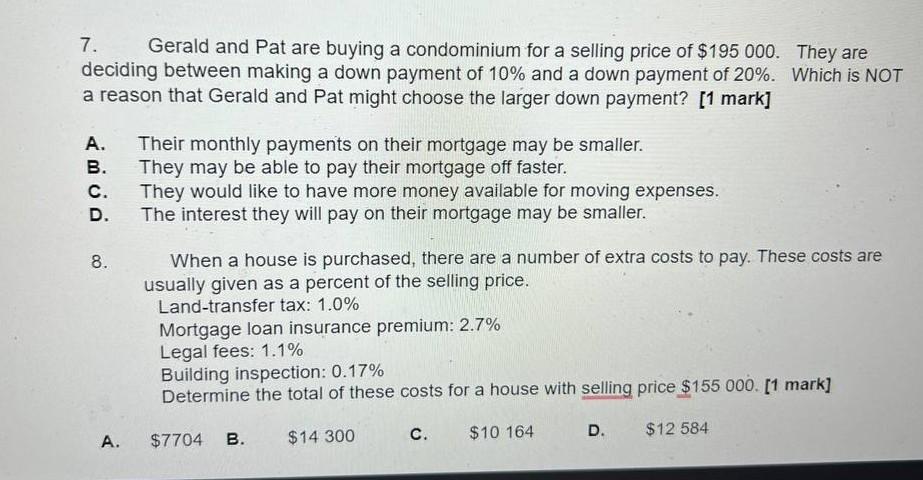

7. Gerald and Pat are buying a condominium for a selling price of $195 000. They are deciding between making a down payment of 10% and a down payment of 20%. Which is NOT a reason that Gerald and Pat might choose the larger down payment? [1 mark] A. Their monthly payments on their mortgage may be smaller. They may be able to pay their mortgage off faster. B. They would like to have more money available for moving expenses. The interest they will pay on their mortgage may be smaller. C. D. 8. A. When a house is purchased, there are a number of extra costs to pay. These costs are usually given as a percent of the selling price. Land-transfer tax: 1.0% Mortgage loan insurance premium: 2.7% Legal fees: 1.1% Building inspection: 0.17% Determine the total of these costs for a house with selling price $155 000. [1 mark] B. $14 300 C. $10 164 D. $12 584 $7704

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below the correct ans...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started