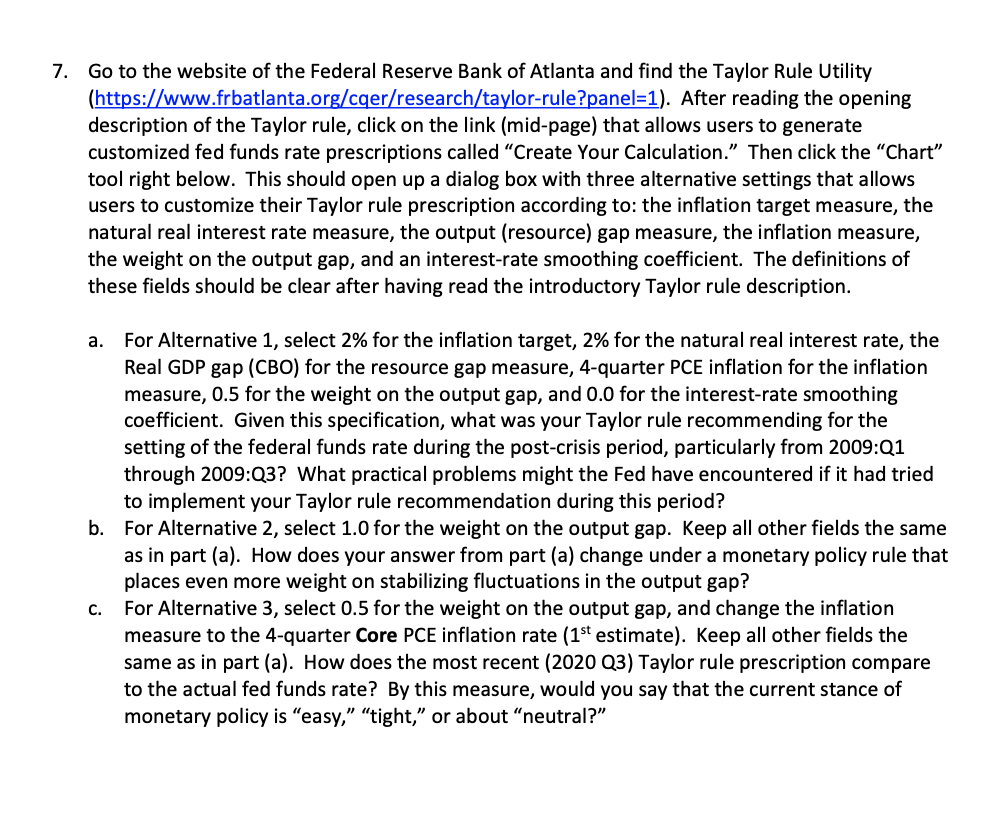

7. Go to the website of the Federal Reserve Bank of Atlanta and nd the Taylor Rule Utility (htt s: www.frbatlanta.or c er research ta lor-rule? anel=1). After reading the opening description ofthe Taylor rule, click on the link (mid-page) that allows users to generate customized fed funds rate prescriptions called \"Create Your Calculation.\" Then click the \"Chart\" tool right below. This should open up a dialog box with three alternative settings that allows users to customize their Taylor rule prescription according to: the ination target measure, the natural real interest rate measure, the output (resource) gap measure, the inflation measure, the weight on the output gap, and an interest-rate smoothing coefficient. The definitions of these elds should be clear after having read the introductory Taylor rule description. a. For Alternative 1, select 2% for the inflation target, 2% for the natural real interest rate, the Real GDP gap ((230) for the resource gap measure, 4-quarter PCE inflation for the inflation measure, 0.5 for the weight on the output gap, and 0.0 for the interest-rate smoothing coefficient. Given this specification, what was your Taylor rule recommending for the setting of the federal funds rate during the post-crisis period, particularly from 2009:Q1 through 2009:03? What practical problems might the Fed have encountered if it had tried to implement your Taylor rule recommendation during this period? b. For Alternative 2, select 1.0 for the weight on the output gap. Keep all other fields the same as in part (a). How does your answer from part (a) change under a monetary policy rule that places even more weight on stabilizing uctuations in the output gap? c. For Alternative 3, select 0.5 for the weight on the output gap, and change the ination measure to the 4-quarter Core PCE inflation rate (1St estimate}. Keep all other elds the same as in part (a). How does the most recent (2020 03) Taylor rule prescription compare to the actual fed funds rate? By this measure, would you say that the current stance of monetary policy is \"easy,\" \"tight,\" or about \"neutral?\