Answered step by step

Verified Expert Solution

Question

1 Approved Answer

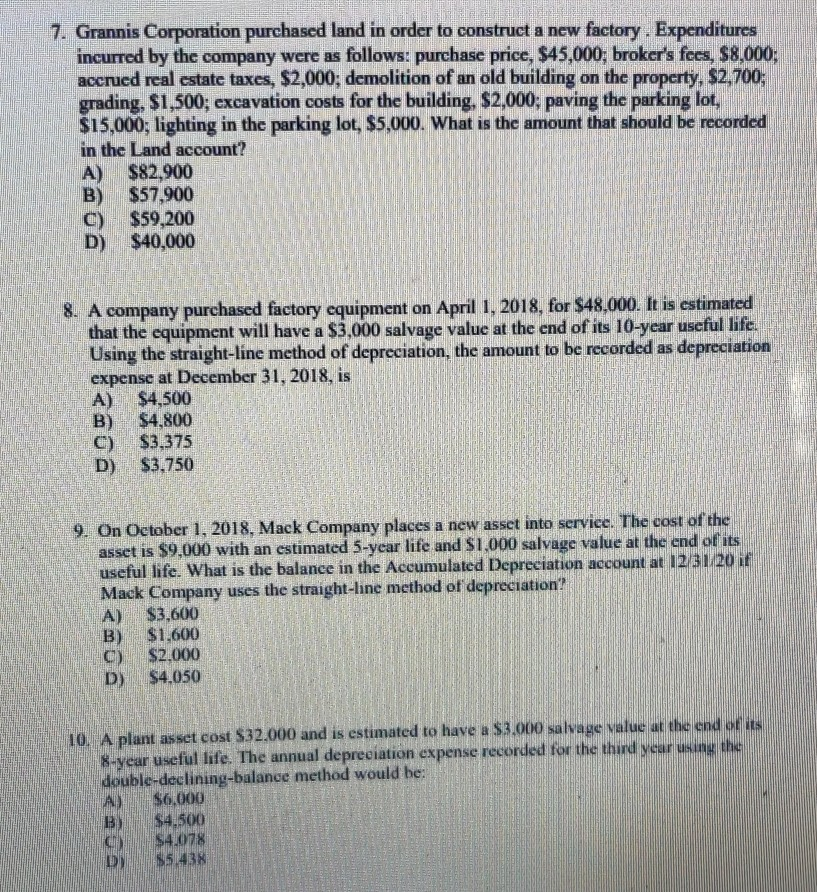

7. Grannis Corporation purchased land in order to construct a new factory. Expenditures incurred by the company were as follows: purchase price, $45,000, broker's fees,

7. Grannis Corporation purchased land in order to construct a new factory. Expenditures incurred by the company were as follows: purchase price, $45,000, broker's fees, $8,000; accrued real estate taxes, $2,000, demolition of an old building on the property, $2,700; grading, $1,500; excavation costs for the building, $2,000; paving the parking lot, $15,000; lighting in the parking lot, $5,000. What is the amount that should be recorded in the Land account? A) $82,900 B) $57,900 c) $59,200 D) $40,000 8. A company purchased factory equipment on April 1, 2018, for $48,000. It is estimated that the equipment will have a $3,000 salvage value at the end of its 10-year useful life Using the straight-line method of depreciation, the amount to be recorded as depreciation expense at December 31, 2018, is A) $4,500 B) $4,800 C) $3,375 D) $3.750 9. On October 1, 2018, Mack Company places a new asset into service. The cost of the asset is $9,000 with an estimated 5-year life and $1,000 salvage value at the end of its useful life. What is the balance in the Accumulated Depreciation account at 12/31/20 if Mack Company uses the straight-line method of depreciation? A) $3.600 B) $1,600 $2.000 D) $4.050 10. A plant asset cost $32.000 and is estimated to have a $3.000 salvage value at the end of its 8-year useful life. The annual depreciation expense recorded for the third yeu double-declining-balance method would be: A $6,000 $4.500 $4.078 $5.438

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started