Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7. How much federal tax will Alex pay this year if the basic personal amount is $13,000 and the taxation rate is 15% for

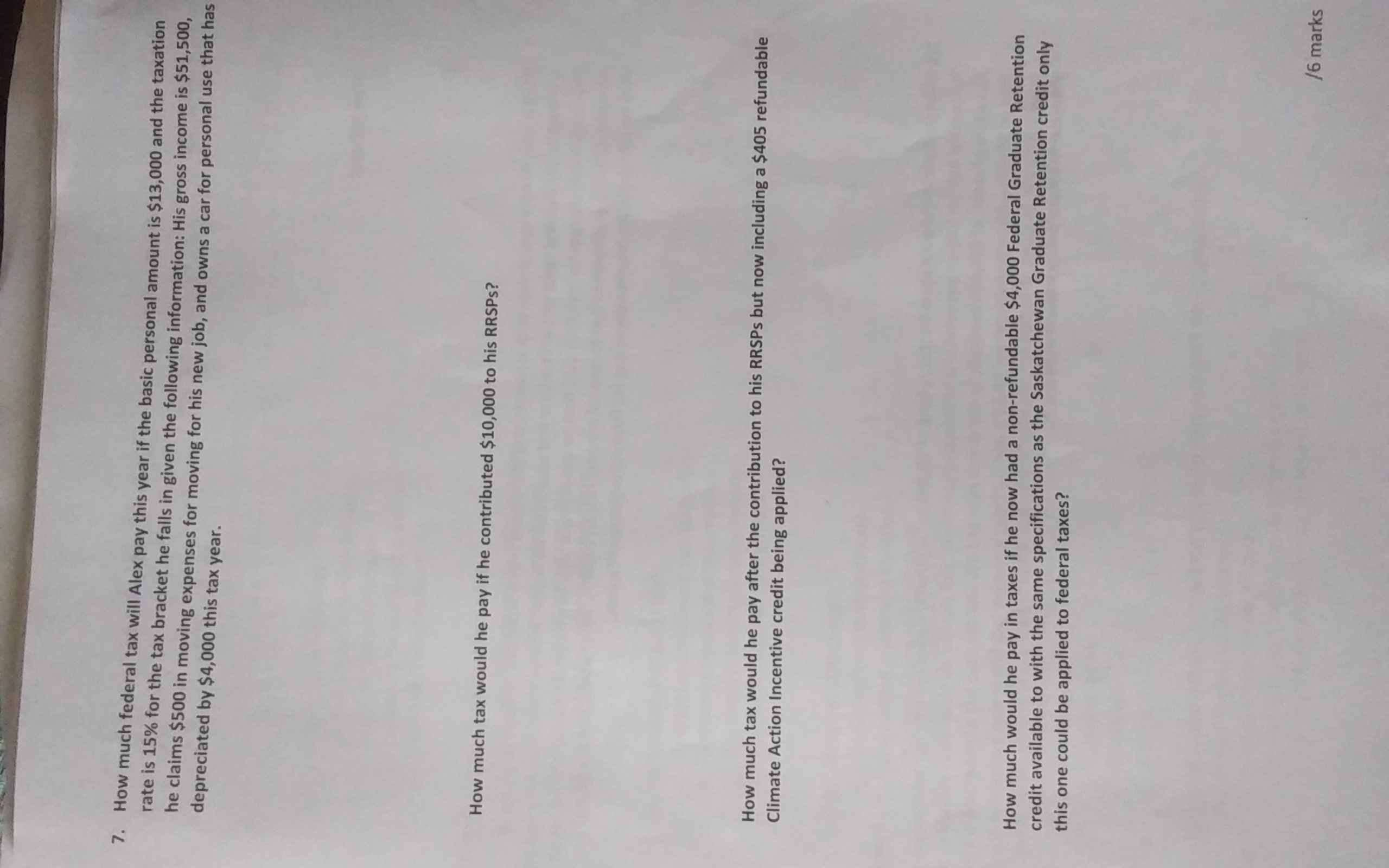

7. How much federal tax will Alex pay this year if the basic personal amount is $13,000 and the taxation rate is 15% for the tax bracket he falls in given the following information: His gross income is $51,500, depreciated by $4,000 this tax year. he claims $500 in moving expenses for moving for his new job, and owns a car for personal use that has How much tax would he pay if he contributed $10,000 to his RRSPs? How much tax would he pay after the contribution to his RRSPs but now including a $405 refundable Climate Action Incentive credit being applied? How much would he pay in taxes if he now had a non-refundable $4,000 Federal Graduate Retention credit available to with the same specifications as the Saskatchewan Graduate Retention credit only this one could be applied to federal taxes? /6 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Calculate Alexs Tax Liability without RRSP Contribution or Credits 1 Calculate Total Income Gross Income 51500 Moving Expenses 500 Depreciation of C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642133775dc5_986541.pdf

180 KBs PDF File

6642133775dc5_986541.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started