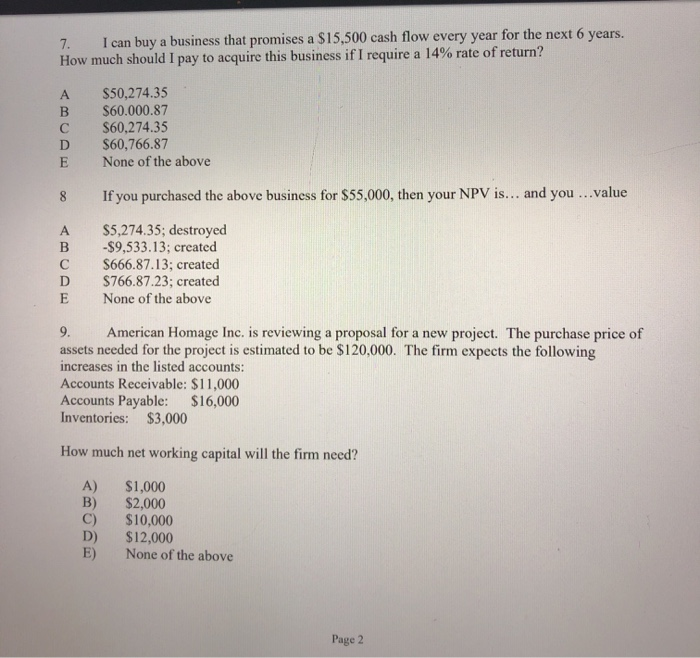

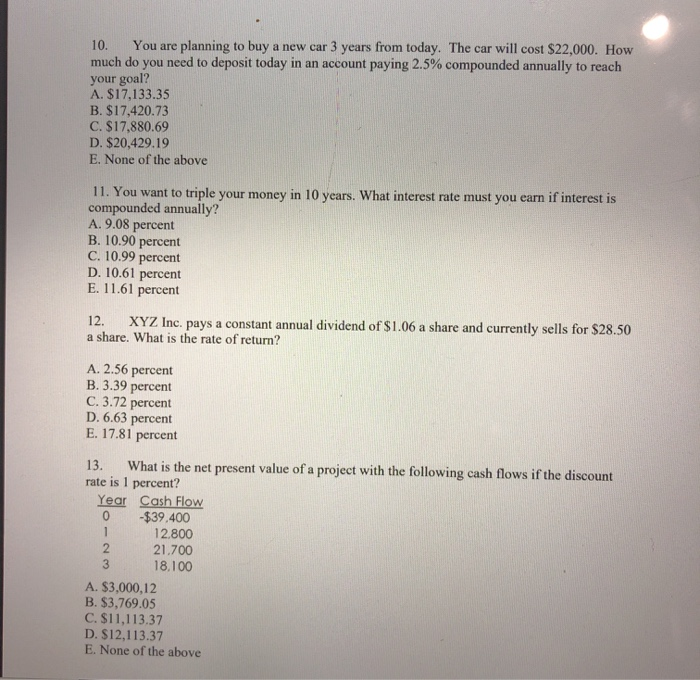

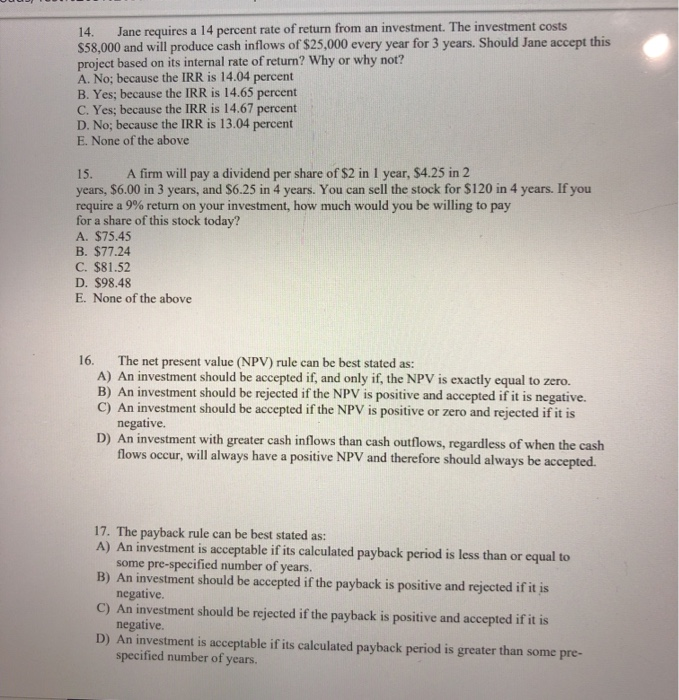

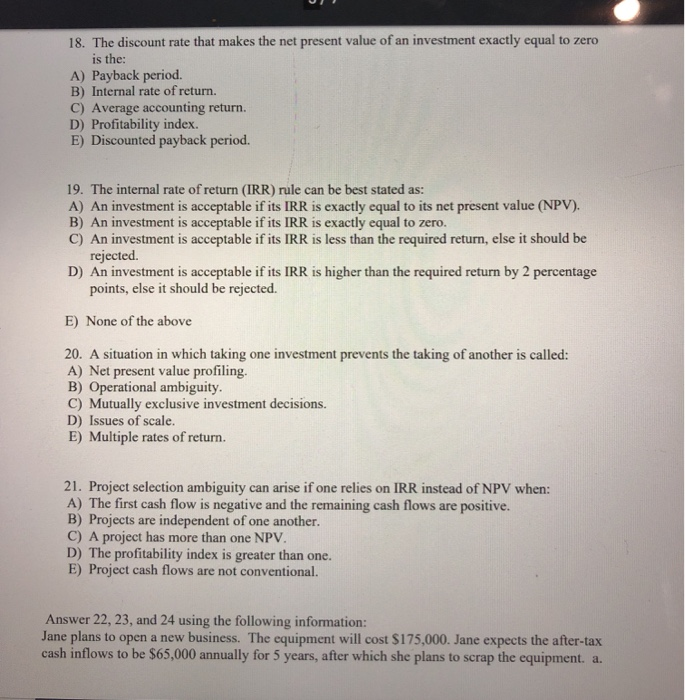

7. I can buy a business that promises a $15,500 cash flow every year for the next 6 years. How much should I pay to acquire this business if I require a 14% rate of return? A $50,274.35 B $60.000.87 C $60,274.35 D $60,766.87 E None of the above 8 If you purchased the above business for $55,000, then your NPV is... and you ...value A B D E $5,274.35; destroyed -$9,533.13; created $666.87.13; created $766.87.23; created None of the above 9. American Homage Inc. is reviewing a proposal for a new project. The purchase price of assets needed for the project is estimated to be $120,000. The firm expects the following increases in the listed accounts: Accounts Receivable: $11,000 Accounts Payable: $16,000 Inventories: $3,000 How much net working capital will the firm need? A) B) C) D) E) $1,000 $2,000 $10,000 $12,000 None of the above Page 2 10. You are planning to buy a new car 3 years from today. The car will cost $22,000. How much do you need to deposit today in an account paying 2.5% compounded annually to reach your goal? A. $17,133.35 B. $17,420.73 C. $17,880.69 D. $20,429.19 E. None of the above 11. You want to triple your money in 10 years. What interest rate must you earn if interest is compounded annually? A. 9.08 percent B. 10.90 percent C. 10.99 percent D. 10.61 percent E. 11.61 percent 12. XYZ Inc. pays a constant annual dividend of $1.06 a share and currently sells for $28.50 a share. What is the rate of return? A. 2.56 percent B.3.39 percent C. 3.72 percent D. 6.63 percent E. 17.81 percent 1 13. What is the net present value of a project with the following cash flows if the discount rate is 1 percent? Year Cash Flow 0 -$39,400 12.800 2 21.700 3 18.100 A. $3,000,12 B. $3,769.05 C. $11,113.37 D. $12,113.37 E. None of the above 14. Jane requires a 14 percent rate of return from an investment. The investment costs $58,000 and will produce cash inflows of $25,000 every year for 3 years. Should Jane accept this project based on its internal rate of return? Why or why not? A. No; because the IRR is 14.04 percent B. Yes, because the IRR is 14.65 percent C. Yes; because the IRR is 14.67 percent D. No; because the IRR is 13.04 percent E. None of the above 15. A firm will pay a dividend per share of $2 in 1 year, $4.25 in 2 years, $6.00 in 3 years, and $6.25 in 4 years. You can sell the stock for $120 in 4 years. If you require a 9% return on your investment, how much would you be willing to pay for a share of this stock today? A. $75.45 B. $77.24 C. $81.52 D. $98.48 E. None of the above 16. The net present value (NPV) rule can be best stated as: A) An investment should be accepted if, and only if, the NPV is exactly equal to zero. B) An investment should be rejected if the NPV is positive and accepted if it is negative. C) An investment should be accepted if the NPV is positive or zero and rejected if it is negative. D) An investment with greater cash inflows than cash outflows, regardless of when the cash flows occur, will always have a positive NPV and therefore should always be accepted. 17. The payback rule can be best stated as: A) An investment is acceptable if its calculated payback period is less than or equal to some pre-specified number of years. B) An investment should be accepted if the payback is positive and rejected if it is negative. C) An investment should be rejected if the payback is positive and accepted if it is negative. D) An investment is acceptable if its calculated payback period is greater than some pre- specified number of years. 18. The discount rate that makes the net present value of an investment exactly equal to zero is the: A) Payback period. B) Internal rate of return. C) Average accounting return. D) Profitability index. E) Discounted payback period. 19. The internal rate of return (IRR) rule can be best stated as: A) An investment is acceptable if its IRR is exactly equal to its net present value (NPV). B) An investment is acceptable if its IRR is exactly equal to zero. C) An investment is acceptable if its IRR is less than the required return, else it should be rejected. D) An investment is acceptable if its IRR is higher than the required return by 2 percentage points, else it should be rejected. E) None of the above 20. A situation in which taking one investment prevents the taking of another is called: A) Net present value profiling. B) Operational ambiguity. C) Mutually exclusive investment decisions. D) Issues of scale. Multiple rates of return. 21. Project selection ambiguity can arise if one relies on IRR instead of NPV when: A) The first cash flow is negative and the remaining cash flows are positive. B) Projects are independent of one another. C) A project has more than one NPV. D) The profitability index is greater than one. E) Project cash flows are not conventional. Answer 22, 23, and 24 using the following information: Jane plans to open a new business. The equipment will cost $175,000. Jane expects the after-tax cash inflows to be $65,000 annually for 5 years, after which she plans to scrap the equipment. a