Answered step by step

Verified Expert Solution

Question

1 Approved Answer

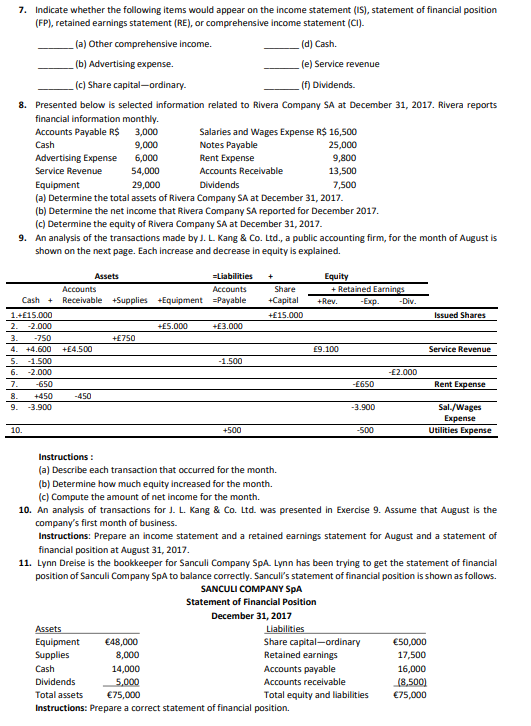

7 . Indicate whether the following items would appear on the income statement ( IS ) , statement of financial position ( FP ) ,

Indicate whether the following items would appear on the income statement IS statement of financial position FP retained earnings statement RE or comprehensive income statement CI

a Other comprehensive income.

d Cash.

b Advertising expense.

e Service revenue

c Share capitalordinary.

f Dividends.

Presented below is selected information related to Rivera Company SA at December Rivera reports financial information monthly.

a Determine the total assets of Rivera Company SA at December

b Determine the net income that Rivera Company SA reported for December

c Determine the equity of Rivera Company SA at December

An analysis of the transactions made by J L Kang & Co Ltd a public accounting firm, for the month of August is shown on the next page. Each increase and decrease in equity is explained.

Instructions:

a Describe each transaction that occurred for the month.

b Determine how much equity increased for the month.

c Compute the amount of net income for the month.

An analysis of transactions for J L Kang & Co Ltd was presented in Exercise Assume that August is the company's first month of business.

Instructions: Prepare an income statement and a retained earnings statement for August and a statement of financial position at August

Lynn Dreise is the bookkeeper for Sanculi Company SpA. Lynn has been trying to get the statement of financial position of Sanculi Company SpA to balance correctly. Sanculi's statement of financial position is shown as follows.

SANCULI COMPANY SpA

Statement of Financial Position

December

Instructions: Prepare a correct statement of financial position. Presented below are three business transactions. On a sheet of paper, list the letters ab and c with columns for assets, liabilities, and equity. For each column, indicate whether the transactions increased decreased or had no effect NE on assets, liabilities, and equity.

a Purchased supplies on account.

b Received cash for performing a service.

c Paid expenses in cash.

Follow the same format as Exercise above. Determine the effect on assets, liabilities, and equity of the following three transactions.

a Shareholders invested cash in the business for ordinary shares.

b Paid a cash dividend.

c Received cash from a customer who had previously been billed for services performed.

Transactions made by Callahan and Co Ltd a law firm, for the month of March are shown below. Prepare a tabular analysis which shows the effects of these transactions on the accounting equation.

The company performed R of services for customers, on credit.

The company received R in cash from customers who had been billed for services in transaction

ThecompanyreceivedabillforRofadvertisingbutwillnotpayituntilalaterdate.

The company paid a dividend of R in cash to shareholders.

Selected transactions for Spring Cruises ASA are listed below.

Sold ordinary shares for cash to start business.

Paid monthly rent.

Purchased equipment on account.

Billed customers for services performed.

Paid dividends.

Received cash from customers billed in

Incurred advertising expense on account.

Purchased additional equipment for cash.

Received cash from customers when service was performed.

Instructions: List the numbers of the above transactions and describe the effect of each transaction on assets, liabilities, and equity. For example, the first answer is Increase in assets and increase in equity.

Collins Computer Timeshare Company SA entered into the following transactions during May

Purchased computer terminals for R $ from Digital Equipment on account.

Paid R $ cash for May rent on storage space.

Received mathbfR$ cash from customers for contracts billed in April.

Performed computer services for Schmidt Construction Company for R$ cash.

Paid Central States Power Co R $ cash for energy usage in May.

Shareholders invested an additional R $ in the business.

Paid Digital Equipment for the terminals purchased in above.

Incurred advertising expense for May of R $ on account.

Instructions: Indicate with the appropriate letter whether each of the transactions above results in: a An increase in assets and a decrease in assets. b An increase in assets and an increase in equity. c An increase in assets and an increase in liabilities. d A decrease in assets and a decrease in equity. e A decrease in assets and a decrease in liabilities. f An increase in liabilities and a decrease in equity. g An increase in equity and a decrease in liabilities.

In alphabetical order below are statement of financial position items for Grande Company Ltd at December Kit Grande is the owner of Grande Company Ltd Prepare a statem

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started