Question

7. Indy Automotive Products is considering a capital budgeting proposal to manufacture after-market performance exhaust systems for the next three years. The initial investment in

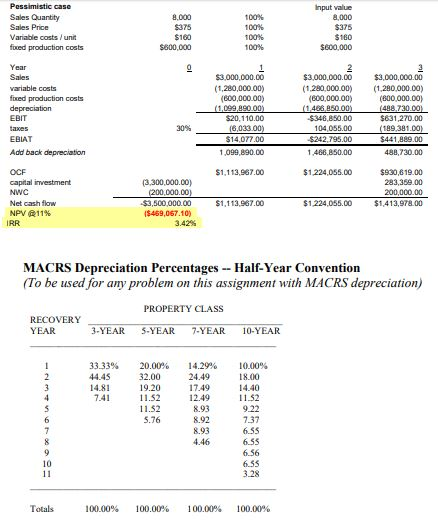

7. Indy Automotive Products is considering a capital budgeting proposal to manufacture after-market performance exhaust systems for the next three years. The initial investment in machinery would total $3,300,000. This amount would be depreciated according to the 3-year MACRs schedule (see Exhibit below). The relevant cost of capital has been estimated to be 11% and the applicable tax rate is 30%. The project would require an immediate NWC investment of $200,000, and this entire amount would be completely recovered at the end of the projects life after the third year. The machinery would have a salvage value of $300,000 (before tax) after three years. The following represent the yearly cash flow projections: (6 points) Pessimistic Middle Scenario Optimistic Sales (in units) 8000 9000 10000 Price per unit $375 $400 $425 Variable costs (per unit) $160 $150 $140 Fixed Production costs $600,000 $550,000 $500,000 Probability of outcome 30% 40% 30% *For simplicity, assume that the state which is realized at t=1 will be in effect for the projects duration. a) Conduct a scenario analysis for the 3 cases specified. What is the NPV in each scenario? The table below shows the Excel template I used for estimating the Pessimistic scenario with the correct answer for that part --you may want to use this format for building your own spreadsheet. b) What is the expected (i.e. probability-weighted) NPV for the project? c) Conduct a sensitivity analysis on Price Per unit variable costs. Specifically, calculate the dollar change in NPV, given a 10% change in the Price per unit from its most likely case value. [For instance, suppose you were to vary the sales price by 10% upward from its most likely value and doing so increased NPV from $25,000 to $33,000. You would respond here as follows: "A 10% change in the Sales price per unit from its most likely value leads to an $8,000 change in NPV.]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started