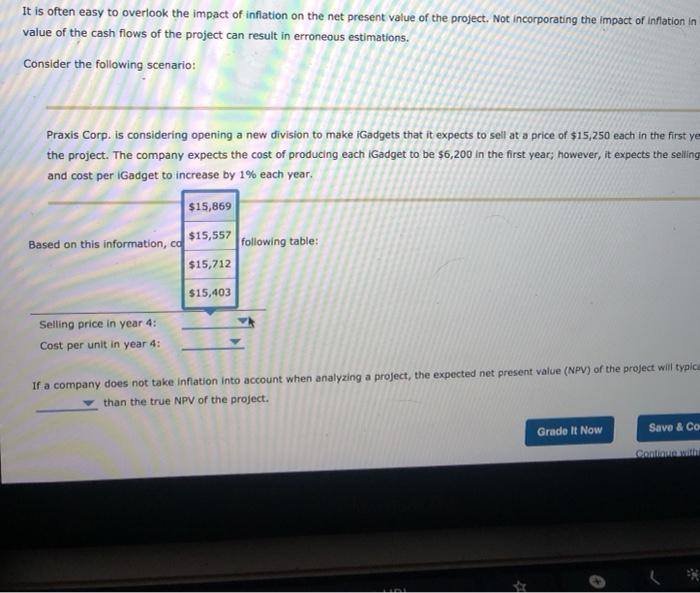

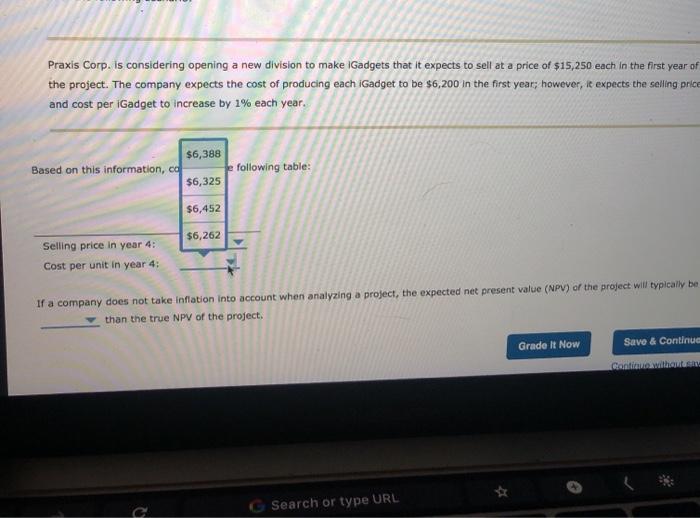

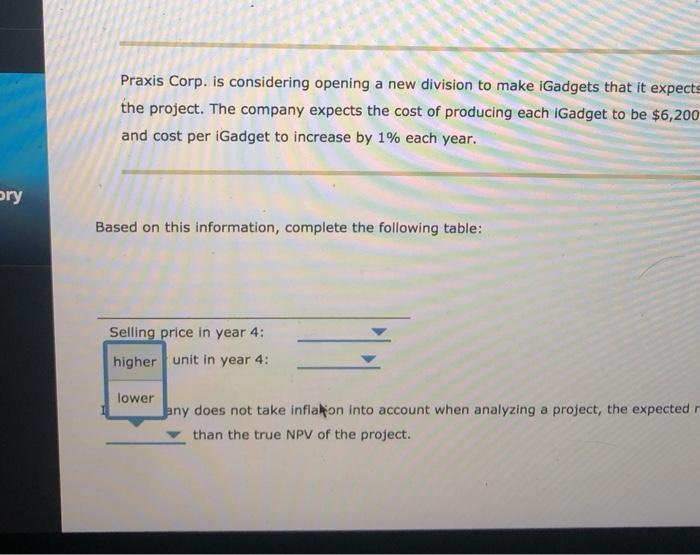

7. Inflation in project analysis It is often easy to overlook the impact of inflation on the net present value of the project. Not incorporating the impact of inflation in determining the value of the cash flows of the project can result in erroneous estimations Consider the following scenario: Praxis Corp. is considering opening a new division to make Gadgets that it expects to sell at a price of $15,250 each in the first year of the project. The company expects the cost of producing each Gadget to be $6,200 in the first year, however, it expects the selling price and cost per Gadget to increase by 1% each year. Based on this information, complete the following table: Selling price in year 4: Cost per unit in year 4: If a company does not take inflation into account when analyzing a project, the expected net present value (NPV) of the project will typically be than the true NPV of the project. It is often easy to overlook the impact of inflation on the net present value of the project. Not incorporating the impact of Inflation in value of the cash flows of the project can result in erroneous estimations. Consider the following scenario: Praxis Corp. is considering opening a new division to make iGadgets that it expects to sell at a price of $15,250 each in the first ye the project. The company expects the cost of producing each iGadget to be $6,200 in the first year; however, it expects the selling and cost per Gadget to increase by 1% each year. $15,869 $15,557 Based on this information, cd $15,712 following table: $15,403 Selling price in year 4: Cost per unit in year 4: If a company does not take inflation into account when analyzing a project, the expected net present value (NPV) of the project wil typica than the true NPV of the project. Grade It Now Save & Co Contoh Praxis Corp. is considering opening a new division to make Gadgets that it expects to sell at a price of $15,250 each in the first year of the project. The company expects the cost of producing each iGadget to be $6,200 in the first year; however, it expects the selling price and cost per iGadget to increase by 1% each year. $6,388 Based on this information, ca e following table: $6,325 $6,452 $6,262 Selling price in year 4: Cost per unit in year 4: If a company does not take inflation into account when analyzing a project, the expected net present value (NPV) of the project will typically be than the true NPV of the project. Grade It Now Save & Continue Gasthaus Search or type URL Praxis Corp. is considering opening a new division to make iGadgets that it expects the project. The company expects the cost of producing each IGadget to be $6,200 and cost per iGadget to increase by 1% each year. ory Based on this information, complete the following table: Selling price in year 4: higher unit in year 4: lower Jany does not take inflation into account when analyzing a project, the expected than the true NPV of the project