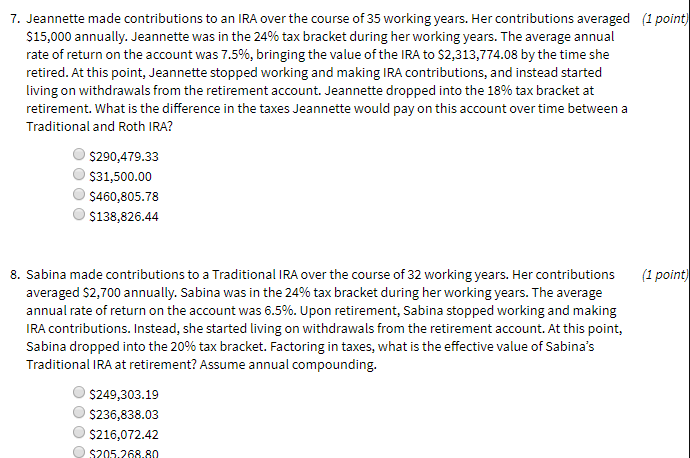

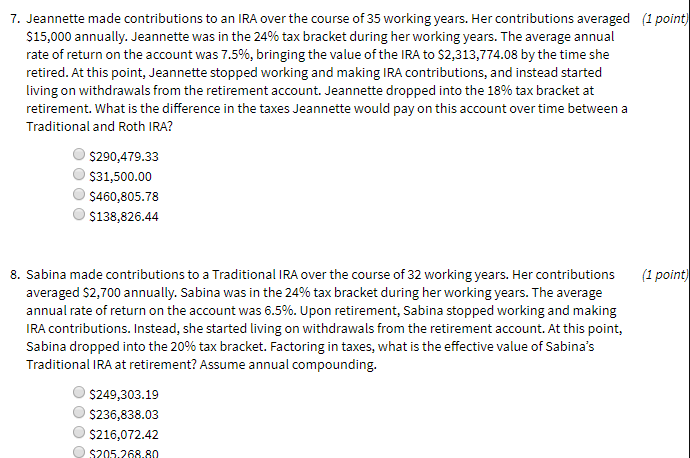

7. Jeannette made contributions to an IRA over the course of 35 working years. Her contributions averaged (1 point SI 5,000 annually. Jeannettewas in the 24% tax bracket during herworking years Thea erage annual rate of return on the account was 7.5%, bringing the value of the IRA to $2.31377408 by the time she retired. At this point, Jeannette stopped working and making IRA contributions, and instead started living on withdrawals from the retirement account. Jeannette dropped into the 18% tax bracket at retirement. What is the difference in the taxes Jeannette would pay on this account over time between a Traditional and Roth IRA? $290,479.33 O S31,500.00 $460,805.78 $138,826.44 8. Sabina made contributions to a Traditional IRA over the course of 32 working years. Her contributions(1 point averaged $2.700 annually. Sabina was in the 24% tax bracket during her working years. The average annual rate of return on the account was 6.5%. Upon retirement, Sabina stopped working and making IRA contributions. Instead, she started living on withdrawals from the retirement account. At this point, Sabina dropped into the 20% tax bracket. Factoring in taxes, what is the effective value of Sabina's Traditional IRA at retirement? Assume annual compounding. s249,303.19 $236,838.03 O s2|6,072.42 205.268.80 7. Jeannette made contributions to an IRA over the course of 35 working years. Her contributions averaged (1 point SI 5,000 annually. Jeannettewas in the 24% tax bracket during herworking years Thea erage annual rate of return on the account was 7.5%, bringing the value of the IRA to $2.31377408 by the time she retired. At this point, Jeannette stopped working and making IRA contributions, and instead started living on withdrawals from the retirement account. Jeannette dropped into the 18% tax bracket at retirement. What is the difference in the taxes Jeannette would pay on this account over time between a Traditional and Roth IRA? $290,479.33 O S31,500.00 $460,805.78 $138,826.44 8. Sabina made contributions to a Traditional IRA over the course of 32 working years. Her contributions(1 point averaged $2.700 annually. Sabina was in the 24% tax bracket during her working years. The average annual rate of return on the account was 6.5%. Upon retirement, Sabina stopped working and making IRA contributions. Instead, she started living on withdrawals from the retirement account. At this point, Sabina dropped into the 20% tax bracket. Factoring in taxes, what is the effective value of Sabina's Traditional IRA at retirement? Assume annual compounding. s249,303.19 $236,838.03 O s2|6,072.42 205.268.80