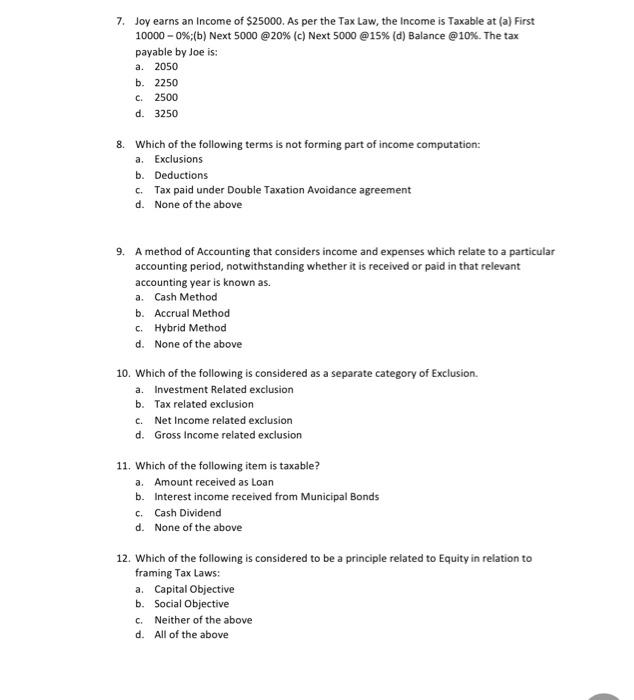

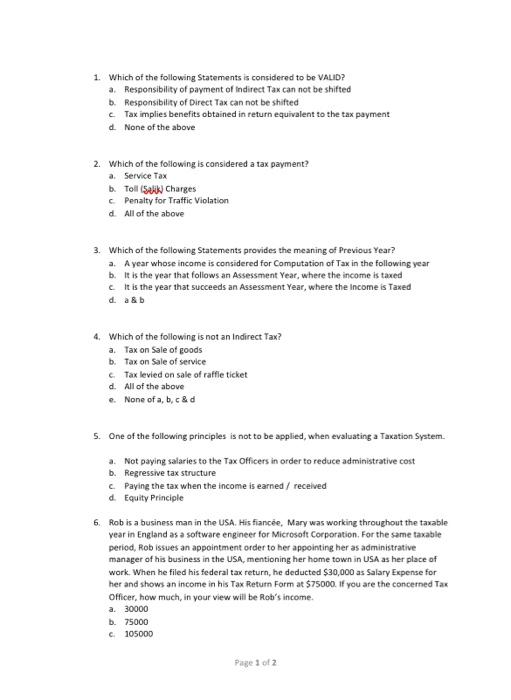

7. Joy earns an Income of $25000. As per the Tax Law, the income is Taxable at (a) First 10000-0%;(b) Next 5000 @20% (c) Next 5000 @15% (d) Balance @10%. The tax payable by Joe is: a. 2050 b. 2250 c. 2500 d. 3250 8. Which of the following terms is not forming part of income computation: a. Exclusions b. Deductions c. Tax paid under Double Taxation Avoidance agreement d. None of the above 9. A method of Accounting that considers income and expenses which relate to a particular accounting period, notwithstanding whether it is received or paid in that relevant accounting year is known as. a. Cash Method b. Accrual Method c. Hybrid Method d. None of the above 10. Which of the following is considered as a separate category of Exclusion. a. Investment Related exclusion b. Tax related exclusion Net Income related exclusion d. Gross Income related exclusion c. 11. Which of the following item is taxable? a. Amount received as Loan b. Interest income received from Municipal Bonds c. Cash Dividend d. None of the above 12. Which of the following is considered to be a principle related to Equity in relation to framing Tax Laws: a Capital Objective b. Social Objective c. Neither of the above d. All of the above 1. Which of the following Statements is considered to be VALID? a. Responsibility of payment of Indirect Tax can not be shifted b. Responsibility of Direct Tax can not be shifted Tax implies benefits obtained in return equivalent to the tax payment d. None of the above 2. Which of the following is considered a tax payment? a. Service Tax b. Toll Selky Charges Penalty for Traffic Violation d. All of the above 3. Which of the following Statements provides the meaning of Previous Year? a. A year whose income is considered for Computation of Tax in the following year b. It is the year that follows an Assessment Year, where the income is taxed It is the year that succeeds an Assessment Year, where the income is Taxed d. a&b 4. Which of the following is not an Indirect Tax? a. Tax on Sale of goods b. Tax on Sale of service Tax levied on sale of raffle ticket d. All of the above e. None of a, b,c&d 5. One of the following principles is not to be applied, when evaluating a Taxation System. Not paying salaries to the Tax Officers in order to reduce administrative cost b. Regressive tax structure cPaying the tax when the income is earned / received d. Equity Principle 6. Rob is a business man in the USA. His fiancee, Mary was working throughout the taxable Year in England as a software engineer for Microsoft Corporation. For the same taxable period, Rob issues an appointment order to her appointing her as administrative manager of his business in the USA, mentioning her home town in USA as her place of work. When he filed his federal tax return, he deducted $30,000 as Salary Expense for her and shows an income in his Tax Return Form at $75000. If you are the concerned Tax Officer, how much, in your view will be Rob's income a. 30000 b. 75000 c105000 Page 1 of 2