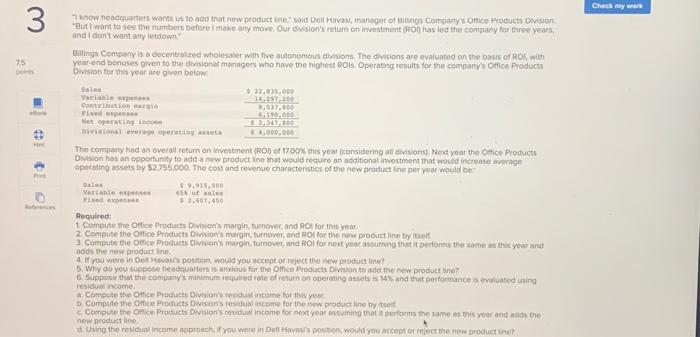

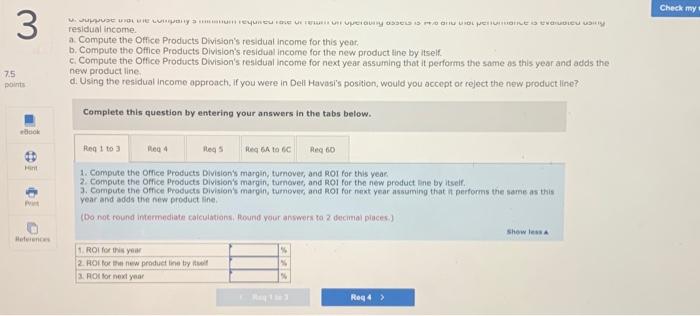

7 know heaqquarters wants us to ade that new product tres, said Dell Havas, manoger of Hinings Companys ortice Pyocucts Division. and I doa't want any leddown" Eillings Compary is a decentralied wholesaler with five autonomous divisions. The divisions are evaluatod on the basis of ROL, with yearend benuses given to the olvsional managers who have the highest ROis. Oporating results far the companys Otfice Products Division for this year are given bolow: The company had an overall return an investment pROp of poon this year (considering all divisions) Next year the Ofice Products Division has an opportunty to add a new product line thet would require an additional investment that would increase average operating assets by $2755,000, The cost and revenue characteristics of the new product line per yoar would be Pequired: 1. Compute the Office Products Division's margin, turnover, and 80 f for this year. 2. Compute the Oefice Products Division's margin, tumower, and ROI for the new product line by itself. 3. Compute the Orfice Products Division) margin, turnover, and ROI for next year assuming that it performs the same as this year and adds the new product line. 4. A you were in Del Hovatis postion, would you accept or reject the now product line? 5. Why do you suppese hendquarters is anxious for the Office Products Division to add the new product ine? 6. Suppose that the compony's minimums required tate of feturn on operating assets is 14% and that performance is evaluated using residuar incoine. a. Compute the Olfice Products Divicion teslaual income for this yeac. b. Compite the Omice Products Division's residual income for the bew product line by itseit. c. Computs the office Products ONisions cesidval income for next yoar assuming that it performs the same as this yeoc and adds the new product line residual incortie. a. Compute the Office Products Division's residual income for this year: b. Compute the Office Products Division's residual income for the new product tine by itself. c. Compute the Otfice. Products Division's fesidual income for next year assuming that it performs the same as this year and adds the new product line. d. Using the residual income approach, if you were in Dell Havasi's position, would you accept or reject the new product lire? Complete this question by entering your answers in the tabs below. 1. Compute the Office Products Division's margin, turnover, and Rol for this vear 2. Compute the Office Products Division's margin, turncivet, and aOl for the new product line by itseif, 3. Compute the Office. Products Divisions margin, tumever, and ROl for next year assuming that it performs the saine as this year and adds the new product ine. (bo not round intermediate calculations, Round your anwers to 2 decimal piaces:) 7 know heaqquarters wants us to ade that new product tres, said Dell Havas, manoger of Hinings Companys ortice Pyocucts Division. and I doa't want any leddown" Eillings Compary is a decentralied wholesaler with five autonomous divisions. The divisions are evaluatod on the basis of ROL, with yearend benuses given to the olvsional managers who have the highest ROis. Oporating results far the companys Otfice Products Division for this year are given bolow: The company had an overall return an investment pROp of poon this year (considering all divisions) Next year the Ofice Products Division has an opportunty to add a new product line thet would require an additional investment that would increase average operating assets by $2755,000, The cost and revenue characteristics of the new product line per yoar would be Pequired: 1. Compute the Office Products Division's margin, turnover, and 80 f for this year. 2. Compute the Oefice Products Division's margin, tumower, and ROI for the new product line by itself. 3. Compute the Orfice Products Division) margin, turnover, and ROI for next year assuming that it performs the same as this year and adds the new product line. 4. A you were in Del Hovatis postion, would you accept or reject the now product line? 5. Why do you suppese hendquarters is anxious for the Office Products Division to add the new product ine? 6. Suppose that the compony's minimums required tate of feturn on operating assets is 14% and that performance is evaluated using residuar incoine. a. Compute the Olfice Products Divicion teslaual income for this yeac. b. Compite the Omice Products Division's residual income for the bew product line by itseit. c. Computs the office Products ONisions cesidval income for next yoar assuming that it performs the same as this yeoc and adds the new product line residual incortie. a. Compute the Office Products Division's residual income for this year: b. Compute the Office Products Division's residual income for the new product tine by itself. c. Compute the Otfice. Products Division's fesidual income for next year assuming that it performs the same as this year and adds the new product line. d. Using the residual income approach, if you were in Dell Havasi's position, would you accept or reject the new product lire? Complete this question by entering your answers in the tabs below. 1. Compute the Office Products Division's margin, turnover, and Rol for this vear 2. Compute the Office Products Division's margin, turncivet, and aOl for the new product line by itseif, 3. Compute the Office. Products Divisions margin, tumever, and ROl for next year assuming that it performs the saine as this year and adds the new product ine. (bo not round intermediate calculations, Round your anwers to 2 decimal piaces:)