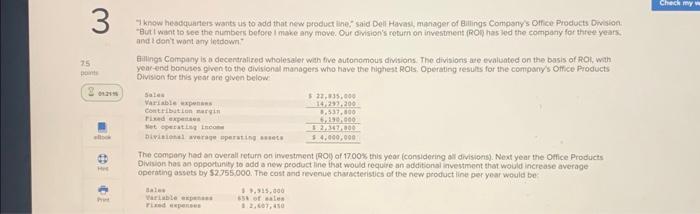

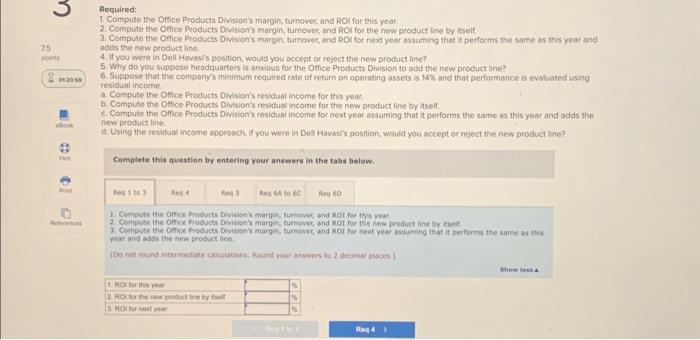

7 know heodquaners wants us to add that new product ine, said Dell Havash manayer of Billings Company's Office Products Devsion. "But I wat to see the numbers before I make any move. Our evision's return on investment (RO) has lod the company for three years. and ton't wont any letdown: Eillings Cornpany is a decentralized wholesaler weh tive sutonemous divisions. The divisions are evaluated on the basis of ROR, with year-end bonuses given to the divisional managers who have the highest ROts. Operating results for the company's Orfice Products Division for this yeat are given below The compony had an overall retum on imvestment (ROy of 1700 s this year (consdering al divisiors). Noxt year the Office Products Divivion has an oppottunity to add a new peoduct line that would require an additional investment that would increase average operating assets by $2755.000. The cast and revenue chuacteristics of the new product line per year would be Required: 1. Compute the Office Products Division's margin, turnovee, and ROl for this year. 2. Compute tive Office Products Divisioris margin, turnower, and ROI for the new product line by itself. 3. Compute the Oflice Products DWision's margin, turnover, and Rot for next year assuming that it performs the same as this yeor and adds the new product line. 4. If you were in Doll Havesirs position, would you accept or reject the new profuct line? 5. Why do you suppose headquarters is arocous for the Office Products Division to add the new product ine? 6. Suppose that the compary's minimum required tote of return on operating assets is t4s and that perfoemance is evaluated using fesidual income a. Compute the OFlice Products Division's residual income for this year b. Cempute the Office Products Division's residual income for the new product line by iself c. Compute the Otfice. Products Division's residual income for next year assuming that it perfortis the same as this year and adds the new prodeict line, d. Using the fesidual income approbeh if you were in Desl Havash position, would you accept or reject the new product line? Complete this question by entering vouf answers in the tabs below. pear and adds the enew produat ine 7 know heodquaners wants us to add that new product ine, said Dell Havash manayer of Billings Company's Office Products Devsion. "But I wat to see the numbers before I make any move. Our evision's return on investment (RO) has lod the company for three years. and ton't wont any letdown: Eillings Cornpany is a decentralized wholesaler weh tive sutonemous divisions. The divisions are evaluated on the basis of ROR, with year-end bonuses given to the divisional managers who have the highest ROts. Operating results for the company's Orfice Products Division for this yeat are given below The compony had an overall retum on imvestment (ROy of 1700 s this year (consdering al divisiors). Noxt year the Office Products Divivion has an oppottunity to add a new peoduct line that would require an additional investment that would increase average operating assets by $2755.000. The cast and revenue chuacteristics of the new product line per year would be Required: 1. Compute the Office Products Division's margin, turnovee, and ROl for this year. 2. Compute tive Office Products Divisioris margin, turnower, and ROI for the new product line by itself. 3. Compute the Oflice Products DWision's margin, turnover, and Rot for next year assuming that it performs the same as this yeor and adds the new product line. 4. If you were in Doll Havesirs position, would you accept or reject the new profuct line? 5. Why do you suppose headquarters is arocous for the Office Products Division to add the new product ine? 6. Suppose that the compary's minimum required tote of return on operating assets is t4s and that perfoemance is evaluated using fesidual income a. Compute the OFlice Products Division's residual income for this year b. Cempute the Office Products Division's residual income for the new product line by iself c. Compute the Otfice. Products Division's residual income for next year assuming that it perfortis the same as this year and adds the new prodeict line, d. Using the fesidual income approbeh if you were in Desl Havash position, would you accept or reject the new product line? Complete this question by entering vouf answers in the tabs below. pear and adds the enew produat ine