Answered step by step

Verified Expert Solution

Question

1 Approved Answer

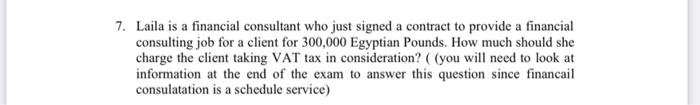

. 7. Laila is a financial consultant who just signed a contract to provide a financial consulting job for a client for 300,000 Egyptian Pounds.

.

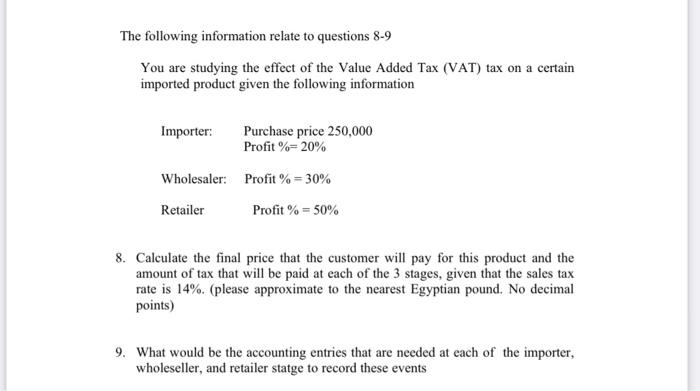

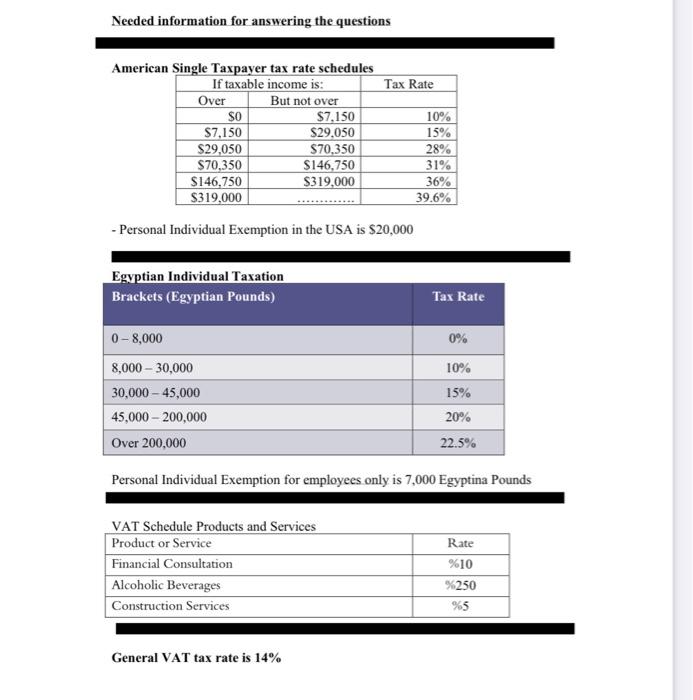

7. Laila is a financial consultant who just signed a contract to provide a financial consulting job for a client for 300,000 Egyptian Pounds. How much should she charge the client taking VAT tax in consideration? ( (you will need to look at information at the end of the exam to answer this question since financail consulatation is a schedule service) The following information relate to questions 8-9 You are studying the effect of the Value Added Tax (VAT) tax on a certain imported product given the following information Importer: Purchase price 250,000 Profit %=20% Wholesaler: Profit %=30% Retailer Profit %=50% 8. Calculate the final price that the customer will pay for this product and the amount of tax that will be paid at each of the 3 stages, given that the sales tax rate is 14%. (please approximate to the nearest Egyptian pound. No decimal points) 9. What would be the accounting entries that are needed at each of the importer, wholeseller, and retailer statge to record these events Needed information for answering the questions American Single Taxpaver tax rate schedules - Personal Individual Exemption in the USA is $20,000 Personal Individual Exemption for employees only is 7,000 Egyptina Pounds General VAT tax rate is 14% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started