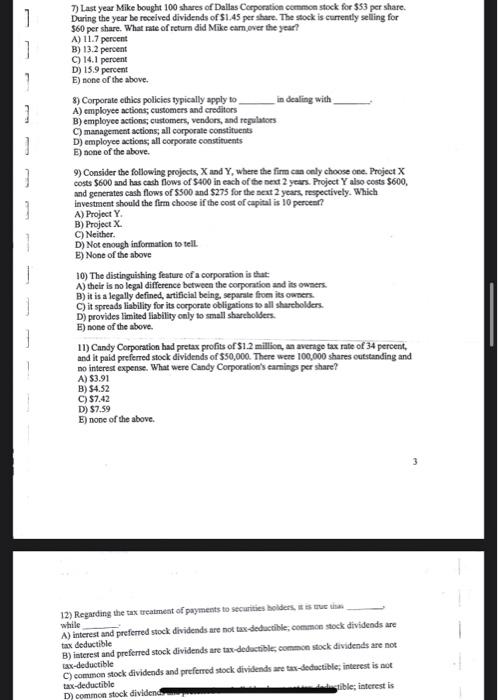

7) Last year Mike boaght 100 shares of Dallas Corporation cormen stock for $53 per share. During the year be received dividends of \$1.45 per share. The stock is currently selling for $60 per share. What nate of retum did Mike earn over the jear? A) 11.7 percent B) 13.2 percent C) 14.1 pervent D) 15.9 percent E) none of the above. 8) Corporate ehics policies typically apply to in dealing with A) employee actions; customers and creditors B) employee actions; customers, vendors, and rtgulators C) management actions, all corporate constituents D) employee actions, all corporate constituents E) tone of the above. 9) Consider the following projects, X and Y, where the firm can only choose one. Project X eosts $600 and has cach flows of $400 in each of the ned 2 year. Project Y also costs $600, and generates cash flows of $500 and $275 for the sent 2 years, respectively. Which investment should the firm choose if the cost of capital is 10 percen? A) Project Y B) Project X. C) Neither- D) Not enough informatice to tell. B) None of the above 10) The distinguishing feature of a corporation is that: A) their is no legal difference between the corpontioe and its owners. B) it is a legally defined, artificial being, separate from its owaers. C) it spreads liability for its corporate obligations to all shareholders. D) provides limited liability only to small shareboliers. E) none of the above. 11) Candy Corporation had pretax profits of $1.2 millice, an average tax rate of 34 percent, and it paid preferred stock dividends of $50,000. There were 100,000 shares cutstanding and no interest expense. What were Candy Corporation's eamings per share? A) $3.91 B) 54.52 C) $7.42 D) $7.59 E) nove of the above. 3 12) Regarding the tax treatmest of pwyments to securities bolders it is urut iha. while A) interest and preferred stock dividends are not tax-dedoctible; common stock dividends are tax deductible B) interest and preferred stock dividends are tax-dedoctible, conmon stock dividends are not cax-deductible C) eommen stock dividends and preferred stock dividends are tax-dedwetible; interest is not tax-deductible D) common stock dividend