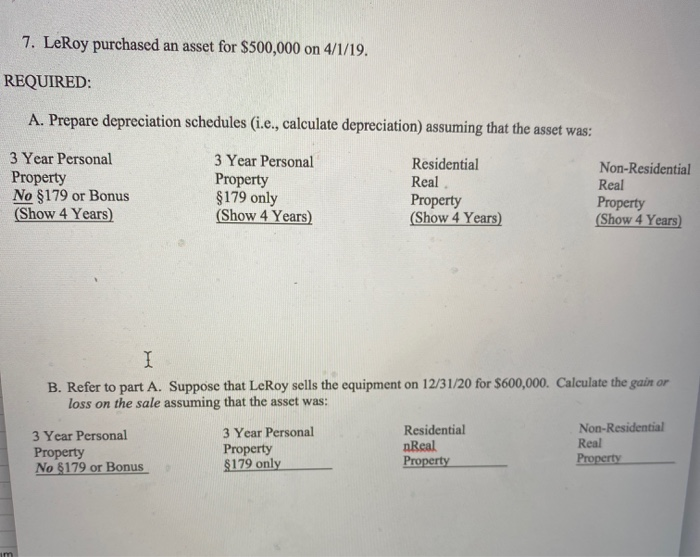

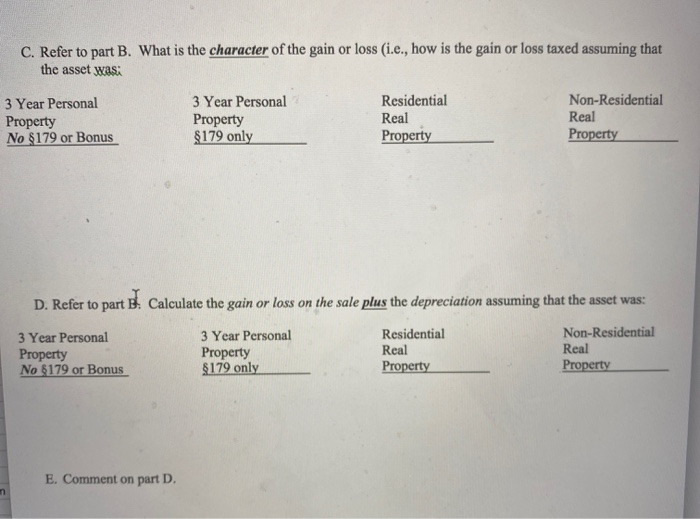

7. LeRoy purchased an asset for $500,000 on 4/1/19. REQUIRED: A. Prepare depreciation schedules (i.e., calculate depreciation) assuming that the asset was: 3 Year Personal Property No $179 or Bonus (Show 4 Years) 3 Year Personal Property $179 only (Show 4 Years) Residential Real Property (Show 4 Years) Non-Residential Real Property (Show 4 Years) B. Refer to part A. Suppose that LeRoy sells the equipment on 12/31/20 for $600,000. Calculate the gain or loss on the sale assuming that the asset was: 3 Year Personal Property No $179 or Bonus 3 Year Personal Property $179 only Residential nReal Property Non-Residential Real Property C. Refer to part B. What is the character of the gain or loss (i.e., how is the gain or loss taxed assuming that the asset wasi 3 Year Personal Property No $179 or Bonus 3 Year Personal Property $179 only Residential Real Property Non-Residential Real Property D. Refer to part E. Calculate the gain or loss on the sale plus the depreciation assuming that the asset was: 3 Year Personal Property No 5179 or Bonus 3 Year Personal Property $179 only Residential Real Property Non-Residential Real Property E. Comment on part D. 7. LeRoy purchased an asset for $500,000 on 4/1/19. REQUIRED: A. Prepare depreciation schedules (i.e., calculate depreciation) assuming that the asset was: 3 Year Personal Property No $179 or Bonus (Show 4 Years) 3 Year Personal Property $179 only (Show 4 Years) Residential Real Property (Show 4 Years) Non-Residential Real Property (Show 4 Years) B. Refer to part A. Suppose that LeRoy sells the equipment on 12/31/20 for $600,000. Calculate the gain or loss on the sale assuming that the asset was: 3 Year Personal Property No $179 or Bonus 3 Year Personal Property $179 only Residential nReal Property Non-Residential Real Property C. Refer to part B. What is the character of the gain or loss (i.e., how is the gain or loss taxed assuming that the asset wasi 3 Year Personal Property No $179 or Bonus 3 Year Personal Property $179 only Residential Real Property Non-Residential Real Property D. Refer to part E. Calculate the gain or loss on the sale plus the depreciation assuming that the asset was: 3 Year Personal Property No 5179 or Bonus 3 Year Personal Property $179 only Residential Real Property Non-Residential Real Property E. Comment on part D