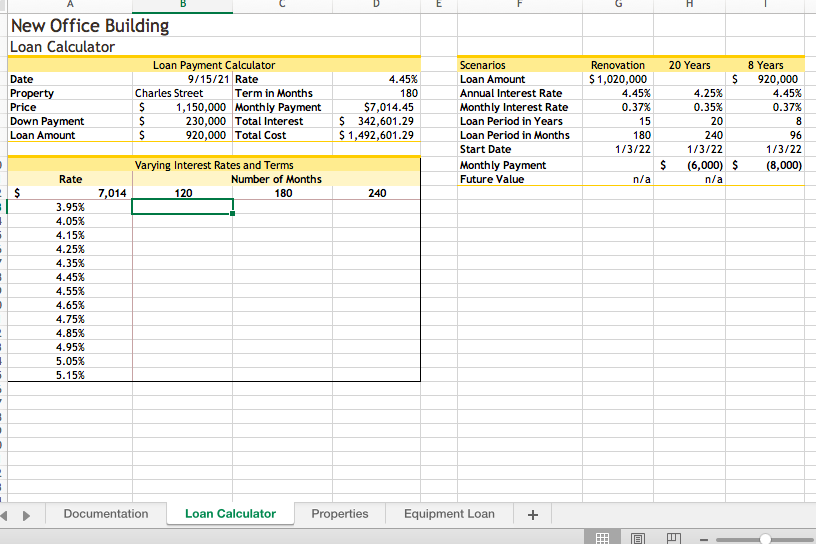

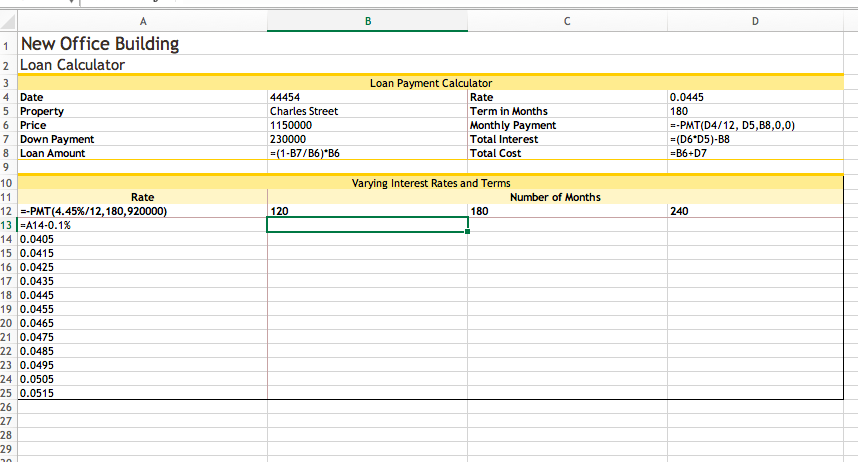

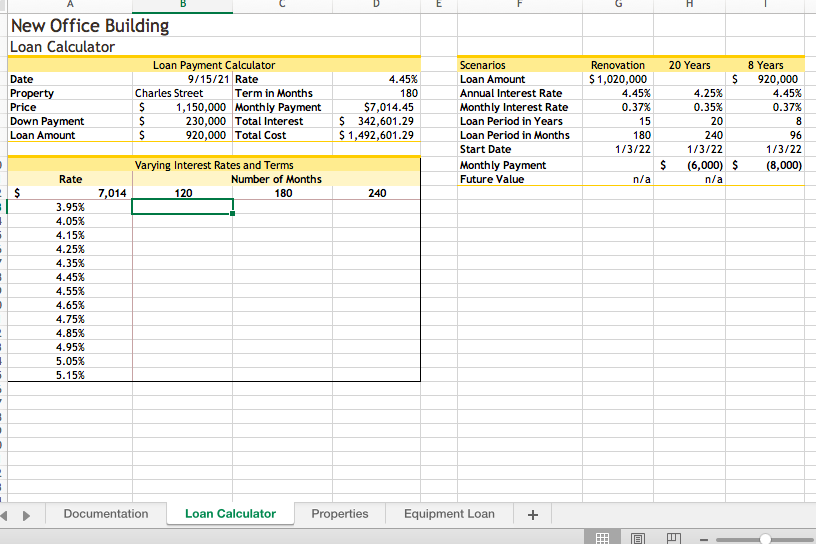

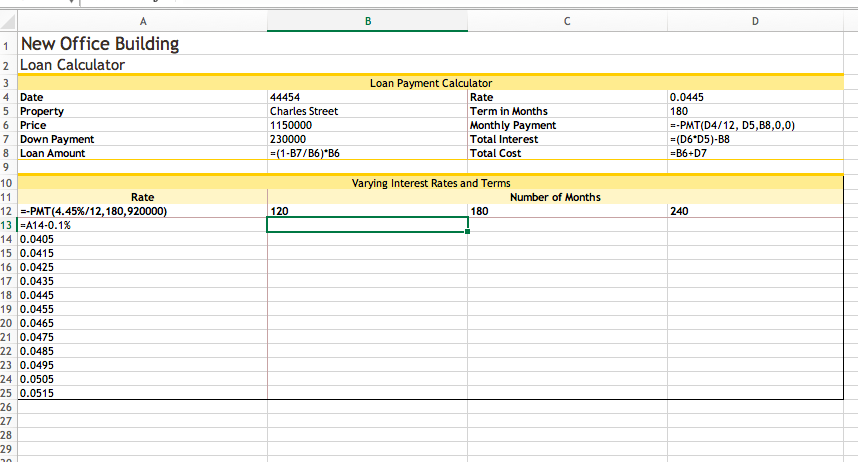

7. Liam wants to compare monthly payments for interest rates that vary from 3.95% to 5.15% and for terms of 120, 180, and 240 months. He has already set up the structure for a data table in the range A12: D25. Create a two-variable data table as follows to provide the comparison that Liam requests: a. In cell A12, enter a formula without using a function that references the Monthly_Payment amount (cell D6) because Liam wants to compare the monthly payments. b. Based on the range A12:D25, create a two-variable data table that uses the term in months (cell D5) as the row input cell and the rate (cell D4) as the column input cell. 8. In the list of interest rates (range A13:A25), create a Conditional Formatting Highlight Cells Rule to highlight the listed rate that matches the rate for the Charles Street property (cell D4) in Light Red Fill with Dark Red Text. 9. Change the color of the left, right, and bottom borders of the range A10:D25 to Gold, Accent 1 to match the other outside borders in the worksheet. 10. Liam has three other options for purchasing the Charles Street property. In the first scenario, he could borrow additional money to fund a renovation of the building. He wants to determine the monthly payment for the first scenario. In cell G10, insert a formula using the PMT function using the monthly interest rate (cell G6), the loan period in months (cell G8), and the loan amount (cell G4) to calculate the monthly payment for the renovation scenario. E New Office Building Loan Calculator Loan Payment Calculator Date 9/15/21 Rate Property Charles Street Term in Months Price $ 1,150,000 Monthly Payment Down Payment S 230,000 Total Interest Loan Amount S 920,000 Total Cost 4.45% 180 $7,014.45 $ 342,601.29 $ 1,492,601.29 Scenarios Loan Amount Annual Interest Rate Monthly Interest Rate Loan Period in Years Loan Period in Months Start Date Monthly Payment Future Value Renovation $ 1,020,000 4.45% 0.37% 15 180 1/3/22 20 Years S 4.25% 0.35% 20 240 1/3/22 $ (6,000) $ n/a 8 Years 920,000 4.45% 0.37% 8 96 1/3/22 (8,000) Rate Varying Interest Rates and Terms Number of Months 120 180 n/a $ 7,014 240 . . 3 . 3.95% 4.05% 4.15% 4.25% 4.35% 4.45% 4.55% 4.65% 4.75% 4.85% 4.95% 5.05% 5.15% Documentation Loan Calculator Properties Equipment Loan + H 1 _ A B D 1 New Office Building 2 Loan Calculator 3 44454 Charles Street 1150000 230000 = (1-B7/B6)*B6 Loan Payment Calculator Rate Term in Months Monthly Payment Total Interest Total Cost 0.0445 180 --PMT(D4/12, D5,38,0,0) = (D6*D5)-B8 =B6D7 Varying Interest Rates and Terms Number of Months 180 120 240 4 Date 5 Property 6 Price 7 Down Payment 8 Loan Amount 9 10 11 Rate 12 --PMT(4.45%/12, 180,920000) 13 =A14-0.1% 14 0.0405 15 0.0415 16 0.0425 17 0.0435 18 0.0445 19 0.0455 20 0.0465 21 0.0475 22 0.0485 23 0.0495 24 0.0505 25 0.0515 26 27 28 29