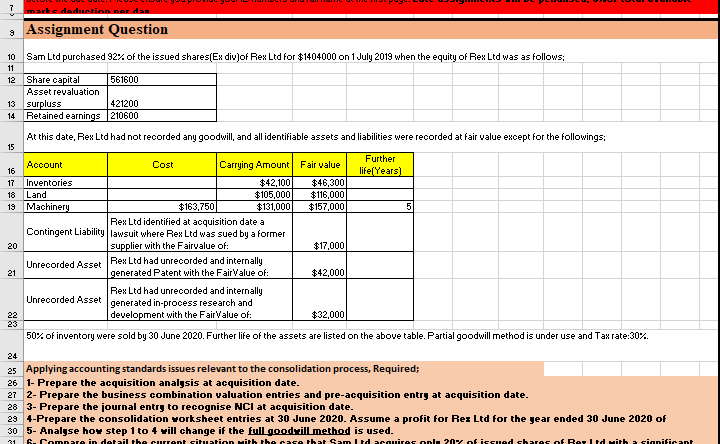

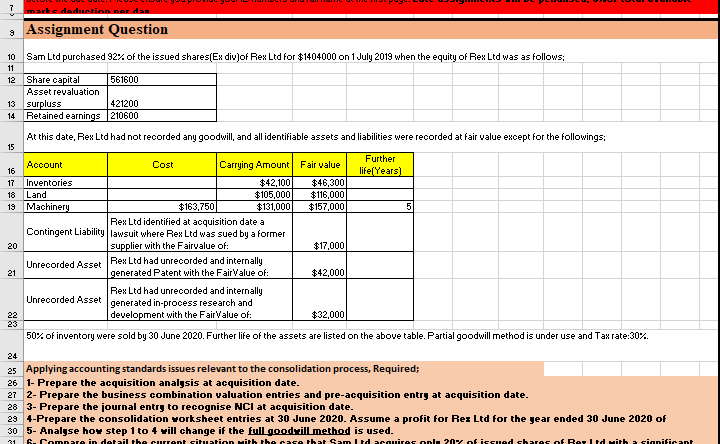

7 marke deduction nor da. 9 Assignment Question 12 10 Sam Ltd purchased 92% of the issued shares(Ex div)of Rex Ltd for $1404000 on 1 July 2019 when the equity of Rex Ltd was as follows: 11 Share capital 561600 Asset revaluation 13 surpluss 421200 14 Retained earnings 210600 At this date, Rex Ltd had not recorded any goodwill, and all identifiable assets and liabilities were recorded at fair value except for the followings: 15 16 17 18 19 20 Further Account Cost Carrying Amount Fair value life(Years) Inventories $42.100 $46,300 Land $105,000 $116,000 Machinery $163,750 $131,000 $157,000 5 Rex Ltd identified at acquisition date a Contingent Liability lawsuit where Rex Ltd was sued by a former supplier with the Fairvalue of: $17,000 Unrecorded Asset Rex Ltd had unrecorded and internally generated Patent with the FairValue of: $42,000 Rex Ltd had unrecorded and internally Unrecorded Asset generated in-process research and development with the FairValue of: $32,000 50% of inventory were sold by 30 June 2020. Further life of the assets are listed on the above table. Partial goodwill method is under use and Tax rate:30%. 21 22 23 24 25 Applying accounting standards issues relevant to the consolidation process, Required; 26 1- Prepare the acquisition analysis at acquisition date. 27 2- Prepare the business combination valuation entries and pre-acquisition entry at acquisition date. 28 3- Prepare the journal entry to recognise NCI at acquisition date. 29 4-Prepare the consolidation worksheet entries at 30 June 2020. Assume a profit for Rex Ltd for the year ended 30 June 2020 of 30 5- Analyse hoy step 1 to 4 will change if the full goodwill method is used. 6. Comnare in detail the current situation with the race that Sam cauires on 20 of issued shares of Berlu with a significant 7 marke deduction nor da. 9 Assignment Question 12 10 Sam Ltd purchased 92% of the issued shares(Ex div)of Rex Ltd for $1404000 on 1 July 2019 when the equity of Rex Ltd was as follows: 11 Share capital 561600 Asset revaluation 13 surpluss 421200 14 Retained earnings 210600 At this date, Rex Ltd had not recorded any goodwill, and all identifiable assets and liabilities were recorded at fair value except for the followings: 15 16 17 18 19 20 Further Account Cost Carrying Amount Fair value life(Years) Inventories $42.100 $46,300 Land $105,000 $116,000 Machinery $163,750 $131,000 $157,000 5 Rex Ltd identified at acquisition date a Contingent Liability lawsuit where Rex Ltd was sued by a former supplier with the Fairvalue of: $17,000 Unrecorded Asset Rex Ltd had unrecorded and internally generated Patent with the FairValue of: $42,000 Rex Ltd had unrecorded and internally Unrecorded Asset generated in-process research and development with the FairValue of: $32,000 50% of inventory were sold by 30 June 2020. Further life of the assets are listed on the above table. Partial goodwill method is under use and Tax rate:30%. 21 22 23 24 25 Applying accounting standards issues relevant to the consolidation process, Required; 26 1- Prepare the acquisition analysis at acquisition date. 27 2- Prepare the business combination valuation entries and pre-acquisition entry at acquisition date. 28 3- Prepare the journal entry to recognise NCI at acquisition date. 29 4-Prepare the consolidation worksheet entries at 30 June 2020. Assume a profit for Rex Ltd for the year ended 30 June 2020 of 30 5- Analyse hoy step 1 to 4 will change if the full goodwill method is used. 6. Comnare in detail the current situation with the race that Sam cauires on 20 of issued shares of Berlu with a significant