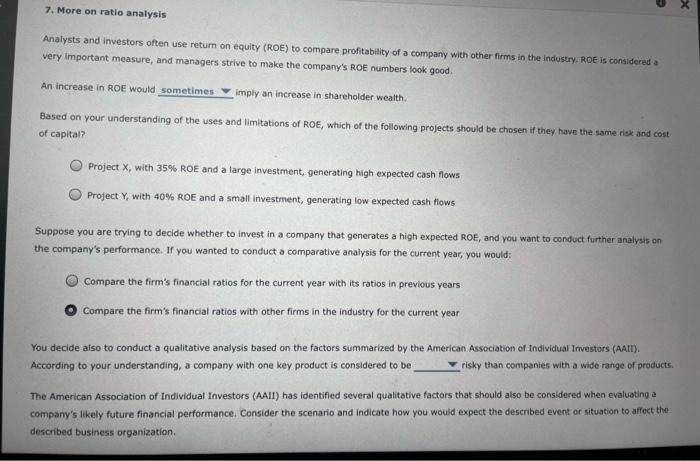

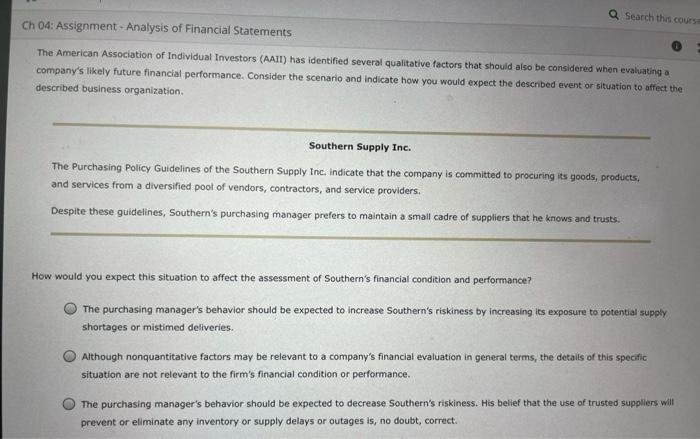

7. More on ratio analysis Analysts and investors often use return on equity (ROE) to compare profitability of a company with other firms in the industry. ROE is considered a very important measure, and managers strive to make the company's ROE numbers look good. An increase in ROE would sometimes imply an increase in shareholder wealth. Based on your understanding of the uses and limitations of ROE, which of the following projects should be chosen if they have the same risk and cost of capital? Project X, with 35% ROE and a large investment, generating high expected cash flows Project y, with 40% ROE and a small Investment, generating low expected cash flows Suppose you are trying to decide whether to invest in a company that generates a high expected ROE, and you want to conduct further analysis on the company's performance. If you wanted to conduct a comparative analysis for the current year, you would: Compare the firm's financial ratios for the current year with its ratios in previous years Compare the firm's financial ratios with other firms in the industry for the current year You decide also to conduct a qualitative analysis based on the factors summarized by the American Association of Individual Investors (AAIT). According to your understanding, a company with one key product is considered to be risky than companies with a wide range of products. The American Association of Individual Investors (AAII) has identified several qualitative factors that should also be considered when evaluating a company's likely future financial performance. Consider the scenario and indicate how you would expect the described event or situation to affect the described business organization. Q Search this course Ch 04: Assignment - Analysis of Financial Statements The American Association of Individual Investors (AAIT) has identified several qualitative factors that should also be considered when evaluating a company's likely future financial performance. Consider the scenario and indicate how you would expect the described event or situation to affect the described business organization Southern Supply Inc. The Purchasing Policy Guidelines of the Southern Supply Inc. indicate that the company is committed to procuring its goods, products, and services from a diversified pool of vendors, contractors, and service providers. Despite these guidelines, Southern's purchasing manager prefers to maintain a small cadre of suppliers that he knows and trusts. How would you expect this situation to affect the assessment of Southern's financial condition and performance? The purchasing manager's behavior should be expected to increase Southern's riskiness by increasing its exposure to potential supply shortages or mistimed deliveries. Although nonquantitative factors may be relevant to a company's financial evaluation in general terms, the details of this specific situation are not relevant to the firm's financial condition or performance. The purchasing manager's behavior should be expected to decrease Southern's riskiness. His belief that the use of trusted suppliers will prevent or eliminate any inventory or supply delays or outages is, no doubt, correct