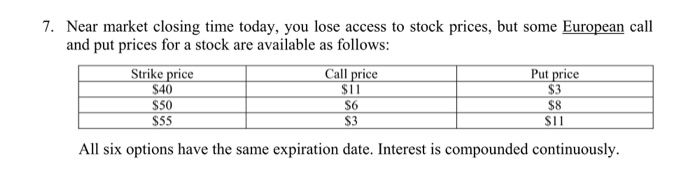

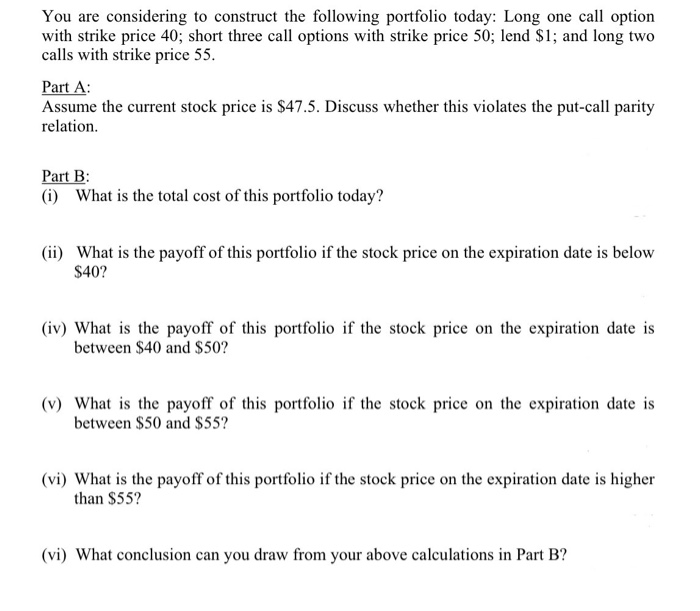

7. Near market closing time today, you lose access to stock prices, but some European call and put prices for a stock are available as follows: Strike price Call price Put price $40 $11 $3 $50 S6 $55 S3 All six options have the same expiration date. Interest is compounded continuously, $8 SIT You are considering to construct the following portfolio today: Long one call option with strike price 40; short three call options with strike price 50; lend $1; and long two calls with strike price 55. Part A: Assume the current stock price is $47.5. Discuss whether this violates the put-call parity relation. Part B: (i) What is the total cost of this portfolio today? (ii) What is the payoff of this portfolio if the stock price on the expiration date is below $40? (iv) What is the payoff of this portfolio if the stock price on the expiration date is between $40 and $50? (v) What is the payoff of this portfolio if the stock price on the expiration date is between $50 and $55? (vi) What is the payoff of this portfolio if the stock price on the expiration date is higher than $55? (vi) What conclusion can you draw from your above calculations in Part B? 7. Near market closing time today, you lose access to stock prices, but some European call and put prices for a stock are available as follows: Strike price Call price Put price $40 $11 $3 $50 S6 $55 S3 All six options have the same expiration date. Interest is compounded continuously, $8 SIT You are considering to construct the following portfolio today: Long one call option with strike price 40; short three call options with strike price 50; lend $1; and long two calls with strike price 55. Part A: Assume the current stock price is $47.5. Discuss whether this violates the put-call parity relation. Part B: (i) What is the total cost of this portfolio today? (ii) What is the payoff of this portfolio if the stock price on the expiration date is below $40? (iv) What is the payoff of this portfolio if the stock price on the expiration date is between $40 and $50? (v) What is the payoff of this portfolio if the stock price on the expiration date is between $50 and $55? (vi) What is the payoff of this portfolio if the stock price on the expiration date is higher than $55? (vi) What conclusion can you draw from your above calculations in Part B