Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#7 Personal computer Color laser printer Photo device/scanner Software Total cost basis Annual O&M costs $4,500 6,500 5.000 2,500 $18,500 10.000 - A firm has

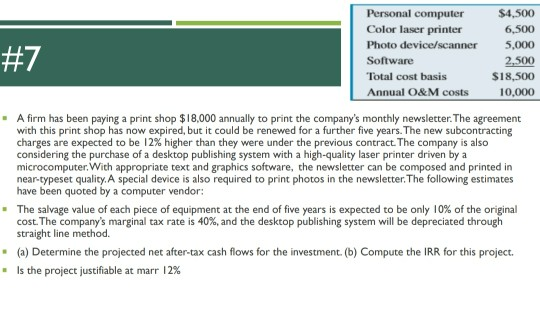

#7 Personal computer Color laser printer Photo device/scanner Software Total cost basis Annual O&M costs $4,500 6,500 5.000 2,500 $18,500 10.000 - A firm has been paying a print shop $18,000 annually to print the company's monthly newsletter. The agreement with this print shop has now expired, but it could be renewed for a further five years. The new subcontracting charges are expected to be 12% higher than they were under the previous contract. The company is also considering the purchase of a desktop publishing system with a high-quality laser printer driven by a microcomputer. With appropriate text and graphics software, the newsletter can be composed and printed in near-typeset quality. A special device is also required to print photos in the newsletter. The following estimates have been quoted by a computer vendor: The salvage value of each piece of equipment at the end of five years is expected to be only 10% of the original cost. The company's marginal tax rate is 40%, and the desktop publishing system will be depreciated through straight line method. (a) Determine the projected net after-tax cash flows for the investment. (b) Compute the IRR for this project. Is the project justifiable at marr 12%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started