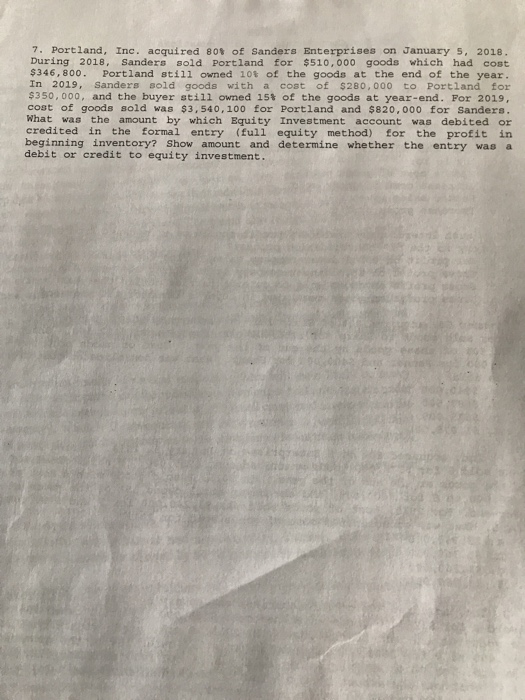

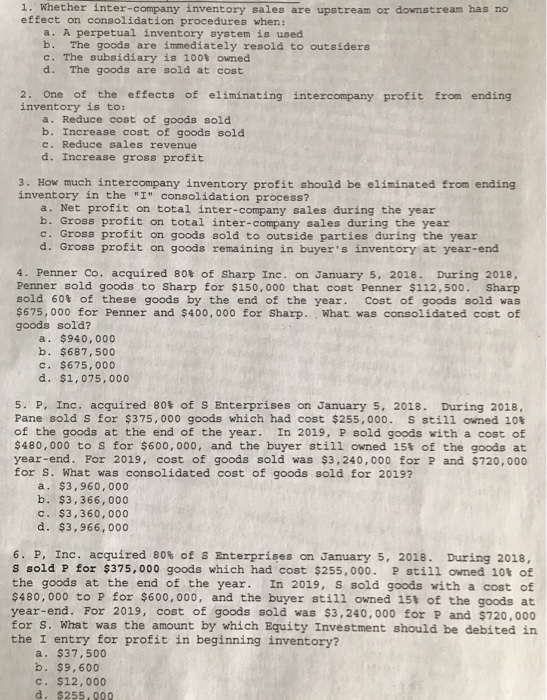

7, Portland, Inc. acquired 80% of Sanders Enterprises on January 5, 2018 During 2018, Sanders sold Portland for $510,000 goods which had cost $346,800. Portland still owned 10t of the goods at the end of the year In 2019, Sanders sold goods with a cost of $280,000 to Portland for $350,000, and the buyer still owned 15% of the goods at year-end. For 2019, cost of goods sold was $3, 540,100 for Portland and $820,000 for sanders. What was the amount by which Equity Investment account was debited or credited in the formal entry (full equity method) for the profit in beginning inventory? Show amount and determine whether the entry was a debit or credit to equity investment 1. Wheth effect on consolidation procedures when: er inter-company inventory sales are upstream or downstream has no a. A perpetual inventory system is used b. The goods are immediately resold to outsiders C. The subsidiary is 100% owned d. The goods are sold at cost 2. One of the effects of eliminating intercompany profit from ending inventory is to: a. Reduce cost of goods sold b. Increase cost of goods sold c. Reduce sales revenue d. Increase gross profit 3. How much intercompany inventory profit should be eliminated from ending inventory in the "I" consolidation process? a. Net profit on total inter-company sales during the year b. Gross profit on total inter-company sales during the year c. Gross profit on goods sold to outside parties during the year d. Gross profit on goods remaining in buyer's inventory at year-end 4. PennerCo. acquired 80% of Sharp Inc. on January 5, 2018. During 2018, Penner sold goods.to Sharp for $150, 000 that cost Penner $112,500. Sharp sold 60% of these goods by the end of the year. Cost of goods sold was $675, 000 for Penner and $400,000 for Sharp. What was consolidated cost of goods sold? , a. $940,000 b. $687,500 c. $675,000 d. $1,075,000 5, P, Inc. acquired 80% of S Enterprises on January 5, 2018. During 2018, Pane sold s for $375,000 goods which had cost $255,000. S still owned 10t of the goods at the end of the year. In 2019, P sold goods with a cost of $480,000 to S for $600,000, and the buyer still owned 15% of the goods at year-end. For 2019, cost of goods sold was $3,240,000 for P and $720,000 for S. What was consolidated cost of goods sold for 2019? , $3,960,000 b. $3,366,000 c. $3,360,000 d. $3,966, 000 P, Inc. acquired 80% of S Enterprises on January 5, 2018. During 2018, s sold P for $375, 000 goods which had cost $255, 000. P still owned 10t of the goods at the end of the year In 2019, s sold goods with a cost of $480,000 to P for $600,000, and the buyer still owned 15t of the goods at year-end. For 2019, cost of goods sold was $3,240,000 for P and $720,000 for s. What was the amount by which Equity Investment should be debited in the I entry for profit in beginning inventory? a. $37,500 b. $9,600 c. $12,000 d. $255.000