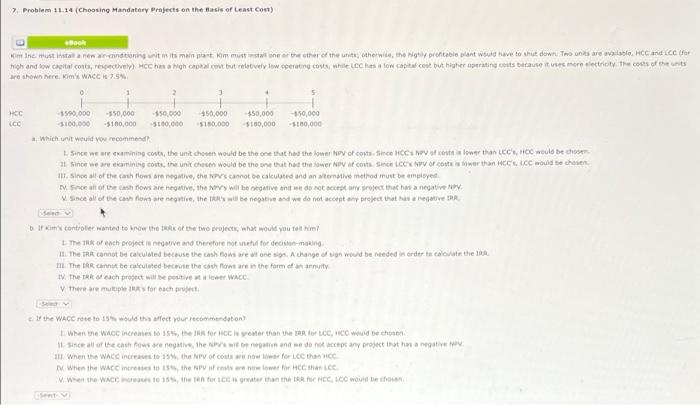

7. Problem 11.14 (Choosing Mandatory Projects on the Basis of Least Cost) kimine mustalanisma atkim musterthether of the units, otherwise, the probleplant would have to shut down. Twents are well. Han for High and low coalcos, rectively)HCha Ngh Chocow but revely low rating costs while slow cost but higher rating contre lectrice costs of the re shown here. Kim's WACC 7.5 2 HOC ico 550.000 -550,000 - 550.000 $50,000 $50,000 -350,000 -5160,000 $100,000 5180.000 $180,000 -5100,000 Which unit would you recommend Sinceramining costs, the unit choon would be the one that had the lower Pot cost SHOP lower than . HOC would be the It since we camining con, then he would be the one that the war NPV con since Voces lower than HCC would be chosen m. Since all of the cash flows are negative, the cannot be calculated and an iterative method must be employed Srce of the cash flows are negative, they will be negative and we do not wroject that has a negative Since all of the cash flow are not the two be negative and we do not contar project that he bilf Kimy controler wanted to the the two projects, what would you to him The of each project is negative and therefore now for deco-ining 1. The cannot be called because the cash flow me on change of son would be needed in order to call the The cannot be calculated becaur lower the form of annuity IV. The of each project wille potete WACC V there are multiples for each the WACC rose to would the affect your recommendation When the WACC incomes to 155, the for Heater than the RFLCC, HCC would be chosen 11. Since all of the negative, the and do not any project that any I when the WACC 115 the NPV of costs owower for the When the WACC to the pools are now lower for HChance Wwe the WACC to 15th for cater than the RCCLCC would be the c. If the WACC rose to 15% would this affect your recommendation? 1. When the WACC Increases to 15%, the IRR for HCC is greater than the IRR for LCC, HCC would be chosen 11. Since all of the cash flows are negative, the NPV's will be negative and we do not accept any project that has a negative NPV. TIL. When the WACC increases to 15%, the NPV of costs are now lower for LCC than HCC IV. When the WACC increases to 15%, the NPV of costs are now lower for HCC than LCC. V. When the WACC Increases to 15%, the IRA for ICC is greater than the 18 for HCC, LCC would be chosen Select Why do you think this result occurred? 1. The reason is that when you discount at a higher rate you are making negative che higher thus improving the NPV. 1. The reason is that when you discount at a higher rate you are making negative che higher and this lowers the NPV. III. The reason is that when you discount at a higher rate you are making negative is smaller and this lower the NPV. IV. The reason is that when you discount at a higher rate you are making negative Fs smaller thus improving the NPV. The reason is that when you discount at a higher rate you are making negative Cs higher thus improving the RA Sev