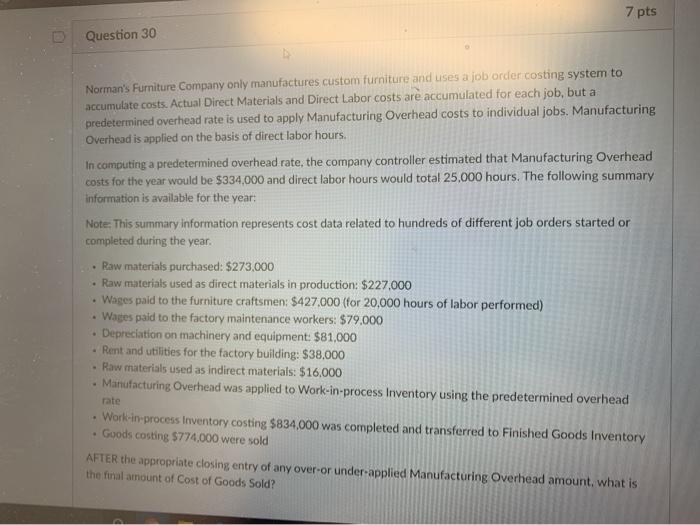

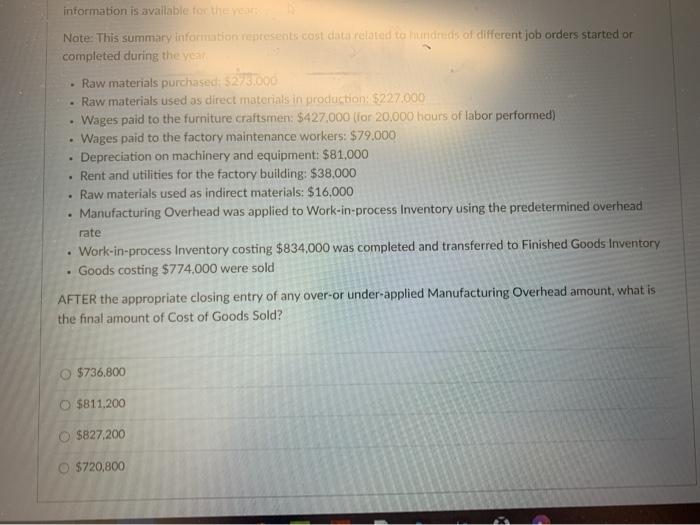

7 pts Question 30 Norman's Furniture Company only manufactures custom furniture and uses a job order costing system to accumulate costs. Actual Direct Materials and Direct Labor costs are accumulated for each job, but a predetermined overhead rate is used to apply Manufacturing Overhead costs to individual jobs. Manufacturing Overhead is applied on the basis of direct labor hours. In computing a predetermined overhead rate, the company controller estimated that Manufacturing Overhead costs for the year would be $334,000 and direct labor hours would total 25.000 hours. The following summary information is available for the year: Note: This summary information represents cost data related to hundreds of different job orders started or completed during the year Raw materials purchased: $273,000 Raw materials used as direct materials in production: $227,000 Wages paid to the furniture craftsmen: $427.000 (for 20,000 hours of labor performed) Wages paid to the factory maintenance workers: $79.000 Depreciation on machinery and equipment: $81,000 Rent and utilities for the factory building: $38,000 Raw materials used as indirect materials: $16,000 Manufacturing Overhead was applied to Work-in-process Inventory using the predetermined overhead rate Work-in-process Inventory costing $834,000 was completed and transferred to Finished Goods Inventory Goods costing $774,000 were sold AFTER the appropriate closing entry of any over-or under-applied Manufacturing Overhead amount, what is the final amount of Cost of Goods Sold? . information is available for the Note: This summary information seresents cost data related to ordreds of different job orders started or completed during the year Raw materials purchased: 522731000 Raw materials used as direct materials in production: $2.27.000 Wages paid to the furniture craftsmen: $427.000 (for 20.000 hours of labor performed) Wages paid to the factory maintenance workers: $79.000 Depreciation on machinery and equipment: $81,000 Rent and utilities for the factory building: $38,000 Raw materials used as indirect materials: $16.000 Manufacturing Overhead was applied to Work-in-process Inventory using the predetermined overhead rate Work-in-process Inventory costing $834,000 was completed and transferred to Finished Goods Inventory Goods costing $774,000 were sold AFTER the appropriate closing entry of any over-or under-applied Manufacturing Overhead amount, what is the final amount of Cost of Goods Sold? . . $736,800 0 $811.200 O $827,200 $720,800