Answered step by step

Verified Expert Solution

Question

1 Approved Answer

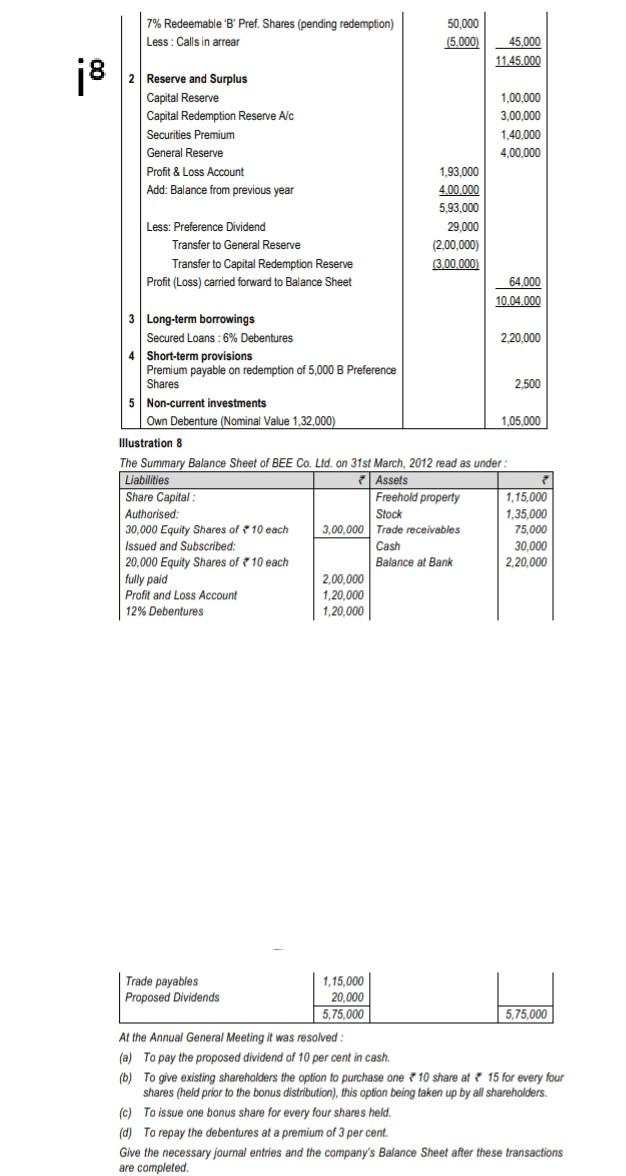

7% Redeemable B Pref. Shares (pending redemption) Less: Calls in arrear 50,000 (5,000) 45,000 11.45.000 8 2 Reserve and Surplus Capital Reserve Capital Redemption Reserve

7% Redeemable B Pref. Shares (pending redemption) Less: Calls in arrear 50,000 (5,000) 45,000 11.45.000 8 2 Reserve and Surplus Capital Reserve Capital Redemption Reserve Alc Securities Premium General Reserve Profit & Loss Account Add: Balance from previous year 1,00,000 3,00.000 1,40.000 4,00,000 Less: Preference Dividend Transfer to General Reserve Transfer to Capital Redemption Reserve Profit (Loss) carried forward to Balance Sheet 1.93,000 400.000 5,93,000 29,000 (2,00,000) (3.00.000) 64.000 10.04.000 220,000 2,500 1,05,000 3 Long-term borrowings Secured Loans: 6% Debentures 4 Short-term provisions Premium payable on redemption of 5,000 B Preference Shares 5 Non-current investments Own Debenture (Nominal Value 1,32,000) Illustration 8 The Summary Balance of BEE Co. Ltd. on arch, 2012 read Liabilities Assets Share Capital Freehold property Authorised: Stock 30,000 Equity Shares of 10 each 3.00.000 Trade receivables Issued and Subscribed Cash 20,000 Equity Shares of 10 each Balance at Bank fully paid 2,00.000 Profil and Loss Account 1,20,000 12% Debentures 1,20,000 under 1.15.000 1,35,000 75,000 30,000 2,20,000 Trade payables 1.15,000 Proposed Dividends 20.000 5,75,000 5,75,000 At the Annual General Meeting it was resolved (a) To pay the proposed dividend of 10 per cent in cash. (b) To give existing shareholders the option to purchase one 10 share at 15 for every four shares (held prior to the bonus distribution, this option being taken up by all shareholders. (c) To issue one bonus share for every four shares held. (d) To repay the debentures at a premium of 3 per cent. Give the necessary journal entries and the company's Balance Sheet after these transactions are completed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started