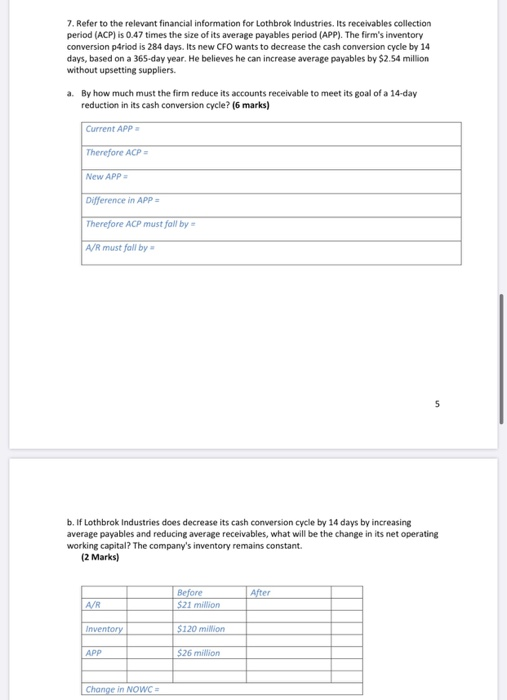

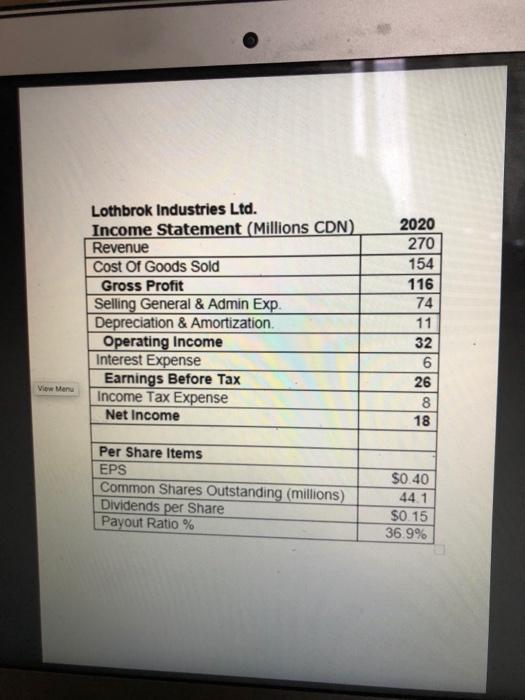

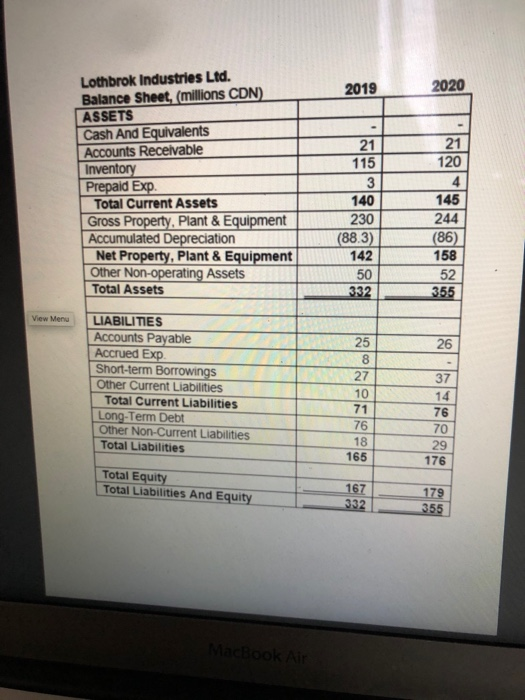

7. Refer to the relevant financial information for Lothbrok Industries. Its receivables collection period (ACP) is 0.47 times the size of its average payables period (APP). The firm's inventory conversion priod is 284 days. Its new CFO wants to decrease the cash conversion cycle by 14 days, based on a 365-day year. He believes he can increase average payables by $2.54 million without upsetting suppliers. a. By how much must the firm reduce its accounts receivable to meet its goal of a 14-day reduction in its cash conversion cycle? (6 marks) Current APP Therefore ACP New APP Difference in APP Therefore ACP must fall by A/R must fall by 5 b. If Lothbrok Industries does decrease its cash conversion cycle by 14 days by increasing average payables and reducing average receivables, what will be the change in its net operating working capital? The company's inventory remains constant. (2 Marks) After Before $21 million AR Inventory $120 million APP $26 million Change in NOWC = Lothbrok Industries Ltd. Income Statement (Millions CDN) Revenue Cost Of Goods Sold Gross Profit Selling General & Admin Exp. Depreciation & Amortization. Operating Income Interest Expense Earnings Before Tax Income Tax Expense Net Income 2020 270 154 116 74 11 32 View Menu 6 26 8 18 Per Share Items EPS Common Shares Outstanding (millions) Dividends per Share Payout Ratio % $0.40 44.1 $0.15 36.9% 2019 2020 Lothbrok Industries Ltd. Balance Sheet, (millions CDN) ASSETS Cash And Equivalents Accounts Receivable Inventory Prepaid Exp. Total Current Assets Gross Property. Plant & Equipment Accumulated Depreciation Net Property, Plant & Equipment Other Non-operating Assets Total Assets 21 115 3 140 230 (88.3) 142 50 332 21 120 4 145 244 (86) 158 52 355 View Menu 26 LIABILITIES Accounts Payable Accrued Exp Short-term Borrowings Other Current Liabilities Total Current Liabilities Long-Term Debt Other Non-Current Liabilities Total Liabilities 25 8 27 10 71 76 18 165 37 14 76 70 29 176 Total Equity Total Liabilities And Equity 167 332 179 355 MacBook Air 7. Refer to the relevant financial information for Lothbrok Industries. Its receivables collection period (ACP) is 0.47 times the size of its average payables period (APP). The firm's inventory conversion priod is 284 days. Its new CFO wants to decrease the cash conversion cycle by 14 days, based on a 365-day year. He believes he can increase average payables by $2.54 million without upsetting suppliers. a. By how much must the firm reduce its accounts receivable to meet its goal of a 14-day reduction in its cash conversion cycle? (6 marks) Current APP Therefore ACP New APP Difference in APP Therefore ACP must fall by A/R must fall by 5 b. If Lothbrok Industries does decrease its cash conversion cycle by 14 days by increasing average payables and reducing average receivables, what will be the change in its net operating working capital? The company's inventory remains constant. (2 Marks) After Before $21 million AR Inventory $120 million APP $26 million Change in NOWC = Lothbrok Industries Ltd. Income Statement (Millions CDN) Revenue Cost Of Goods Sold Gross Profit Selling General & Admin Exp. Depreciation & Amortization. Operating Income Interest Expense Earnings Before Tax Income Tax Expense Net Income 2020 270 154 116 74 11 32 View Menu 6 26 8 18 Per Share Items EPS Common Shares Outstanding (millions) Dividends per Share Payout Ratio % $0.40 44.1 $0.15 36.9% 2019 2020 Lothbrok Industries Ltd. Balance Sheet, (millions CDN) ASSETS Cash And Equivalents Accounts Receivable Inventory Prepaid Exp. Total Current Assets Gross Property. Plant & Equipment Accumulated Depreciation Net Property, Plant & Equipment Other Non-operating Assets Total Assets 21 115 3 140 230 (88.3) 142 50 332 21 120 4 145 244 (86) 158 52 355 View Menu 26 LIABILITIES Accounts Payable Accrued Exp Short-term Borrowings Other Current Liabilities Total Current Liabilities Long-Term Debt Other Non-Current Liabilities Total Liabilities 25 8 27 10 71 76 18 165 37 14 76 70 29 176 Total Equity Total Liabilities And Equity 167 332 179 355 MacBook Air