Answered step by step

Verified Expert Solution

Question

1 Approved Answer

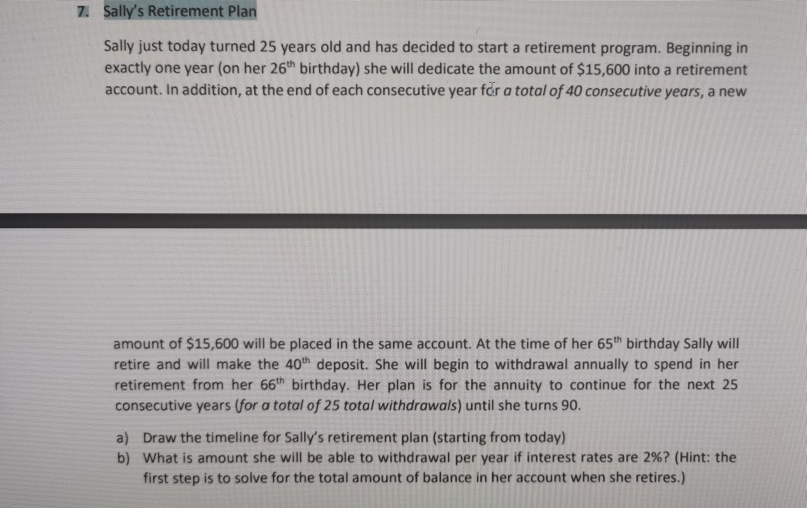

7. Sally's Retirement Plan Sally just today turned 25 years old and has decided to start a retirement program. Beginning in exactly one year (on

7. Sally's Retirement Plan Sally just today turned 25 years old and has decided to start a retirement program. Beginning in exactly one year (on her 26th birthday) she will dedicate the amount of $15,600 into a retirement account. In addition, at the end of each consecutive year for a total of 40 consecutive years, a new amount of $15,600 will be placed in the same account. At the time of her 65th birthday Sally will retire and will make the 40th deposit. She will begin to withdrawal annually to spend in her retirement from her 66th birthday. Her plan is for the annuity to continue for the next 25 consecutive years for a total of 25 total withdrawals) until she turns 90. a) Draw the timeline for Sally's retirement plan (starting from today) b) What is amount she will be able to withdrawal per year if interest rates are 2%? (Hint: the first step is to solve for the total amount of balance in her account when she retires.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started