Answered step by step

Verified Expert Solution

Question

1 Approved Answer

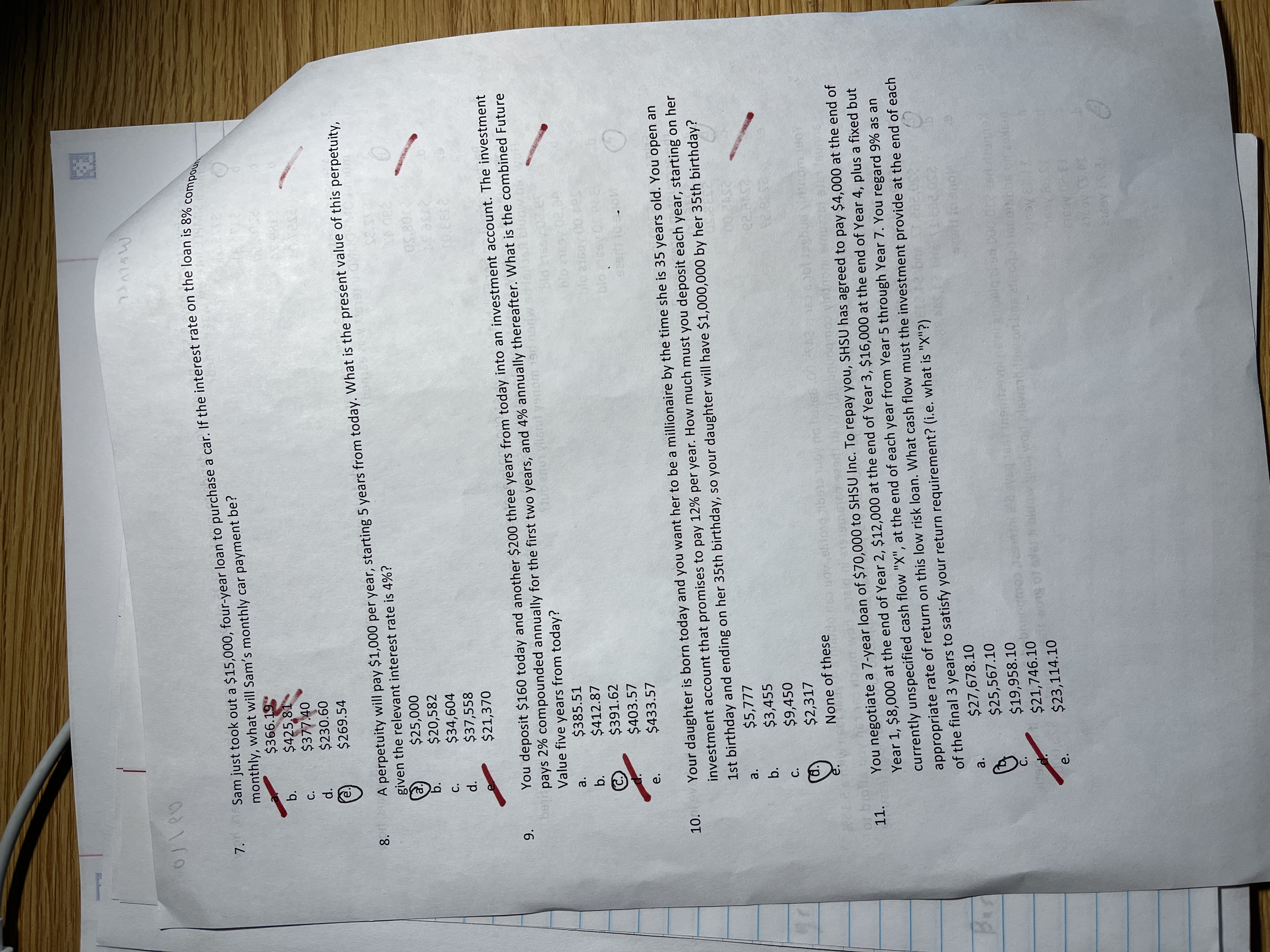

7 . Sam just took out a $ 1 5 , 0 0 0 , four year loan to purchase a car. If the interest

Sam just took out a $ four year loan to purchase a car. If the interest rate on the loan is compounded monthly, what will Sam's monthly car payment be

A$ Correct Answer

B$

C$

D$

E$

A perpetuity will pay $ per year, starting years from today. What is the present value of this perpetuity, given the relevent interest rate is

A $

B $

C $

D $

E $Correct Answer

You deposit $ today and another $ three years from today into an investment account. The investment pays compounded annually for the first two years, and annually thereafter. What is the combined future value five years from today?

A $

B$

C $

D$Correct Answer

E $

Your daughter is born today and you want here to be a millionare by the time she is years old. You open an investment account that promises to pay per year. How much must you deposit each year, starting on her st birthday and ending on her th birthday, so your daughter will have $ by her th birthday?

A $

B $

C $

D $Correct Answer

E None of these

You navigate a year loan of $ to SHSU Inc. To repay you, SHSU has agreed to pay $ at the end of Year $ at the end of yer $ at the end of year $ at the end of year plus a fixed but unspecified cash flow x at the end of each year from year through year You reguard as an appropriate rate of return on this low risk loan. What cash flow must the investment provide at the end of each of the final years to satisfy your return requirement? ie What is X

A $

B$

C$

D$Correct Answer

E$

Please provide step by step solution for each problem. As well as provide instruction on how to solve manually on a financial calculator.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started