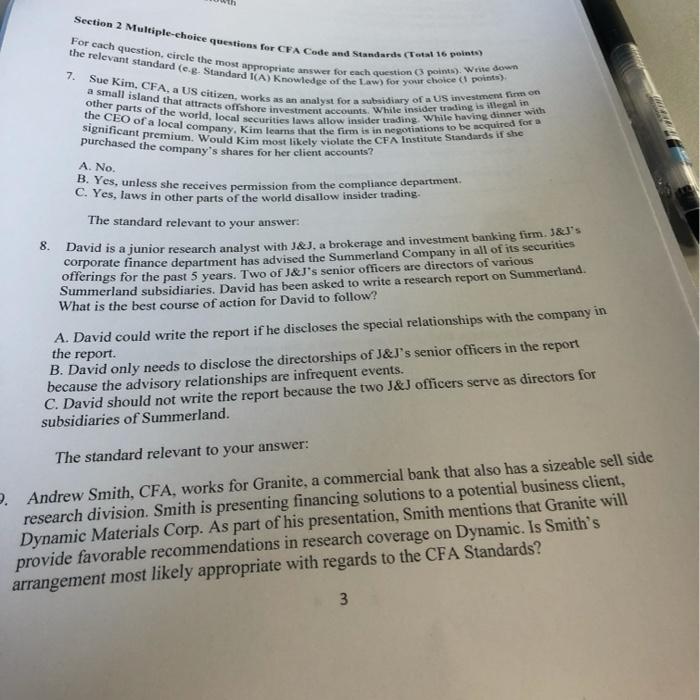

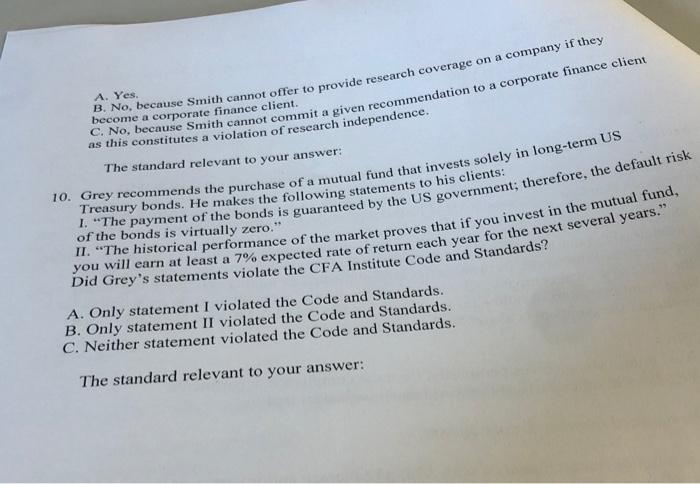

7. Section 2 Multiple-choice questions for CFA Code and Standards (Total 16 points) the relevant standard (eg. Standard (A) Knowledge of the Law) for your choice ( points) For cach question, circle the most appropriate answer for each question points). Write down Sue Kim, CFA, a US citizen, works as an analyst for a subsidiary of a US investment in on other parts of the world, local securities laws allow insider trading. While having dinner with a small island that attracts offshore investment accounts. While insider trading is illegal in the CEO of a local company. Kim learns that the firm is in negotiations to be acquired for a significant premium. Would Kim most likely violate the CFA Institute Standards if she purchased the company's shares for her client accounts? A. No. 8. B. Yes, unless she receives permission from the compliance department C. Yes, laws in other parts of the world disallow insider trading. The standard relevant to your answer: David is a junior research analyst with J&J, a brokerage and investment banking firm. J&J's corporate finance department has advised the Summerland Company in all of its securities offerings for the past 5 years. Two of J&J's senior officers are directors of various Summerland subsidiaries. David has been asked to write a research report on Summerland. What is the best course of action for David to follow? A. David could write the report if he discloses the special relationships with the company in the report. B. David only needs to disclose the directorships of J&J's senior officers in the report because the advisory relationships are infrequent events. C. David should not write the report because the two J&J officers serve as directors for subsidiaries of Summerland. The standard relevant to your answer: 2. Andrew Smith, CFA, works for Granite, a commercial bank that also has a sizeable sell side research division. Smith is presenting financing solutions to a potential business client, Dynamic Materials Corp. As part of his presentation, Smith mentions that Granite will provide favorable recommendations in research coverage on Dynamic. Is Smith's arrangement most likely appropriate with regards to the CFA Standards? 3 A. Yes, B. No, because Smith cannot offer to provide research coverage on a company if they become a corporate finance client. as this constitutes a violation of research independence. C. No, because Smith cannot commit a given recommendation to a corporate finance client The standard relevant to your answer: Treasury bonds. He makes the following statements to his clients: 10. Grey recommends the purchase of a mutual fund that invests solely in long-term US of the bonds is virtually zero. 1. "The payment of the bonds is guaranteed by the US government; therefore, the default risk II. "The historical performance of the market proves that if you invest in the mutual fund, Did will earn at least a 7% expected rate of return each year for the next several years." Did Grey's statements violate the CFA Institute Code and Standards? A. Only statement I violated the Code and Standards. B. Only statement II violated the Code and Standards. C. Neither statement violated the Code and Standards. The standard relevant to your