Answered step by step

Verified Expert Solution

Question

1 Approved Answer

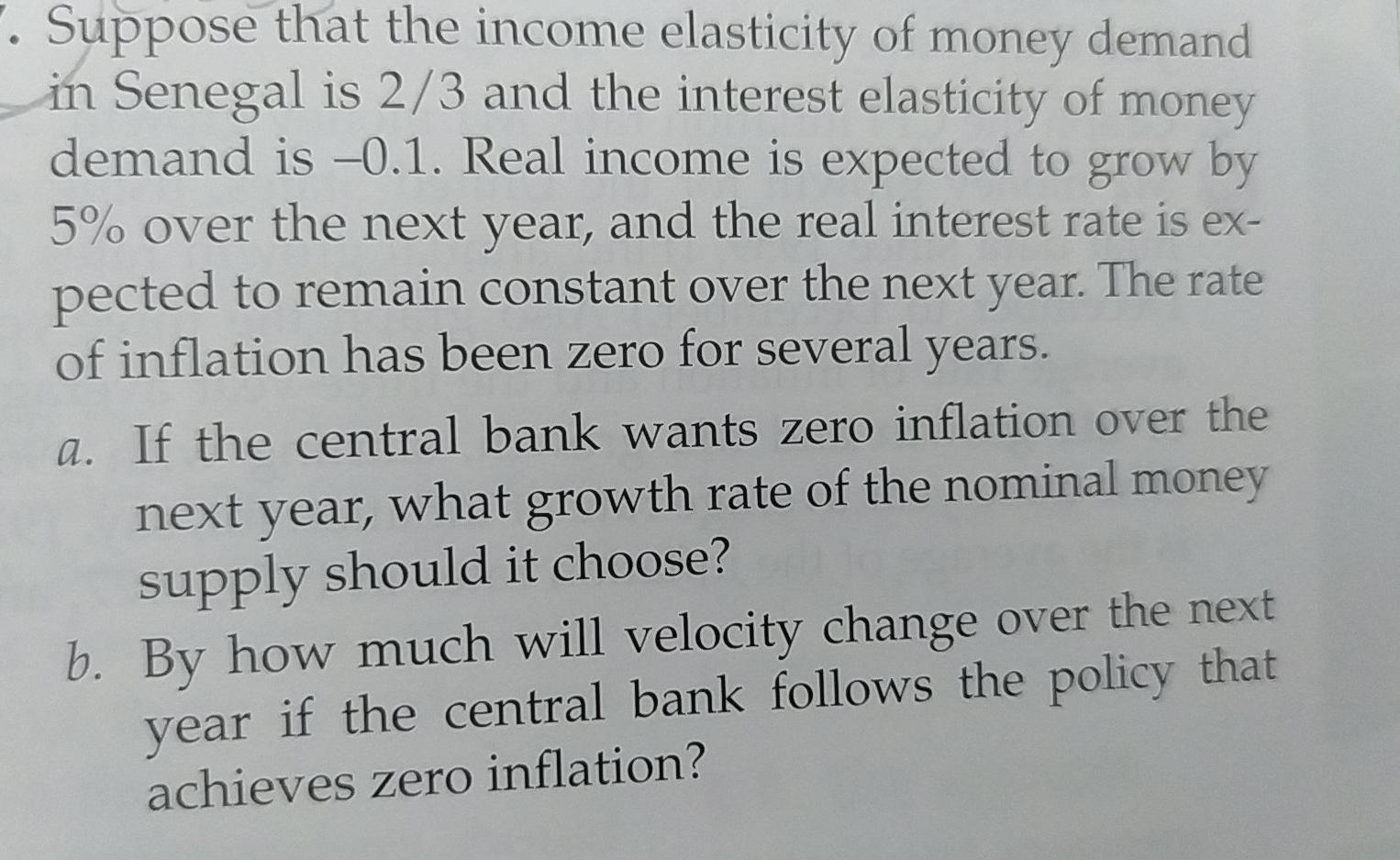

7. Suppose that the income elasticity of money demand in Senegal is 2/3 and the interest elasticity of money demand is -0.1. Real income is

7. Suppose that the income elasticity of money demand in Senegal is 2/3 and the interest elasticity of money demand is -0.1. Real income is expected to grow by 5% over the next year, and the real interest rate is ex- pected to remain constant over the next year. The rate of inflation has been zero for several years. a. If the central bank wants zero inflation over the next year, what growth rate of the nominal money supply should it choose? b. By how much will velocity change over the next year if the central bank follows the policy that achieves zero inflation? . Suppose that the income elasticity of money demand in Senegal is 2/3 and the interest elasticity of money demand is -0.1. Real income is expected to grow by 5% over the next year, and the real interest rate is ex- pected to remain constant over the next year. The rate of inflation has been zero for several years. a. If the central bank wants zero inflation over the next year, what growth rate of the nominal money supply should it choose? b. By how much will velocity change over the next year if the central bank follows the policy that achieves zero inflation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started