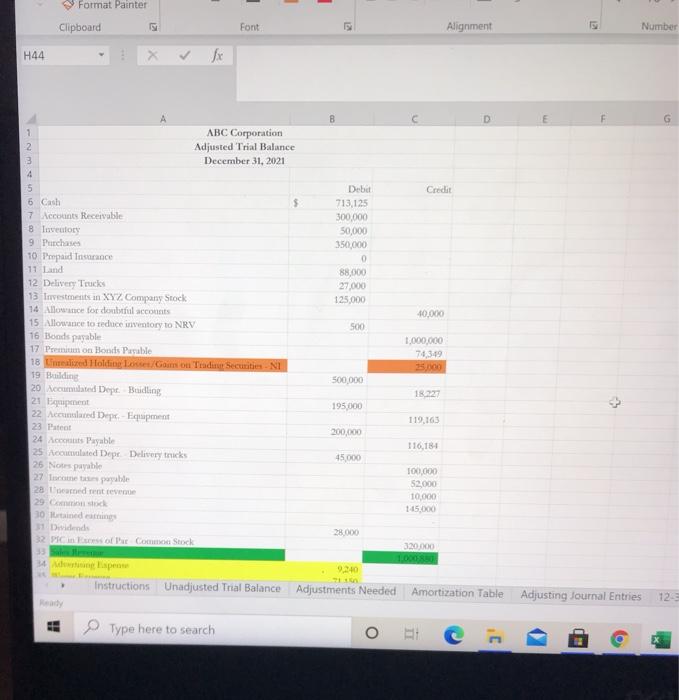

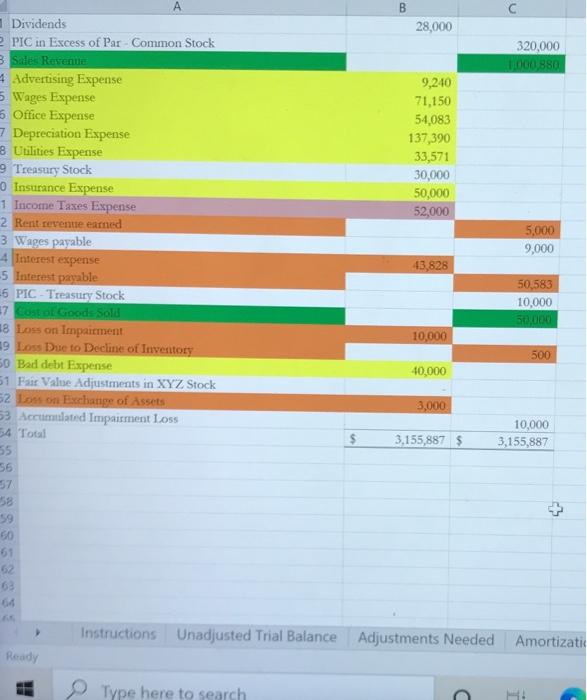

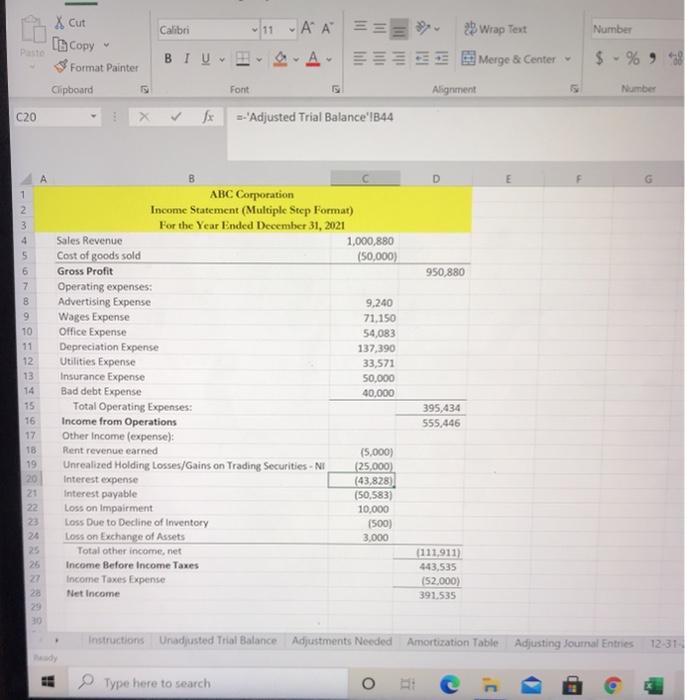

7. The final step is the post Closing Tol Balance, wluch will use the ending bulances from the Post Close T Accounts 7 9 0 1 3 14 46 47 Doutole check you work. There are a few things to check for Adiested Trial Balance: Make sue debit column and credit con total to the same time at the bottom Net income from the income statement will flow though to the Statement of Retained Taman Erling Shacholders' Equity bulines will low through to the Stockholles Etaty section of the Balance Sheet The Post Closing Tu Bolunce should not have my evento, ospense gain, or los tempos, accounts: Check time: Income from otions $25,446 Check me 2 Income before incontes - $244.119. Check tigue 3 Total Cuent Assets 12/31/21 $1,138,625 Check Ligte 4 Retained Famigaw 12/31/21 $167,295 Check tige : Total Stockholders' Equity at 12/31/21 5612,295, Check figue: Total Liabilitas at 12/31/2= $1,408,940 Check figur 7: Total Other locom/Gas and Expenses)/(L) for 2021 (501,327) Remember Nettmatten in Pinacial Statements, Prieto lint Preview before but to make sure your statements de beat Otherwise, incat may send back to you for reason! Lacude your work at the bottom of each tabs needed Ask questions prior to the dayight before the due date. The due date is deady indicated on the comme schedule. Utiliwe found and worksheet linking in your financial statements to improve accuency and we time in completing the assent Please take advantage of Race by ming tomato calculate top of bese "Total Liabilities and Stockholders' Equity") -DO NOT force any cells to match check figures iven. Any adjustments in the T.Accounts or financial statements not supported by legitimate adjusting or closing entries will be considered financial statement mirepresentation sufficient to result in a failing trade. Fial Ther is intended to make www.th yow wonten ir acting www.elkory will remain www tudied during your sledile entine miliwy wpurteotan tube www.ytime as this yet to the coup. The owner mastered walks wyprobowie problew will aww well in the rest of your montieg iww. Powita powator window w d we that wada towar wat will be caled. Please note sur 50 pl ter wel wil work of Minder Instructions Unadjusted Trial Balance Adjustments Needed Amortization Table Adjusting Journal Entries 12-31-21 T.Accounts Adjusted Trial Format Painter Clipboard Font Alignment 21 Number H44 fx D F Credit Debit 713,125 300.000 50,000 350,000 0 88,000 27,000 125,000 ABC Corporation 2 Adjusted Trial Balance 3 December 31, 2021 4 5 6 Cash $ 7 Accounts Receivable 8 Tovutory 9 Purchases 10 Prepaid Insurance 11 Land 12 Delivery Trucks 13 Investments in XYZ. Company Stock 14 Allowance for doubtful accounts 15 Allowance to reduce inventory to NRV 16 Bonds payable 17 Premium on Bonds Payable 18 med Holdelse/Garson Tradin Securities - NI 19 Building 20 Accumulated Dept. Beidling 21 Equipment 22 Accurated Depe-Exupent 23 Patet 24 Acts Payable 25 Acumulated Depr Delivery tricks 25 Notrs payable 27 came able 28 decedenteve 29 Corso 40,000 500 1,000,000 76,349 500,000 18227 195,000 119.163 200,000 116,181 45.000 100,000 52.000 10,000 145.000 31 Dividends 28.000 32 Piness of Pur Coco Stock 320,000 1.000 34 Mapes Instructions Unadjusted Trial Balance Adjustments Needed Amortization Table Adjusting Journal Entries 12 Type here to search O B C 28,000 320,000 1.000,880 9,240 71,150 54,083 137,390 33,571 30,000 50,000 52,000 | Dividends 2 PIC in Excess of Par - Common Stock Sales Revenue 4 Advertising Expense 5 Wages Expense Office Expense 7 Depreciation Expense 8 Utilities Expense 9 Treasury Stock Insurance Expense 1 Income Taxes Expense 2 Rent revenue earned 3 Wages payable 4 Interest expense -5 Interest payable -6 PIC - Treasury Stock 17 Cost of Goods Sold 18 Loss on Impairment 99 Loss Due to Decline of Inventory 50 Bad debt Expense 51 Pair Value Adjustments in XYZ Stock 52 Low on Exchange of Assets 53 Actilated Impairment Loss SA Total 55 56 57 5,000 9,000 43,828 50,583 10,000 50,000 10,000 500 40,000 3,000 $ 3,155,887 $ 10,000 3,155,887 59 50 61 62 63 Instructions Unadjusted Trial Balance Adjustments Needed Amortizati Ready Type here to search X Cut Calibri Number [copy 11 AA == 2Wrap Text A Merge & Center V $ - % , Format Painter Clipboard Font Alignment Number C20 Jx --'Adjusted Trial Balance B44 D 2 4 5 950 880 7 B 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 ABC Corporation Income Statement (Multiple Step Format) For the Year Ended December 31, 2021 Sales Revenue 1,000,880 Cost of goods sold (50,000) Gross Profit Operating expenses: Advertising Expense 9,240 Wages Expense 71.150 Office Expense 54,083 Depreciation Expense 137,390 Utilities Expense 33,571 Insurance Expense 50,000 Bad debt Expense 40,000 Total Operating Expenses: Income from Operations Other Income (expense): Rent revenue earned (5,000) Unrealized Holding Losses/Gains on Trading Securities - NI (25,000 Interest expense (43,828) Interest payable (50,583) Loss on Impairment 10.000 Loss Due to Decline of Inventory {500) Loss on Exchange of Assets 3.000 Total other income, net Income Before Income Taxes Income Taxes Expense Net Income 395,434 555.446 27 (111,911) 443,535 (52,000) 391.535 29 Instructions Uradjusted Trial Balance Adjustments Needed Amortization Table Adjusting Soutral Entries 12-31 Type here to search O 7. The final step is the post Closing Tol Balance, wluch will use the ending bulances from the Post Close T Accounts 7 9 0 1 3 14 46 47 Doutole check you work. There are a few things to check for Adiested Trial Balance: Make sue debit column and credit con total to the same time at the bottom Net income from the income statement will flow though to the Statement of Retained Taman Erling Shacholders' Equity bulines will low through to the Stockholles Etaty section of the Balance Sheet The Post Closing Tu Bolunce should not have my evento, ospense gain, or los tempos, accounts: Check time: Income from otions $25,446 Check me 2 Income before incontes - $244.119. Check tigue 3 Total Cuent Assets 12/31/21 $1,138,625 Check Ligte 4 Retained Famigaw 12/31/21 $167,295 Check tige : Total Stockholders' Equity at 12/31/21 5612,295, Check figue: Total Liabilitas at 12/31/2= $1,408,940 Check figur 7: Total Other locom/Gas and Expenses)/(L) for 2021 (501,327) Remember Nettmatten in Pinacial Statements, Prieto lint Preview before but to make sure your statements de beat Otherwise, incat may send back to you for reason! Lacude your work at the bottom of each tabs needed Ask questions prior to the dayight before the due date. The due date is deady indicated on the comme schedule. Utiliwe found and worksheet linking in your financial statements to improve accuency and we time in completing the assent Please take advantage of Race by ming tomato calculate top of bese "Total Liabilities and Stockholders' Equity") -DO NOT force any cells to match check figures iven. Any adjustments in the T.Accounts or financial statements not supported by legitimate adjusting or closing entries will be considered financial statement mirepresentation sufficient to result in a failing trade. Fial Ther is intended to make www.th yow wonten ir acting www.elkory will remain www tudied during your sledile entine miliwy wpurteotan tube www.ytime as this yet to the coup. The owner mastered walks wyprobowie problew will aww well in the rest of your montieg iww. Powita powator window w d we that wada towar wat will be caled. Please note sur 50 pl ter wel wil work of Minder Instructions Unadjusted Trial Balance Adjustments Needed Amortization Table Adjusting Journal Entries 12-31-21 T.Accounts Adjusted Trial Format Painter Clipboard Font Alignment 21 Number H44 fx D F Credit Debit 713,125 300.000 50,000 350,000 0 88,000 27,000 125,000 ABC Corporation 2 Adjusted Trial Balance 3 December 31, 2021 4 5 6 Cash $ 7 Accounts Receivable 8 Tovutory 9 Purchases 10 Prepaid Insurance 11 Land 12 Delivery Trucks 13 Investments in XYZ. Company Stock 14 Allowance for doubtful accounts 15 Allowance to reduce inventory to NRV 16 Bonds payable 17 Premium on Bonds Payable 18 med Holdelse/Garson Tradin Securities - NI 19 Building 20 Accumulated Dept. Beidling 21 Equipment 22 Accurated Depe-Exupent 23 Patet 24 Acts Payable 25 Acumulated Depr Delivery tricks 25 Notrs payable 27 came able 28 decedenteve 29 Corso 40,000 500 1,000,000 76,349 500,000 18227 195,000 119.163 200,000 116,181 45.000 100,000 52.000 10,000 145.000 31 Dividends 28.000 32 Piness of Pur Coco Stock 320,000 1.000 34 Mapes Instructions Unadjusted Trial Balance Adjustments Needed Amortization Table Adjusting Journal Entries 12 Type here to search O B C 28,000 320,000 1.000,880 9,240 71,150 54,083 137,390 33,571 30,000 50,000 52,000 | Dividends 2 PIC in Excess of Par - Common Stock Sales Revenue 4 Advertising Expense 5 Wages Expense Office Expense 7 Depreciation Expense 8 Utilities Expense 9 Treasury Stock Insurance Expense 1 Income Taxes Expense 2 Rent revenue earned 3 Wages payable 4 Interest expense -5 Interest payable -6 PIC - Treasury Stock 17 Cost of Goods Sold 18 Loss on Impairment 99 Loss Due to Decline of Inventory 50 Bad debt Expense 51 Pair Value Adjustments in XYZ Stock 52 Low on Exchange of Assets 53 Actilated Impairment Loss SA Total 55 56 57 5,000 9,000 43,828 50,583 10,000 50,000 10,000 500 40,000 3,000 $ 3,155,887 $ 10,000 3,155,887 59 50 61 62 63 Instructions Unadjusted Trial Balance Adjustments Needed Amortizati Ready Type here to search X Cut Calibri Number [copy 11 AA == 2Wrap Text A Merge & Center V $ - % , Format Painter Clipboard Font Alignment Number C20 Jx --'Adjusted Trial Balance B44 D 2 4 5 950 880 7 B 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 ABC Corporation Income Statement (Multiple Step Format) For the Year Ended December 31, 2021 Sales Revenue 1,000,880 Cost of goods sold (50,000) Gross Profit Operating expenses: Advertising Expense 9,240 Wages Expense 71.150 Office Expense 54,083 Depreciation Expense 137,390 Utilities Expense 33,571 Insurance Expense 50,000 Bad debt Expense 40,000 Total Operating Expenses: Income from Operations Other Income (expense): Rent revenue earned (5,000) Unrealized Holding Losses/Gains on Trading Securities - NI (25,000 Interest expense (43,828) Interest payable (50,583) Loss on Impairment 10.000 Loss Due to Decline of Inventory {500) Loss on Exchange of Assets 3.000 Total other income, net Income Before Income Taxes Income Taxes Expense Net Income 395,434 555.446 27 (111,911) 443,535 (52,000) 391.535 29 Instructions Uradjusted Trial Balance Adjustments Needed Amortization Table Adjusting Soutral Entries 12-31 Type here to search O