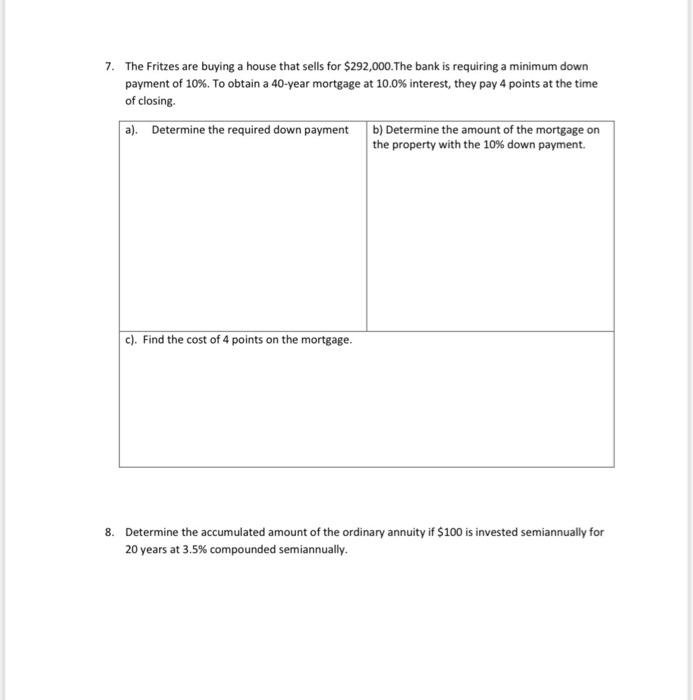

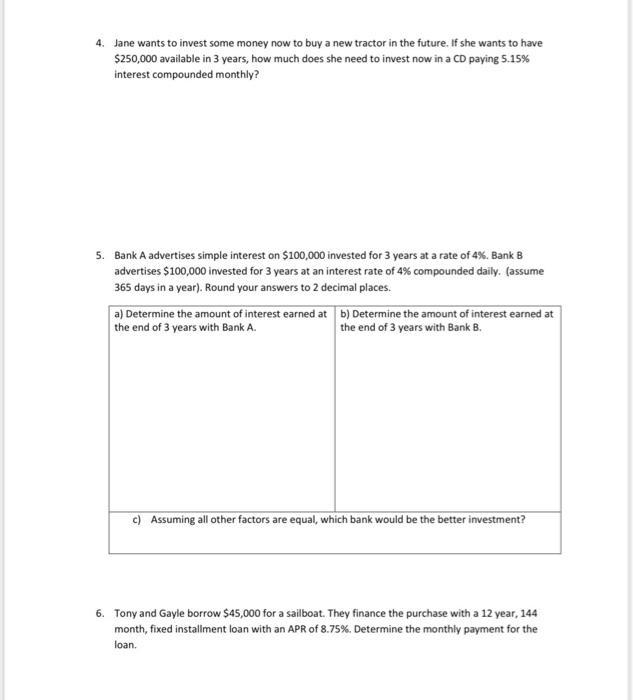

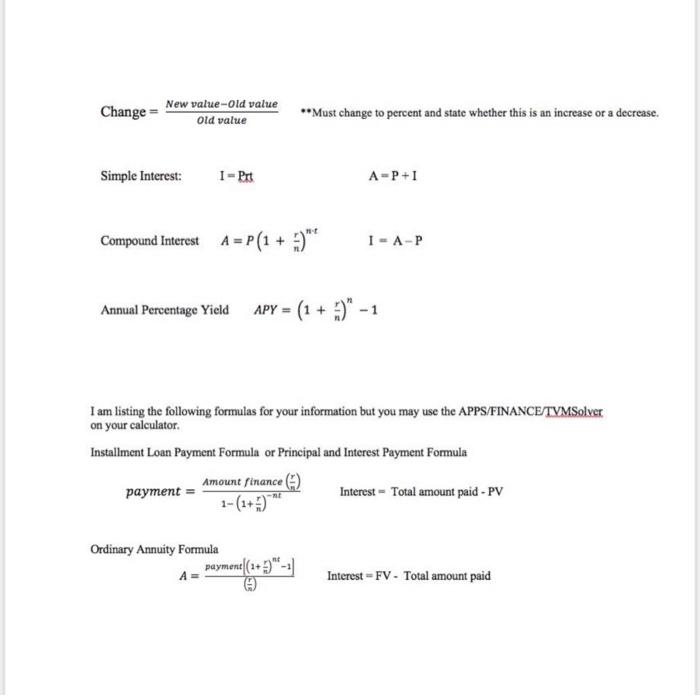

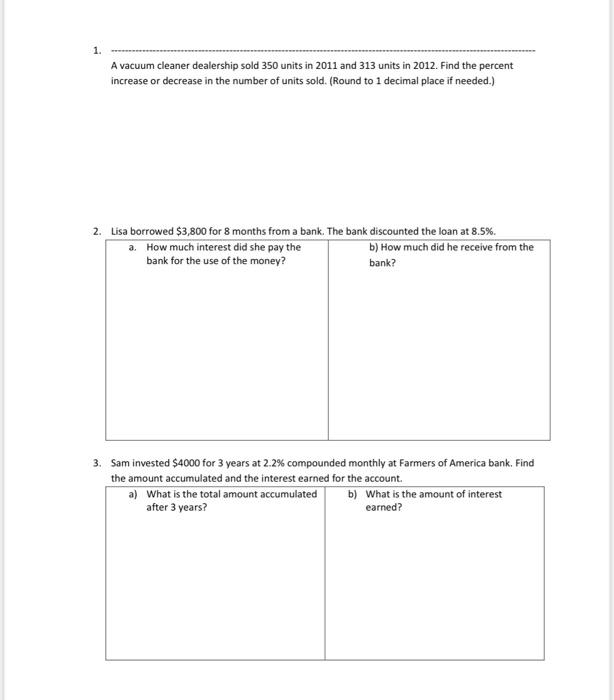

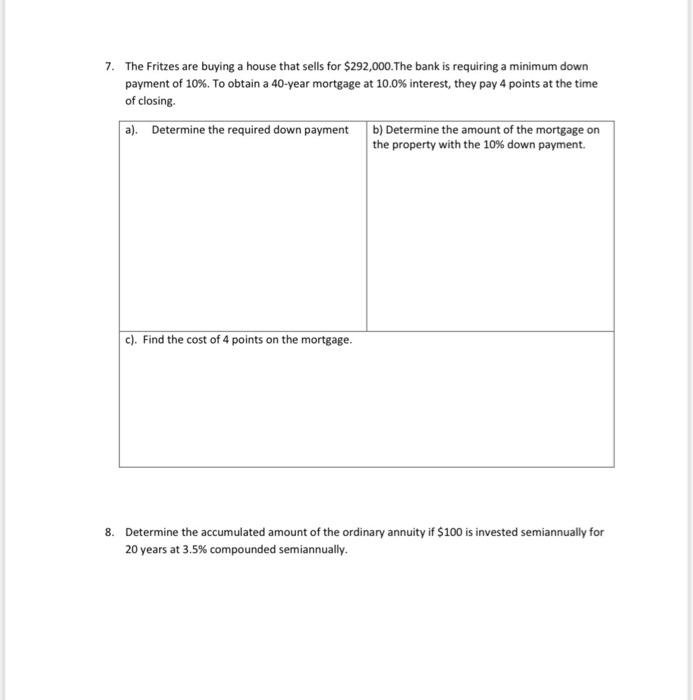

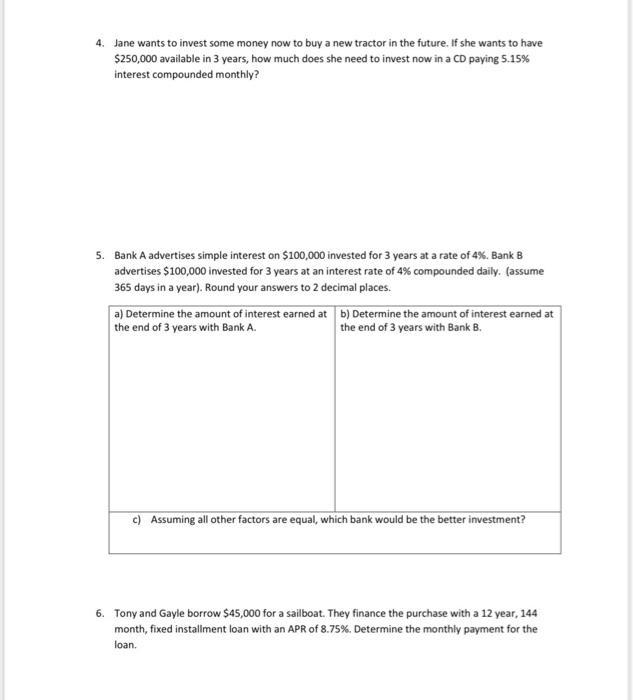

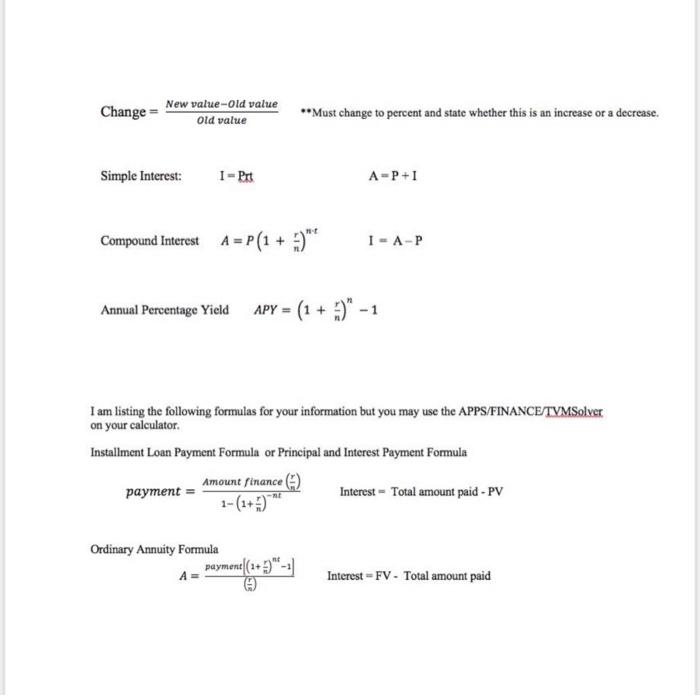

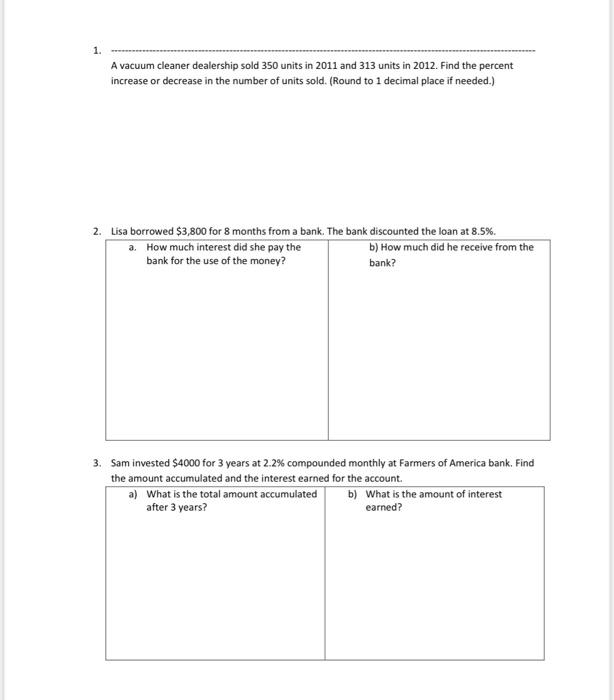

7. The Fritzes are buying a house that sells for $292,000. The bank is requiring a minimum down payment of 10%. To obtain a 40-year mortgage at 10.0% interest, they pay 4 points at the time of closing a). Determine the required down payment b) Determine the amount of the mortgage on the property with the 10% down payment. c). Find the cost of 4 points on the mortgage. 8. Determine the accumulated amount of the ordinary annuity if $100 is invested semiannually for 20 years at 3.5% compounded semiannually. 4. Jane wants to invest some money now to buy a new tractor in the future. If she wants to have $250,000 available in 3 years, how much does she need to invest now in a CD paying 5.15% interest compounded monthly? 5. Bank A advertises simple interest on $100,000 invested for 3 years at a rate of 4%. Bank B advertises $100,000 invested for 3 years at an interest rate of 4% compounded daily. (assume 365 days in a year). Round your answers to 2 decimal places. a) Determine the amount of interest earned at b) Determine the amount of interest earned at the end of 3 years with Bank A. the end of 3 years with Bank B. c) Assuming all other factors are equal, which bank would be the better investment? 6. Tony and Gayle borrow $45,000 for a sailboat. They finance the purchase with a 12 year, 144 month, fixed installment loan with an APR of 8.75%. Determine the monthly payment for the loan. New value-old value Change = Old value **Must change to percent and state whether this is an increase or a decrease. Simple Interest: I - PR A-P+1 Compound Interest A = P(1 + 3)" I-A-P Annual Percentage Yield APY = (1 + 3)" - 1 I am listing the following formulas for your information but you may use the APPS/FINANCE/TVMSolver on your calculator Installment Loan Payment Formula or Principal and Interest Payment Formula Amount finance) payment Interest - Total amount paid - PV Ordinary Annuity Formula payment (2+3-1) Interest - FV - Total amount paid 1. A vacuum cleaner dealership sold 350 units in 2011 and 313 units in 2012. Find the percent increase or decrease in the number of units sold. (Round to 1 decimal place if needed.) 2. Lisa borrowed 8 months from a bank. The bank discounted the loan at 8.5%. a. How much interest did she pay the b) How much did he receive from the bank for the use of the money? bank? 3. Sam invested $4000 for 3 years at 2.2% compounded monthly at Farmers of America bank. Find the amount accumulated and the interest earned for the account. a) What is the total amount accumulated b) What is the amount of interest after 3 years? earned