Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7. The Klaussen family has just purchased a home for $229,000. Before finalizing their offer on the home, they have a professional building inspector

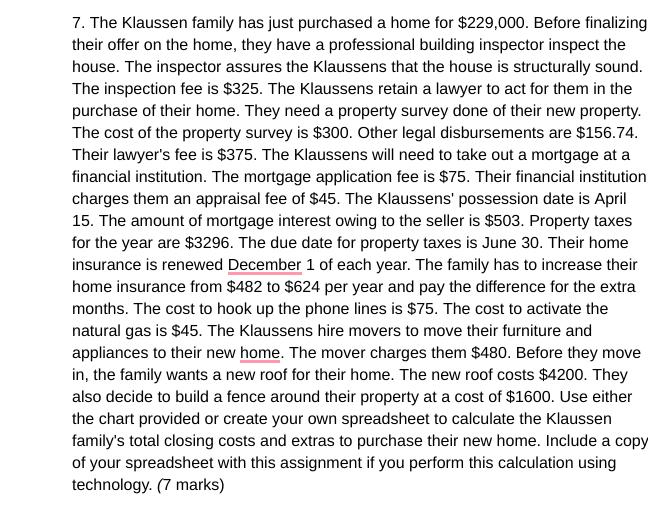

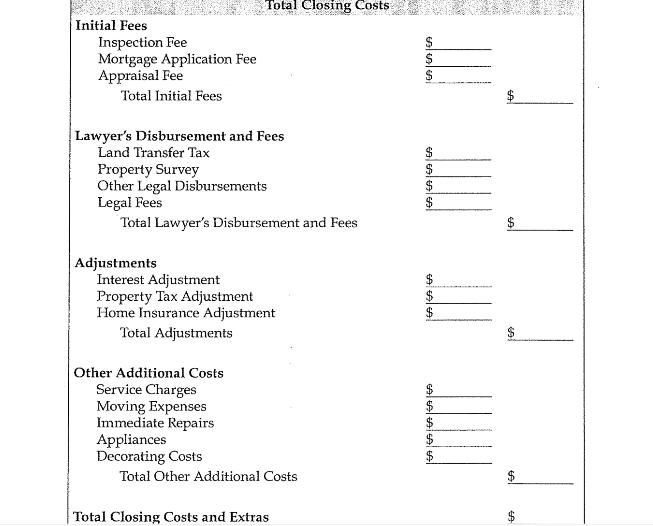

7. The Klaussen family has just purchased a home for $229,000. Before finalizing their offer on the home, they have a professional building inspector inspect the house. The inspector assures the Klaussens that the house is structurally sound. The inspection fee is $325. The Klaussens retain a lawyer to act for them in the purchase of their home. They need a property survey done of their new property. The cost of the property survey is $300. Other legal disbursements are $156.74. Their lawyer's fee is $375. The Klaussens will need to take out a mortgage at a financial institution. The mortgage application fee is $75. Their financial institution charges them an appraisal fee of $45. The Klaussens' possession date is April 15. The amount of mortgage interest owing to the seller is $503. Property taxes for the year are $3296. The due date for property taxes is June 30. Their home insurance is renewed December 1 of each year. The family has to increase their home insurance from $482 to $624 per year and pay the difference for the extra months. The cost to hook up the phone lines is $75. The cost to activate the natural gas is $45. The Klaussens hire movers to move their furniture and appliances to their new home. The mover charges them $480. Before they move in, the family wants a new roof for their home. The new roof costs $4200. They also decide to build a fence around their property at a cost of $1600. Use either the chart provided or create your own spreadsheet to calculate the Klaussen family's total closing costs and extras to purchase their new home. Include a copy of your spreadsheet with this assignment if you perform this calculation using technology. (7 marks) Total Closing Costs SSS $ $ $ $ 69696969 696969 $ $ Initial Fees Inspection Fee Mortgage Application Fee Appraisal Fee Total Initial Fees Lawyer's Disbursement and Fees Land Transfer Tax Property Survey Other Legal Disbursements Legal Fees Total Lawyer's Disbursement and Fees Adjustments Interest Adjustment Property Tax Adjustment Home Insurance Adjustment Total Adjustments Other Additional Costs Service Charges Moving Expenses Immediate Repairs Appliances Decorating Costs Total Other Additional Costs Total Closing Costs and Extras SA SA EA 5555LA $ $ $ $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started