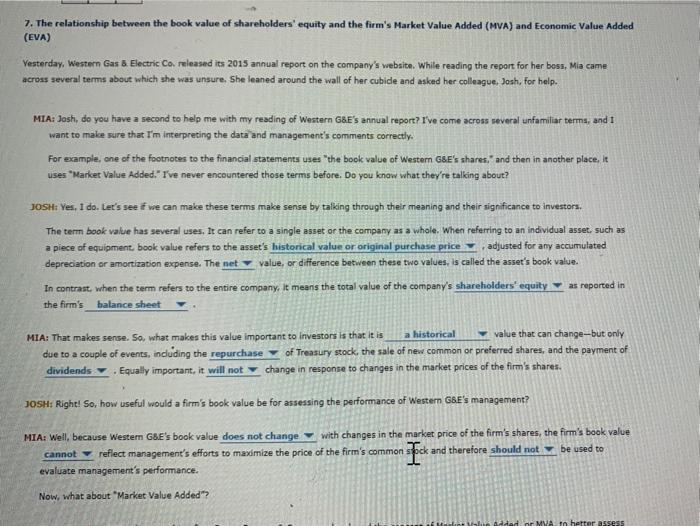

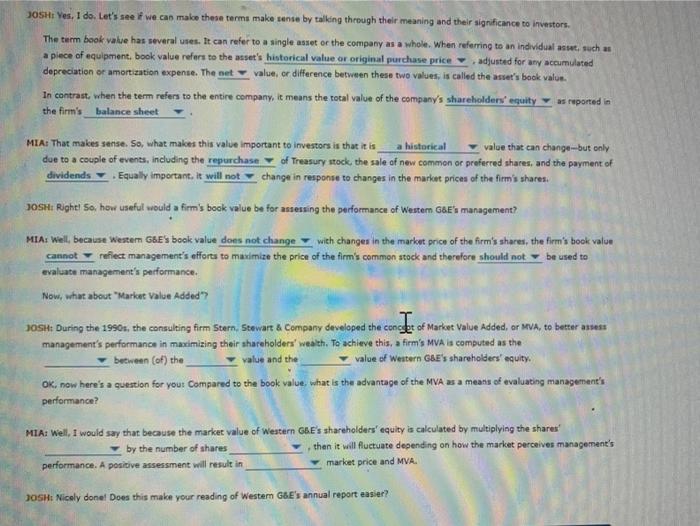

7. The relationship between the book value of shareholders' equity and the firm's Market Value Added (MVA) and Economic Value Added (EVA) Yesterday, Western Gas & Electric Co. released its 2015 annual report on the company's website. While reading the report for her boss, Mia came across several terms about which she was unsure, She leaned around the wall of her cubide and asked her colleague, Josh. For help. MIA: Jash, do you have a second to help me with my reading of Western GBE's annual report? I've come across several unfamiliar terms, and 1 want to make sure that I'm interpreting the data and management's comments correctly. For example, one of the footnotes to the financial statements uses "the book value of Western GSE's shares, and then in another place. It uses "Market Value Added." I've never encountered those terms before. Do you know what they're talking about? JOSH: Yes, I do. Let's see we can make these terms make sense by talking through their meaning and their significance to investors, The term book value has several uses. It can refer to a single asset the company as a whole. When referring to an individual asset, such as a piece of equipment book value refers to the asset's historical value or original purchase price adjusted for any accumulated depreciation or amortization expense. The net value, or difference between these two values, is called the asset's book value. In contrast, when the term refers to the entire company, it means the total value of the company's shareholders' equity as reported in the firm's balance sheet MIA: That makes sense. So, what makes this value important to investors is that it is a historical value that can change-but only due to a couple of events, including the repurchase of Treasury stock, the sale of new common or preferred shares, and the payment of dividends. Equally important, it will not change in response to changes in the market prices of the firm's shares. JOSH: Right! So, how useful would a firm's book value be for assessing the performance of Western GBE's management? MIA: Well, because Western GSE's book value does not change with changes in the market price of the firm's shares, the firm's book value cannot reflect management's efforts to maximize the price of the firm's common and therefore should not be used to evaluate management's performance. Ticke Now, what about "Market Value Added"? dad MVA to herter assess JOSH: Yes. I do. Let's see if we can make these terms make sense by talking through their meaning and their significance to investors The term book value has several use. It can refer to a single asset or the company as a whole. When referring to an individual assautsuch as a plece of equipment, book value refers to the asset's historical value or original purchase price adjusted for any accumulated depreciation or amortization expense. The net value, or difference between these two values, is called the asset's book valun. In contrast, when the term refers to the entire company, it means the total value of the company's shareholders' equity as reported in the firm's_balance sheet MIA: That makes sense. So, what makes this value important to investors is that it is a historical value that can change-but only due to a couple of events, including the repurchase of Treasury stock, the sale of new common or preferred shares, and the payment of dividends Equally important. It will not change in response to changes in the market prices of the firm's shares JOSH: Right! So, how useful would a firm's book value be for assessing the performance of Western Gee's management? MIA: Well, because Western GE's book value does not change with changes in the market price of the firm's shares, the firm's book value cannot reflect management's efforts to maximize the price of the firm's common stock and therefore should not be used to evaluate management's performance. Now, what about "Market Value Added"> JOSH: During the 1990s, the consulting firm Stern, Stewart & Company developed the coneg of Market Value Added, ar MVA, to better assess management's performance in maximizing their shareholders' wealth. To achieve this, a firm's MVA is computed as the between (of) the value and the value of Western G&E's shareholders' equity. OK, now here's a question for your compared to the book value, what is the advantage of the MVA as a means of evaluating management's performance? MIA: Well, I would say that because the market value of Western Gee's shareholders' equity is calculated by multiplying the shares by the number of shares then it will fluctuate depending on how the market perceives management's performance. A positive assessment will result in market price and MVA BOSH: Nicely donel Does this make your reading of Westem GE's annual report easier