Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7) The XYZ stock is currently traded at $20 per share. Suppose you have $10,000 cash available, how many shares of XYZ stock can you

7)

The XYZ stock is currently traded at $20 per share. Suppose you have $10,000 cash available, how many shares of XYZ stock can you buy if you borrow the maximum amount from the broker under the above margin requirements?

8)

Suppose that you purchased the maximum amount of XYZ stock that you are allowed to in question 7. What is the lowest price that XYZ can reach one year from now so that your margin is still above the required maintenance margin? Round to the nearest cent.

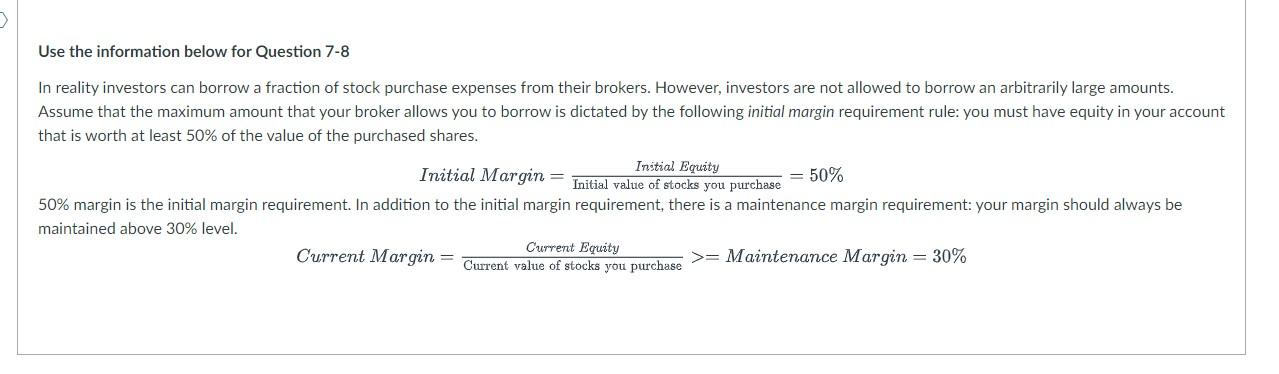

> Use the information below for Question 7-8 In reality investors can borrow a fraction of stock purchase expenses from their brokers. However, investors are not allowed to borrow an arbitrarily large amounts. Assume that the maximum amount that your broker allows you to borrow is dictated by the following initial margin requirement rule: you must have equity in your account that is worth at least 50% of the value of the purchased shares. = 50% Instial Equity Initial Margin = Initial value of stocks you purchase 50% margin is the initial margin requirement. In addition to the initial margin requirement, there is a maintenance margin requirement: your margin should always be maintained above 30% level. Current Equity Current Margin = Current value of stocks you purchase >= Maintenance Margin = 30%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started