Answered step by step

Verified Expert Solution

Question

1 Approved Answer

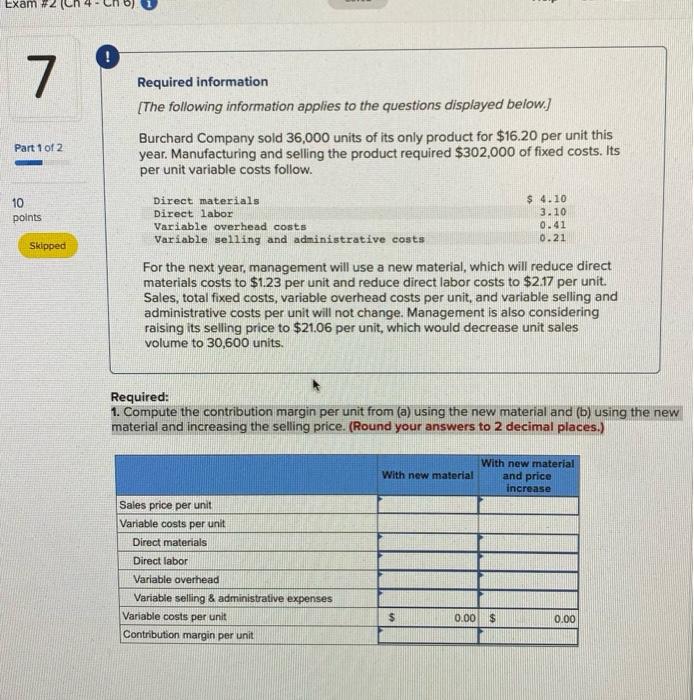

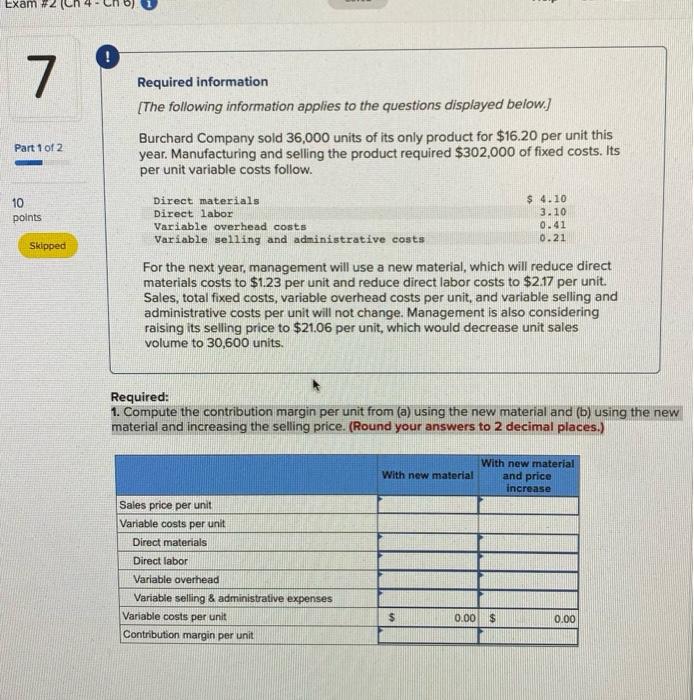

7 thx Required information [The following information applies to the questions displayed below.] Burchard Company sold 36,000 units of its only product for $16.20 per

7 thx

Required information [The following information applies to the questions displayed below.] Burchard Company sold 36,000 units of its only product for $16.20 per unit this year. Manufacturing and selling the product required $302,000 of fixed costs. Its per unit variable costs follow. For the next year, management will use a new material, which will reduce direct materials costs to $1.23 per unit and reduce direct labor costs to $2.17 per unit. Sales, total fixed costs, variable overhead costs per unit, and variable selling and administrative costs per unit will not change. Management is also considering raising its selling price to $21.06 per unit, which would decrease unit sales volume to 30,600 units. Required: 1. Compute the contribution margin per unit from (a) using the new material and (b) using the new material and increasing the selling price. (Round your answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started