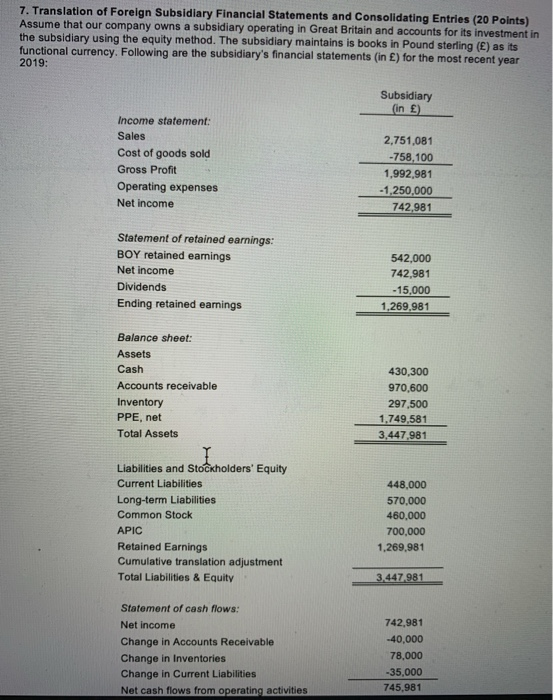

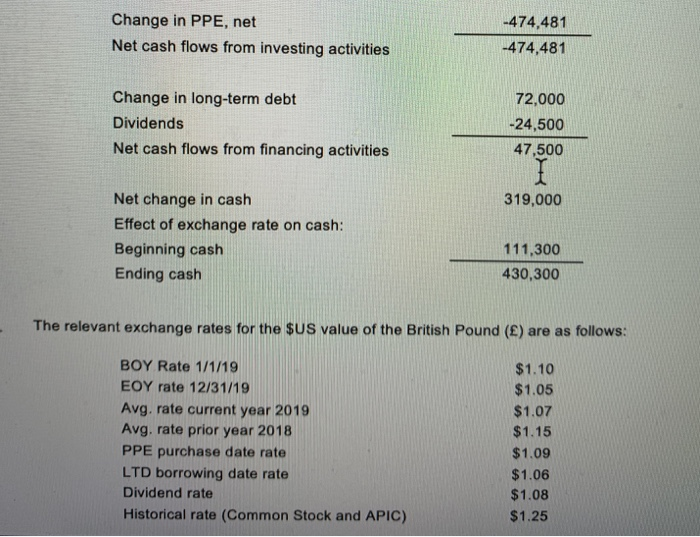

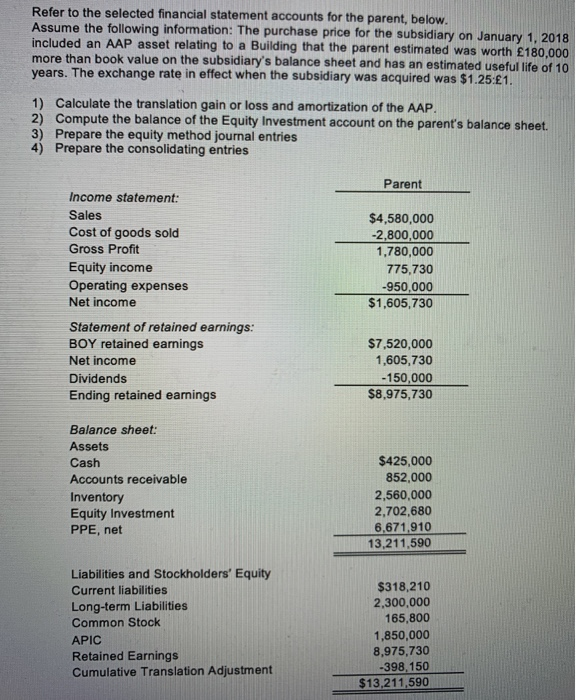

7. Translation of Foreign Subsidiary Financial Statements and Consolidating Entries (20 Points) Assume that our company owns a subsidiary operating in Great Britain and accounts for its Investment in the subsidiary using the equity method. The subsidiary maintains is books in Pound sterling () as its functional currency. Following are the subsidiary's financial statements (in ) for the most recent year 2019: Subsidiary (in ) Income statement: Sales Cost of goods sold Gross Profit Operating expenses Net income 2,751,081 -758,100 1,992,981 -1,250,000 742,981 Statement of retained earnings: BOY retained earnings Net income Dividends Ending retained earnings 542,000 742.981 - 15,000 1,269.981 Balance sheet: Assets Cash Accounts receivable Inventory PPE, net Total Assets 430,300 970,600 297,500 1.749,581 3,447,981 Liabilities and Stockholders' Equity Current Liabilities Long-term Liabilities Common Stock APIC Retained Earnings Cumulative translation adjustment Total Liabilities & Equity 448,000 570,000 460,000 700,000 1,269,981 3.447.981 Statement of cash flows: Net income Change in Accounts Receivable Change in Inventories Change in Current Liabilities Net cash flows from operating activities 742,981 -40,000 78,000 -35,000 745.981 Change in PPE, net Net cash flows from investing activities -474,481 -474,481 Change in long-term debt Dividends Net cash flows from financing activities 72,000 -24,500 47,500 319,000 Net change in cash Effect of exchange rate on cash: Beginning cash Ending cash 111,300 430,300 The relevant exchange rates for the $US value of the British Pound () are as follows: BOY Rate 1/1/19 EOY rate 12/31/19 Avg. rate current year 2019 Avg. rate prior year 2018 PPE purchase date rate LTD borrowing date rate Dividend rate Historical rate (Common Stock and APIC) $1.10 $1.05 $1.07 $1.15 $1.09 $1.06 $1.08 $1.25 Refer to the selected financial statement accounts for the parent, below. Assume the following information: The purchase price for the subsidiary on January 1, 2018 included an AAP asset relating to a Building that the parent estimated was worth 180,000 more than book value on the subsidiary's balance sheet and has an estimated useful life of 10 years. The exchange rate in effect when the subsidiary was acquired was $1.25 1. 1) Calculate the translation gain or loss and amortization of the AAP. 2) Compute the balance of the Equity Investment account on the parent's balance sheet. 3) Prepare the equity method journal entries 4) Prepare the consolidating entries Parent Income statement: Sales Cost of goods sold Gross Profit Equity income Operating expenses Net income Statement of retained earnings: BOY retained earnings Net income Dividends Ending retained earnings $4,580,000 -2,800,000 1,780,000 775,730 -950,000 $1,605,730 $7,520,000 1,605,730 - 150,000 $8,975,730 Balance sheet: Assets Cash Accounts receivable Inventory Equity Investment PPE, net $425,000 852,000 2,560,000 2,702,680 6,671,910 13,211,590 Liabilities and Stockholders' Equity Current liabilities Long-term Liabilities Common Stock APIC Retained Earnings Cumulative Translation Adjustment $318,210 2,300,000 165,800 1,850,000 8,975,730 -398,150 $13,211,590