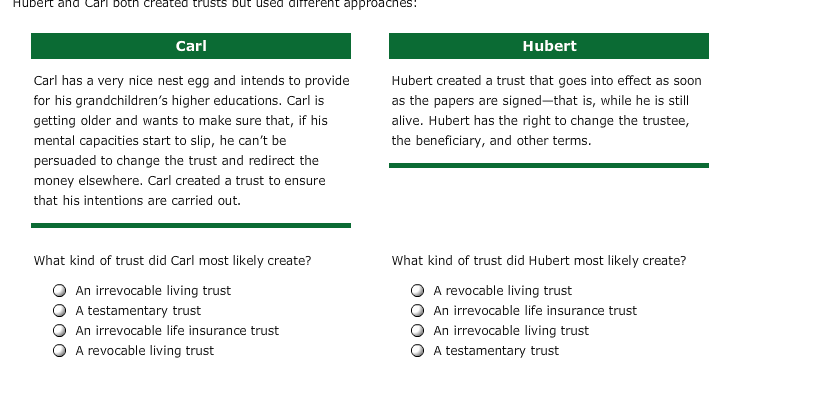

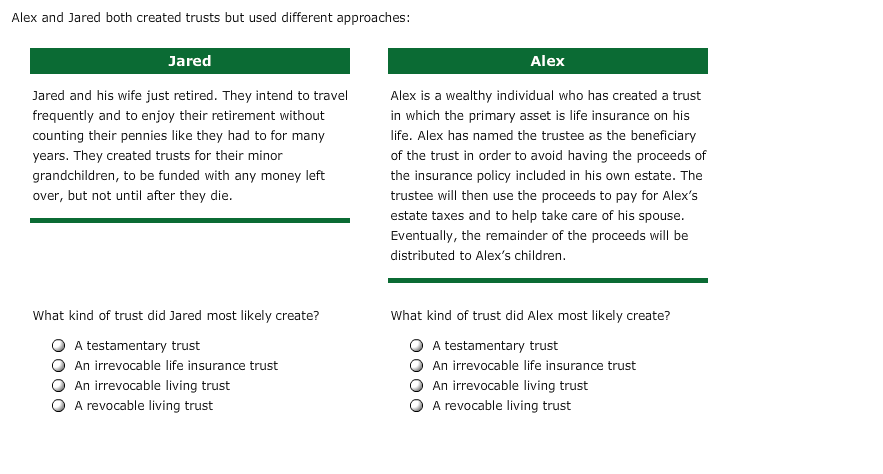

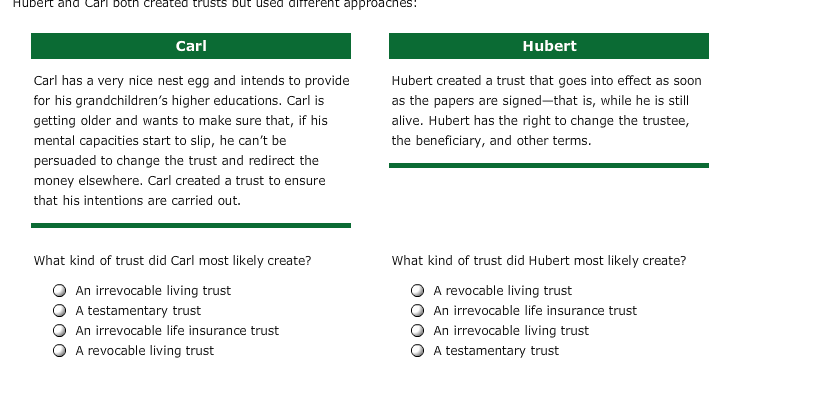

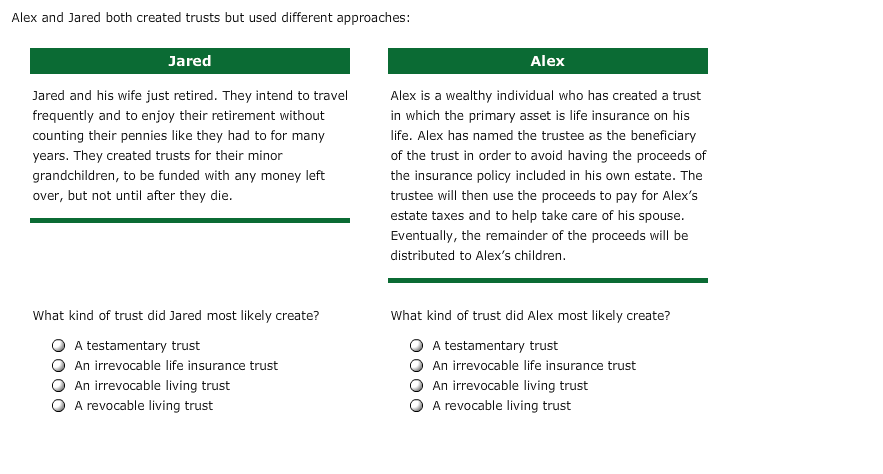

7. Using trusts to transfer assets from an estate Aa Aa Trusts facilitate the transfer of property (and the income from that property) from an estate to another party. A trust is a legal relationship created when one party, the grantor , transfers property to a second party, the trustee (which may be an organization or an individual), for the benefit of one or more third parties, the beneficiaries The property placed in the trust is called the trust principal or res (the Latin word for thing or possession). Trusts are used for various purposes, but the most common reasons for using a trust to transfer assets from an estate are (1) to attain income and estate tax savings and (2) to conserve property over a long period time. Consider the following scenarios. Hubert and Carl both created trusts but used different approaches: Hubert and Carl both created trusts but used altrerent approaches: Carl Hubert Carl has a very nice nest egg and intends to provide for his grandchildren's higher educations. Carl is getting older and wants to make sure that, if his mental capacities start to slip, he can't be persuaded to change the trust and redirect the money elsewhere. Carl created a trust to ensure that his intentions are carried out. Hubert created a trust that goes into effect as soon as the papers are signedthat is, while he is still alive. Hubert has the right to change the trustee, the beneficiary, and other terms. What kind of trust did Carl most likely create? An irrevocable living trust A testamentary trust An irrevocable life insurance trust A revocable living trust What kind of trust did Hubert most likely create? A revocable living trust An irrevocable life insurance trust An irrevocable living trust A testamentary trust Alex and Jared both created trusts but used different approaches: Jared Alex Jared and his wife just retired. They intend to travel frequently and to enjoy their retirement without counting their pennies like they had to for many years. They created trusts for their minor grandchildren, to be funded with any money left over, but not until after they die. Alex is a wealthy individual who has created a trust in which the primary asset is life insurance on his life. Alex has named the trustee as the beneficiary of the trust in order to avoid having the proceeds of the insurance policy included in his own estate. The trustee will then use the proceeds to pay for Alex's estate taxes and to help take care of his spouse. Eventually, the remainder of the proceeds will be distributed to Alex's children. What kind of trust did Jared most likely create? A testamentary trust An irrevocable life insurance trust An irrevocable living trust A revocable living trust What kind of trust did Alex most likely create? A testamentary trust An irrevocable life insurance trust An irrevocable living trust A revocable living trust