Answered step by step

Verified Expert Solution

Question

1 Approved Answer

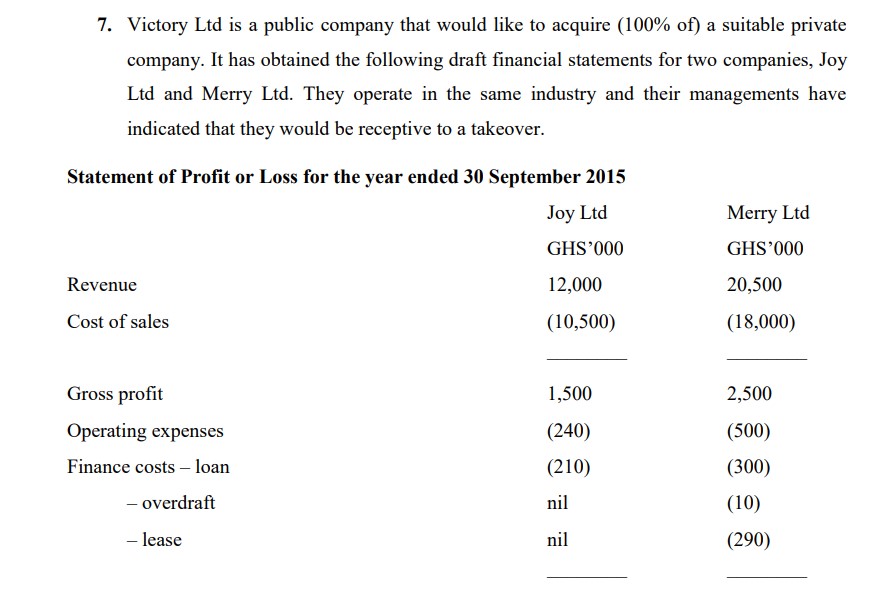

7. Victory Ltd is a public company that would like to acquire ( 100% of) a suitable private company. It has obtained the following draft

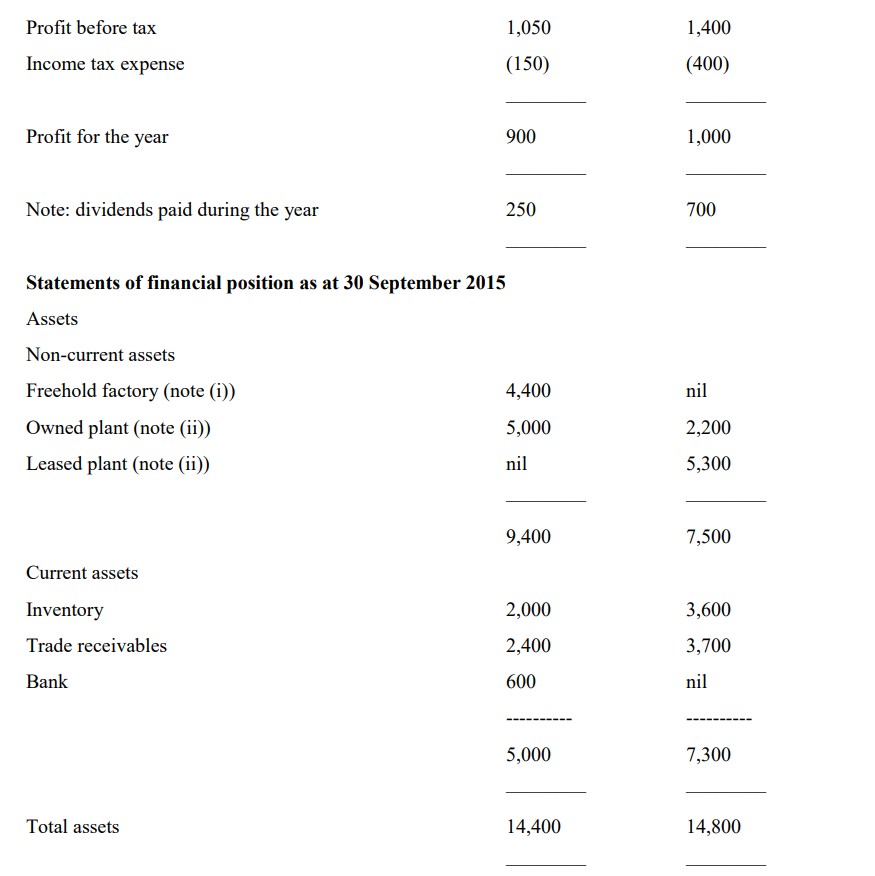

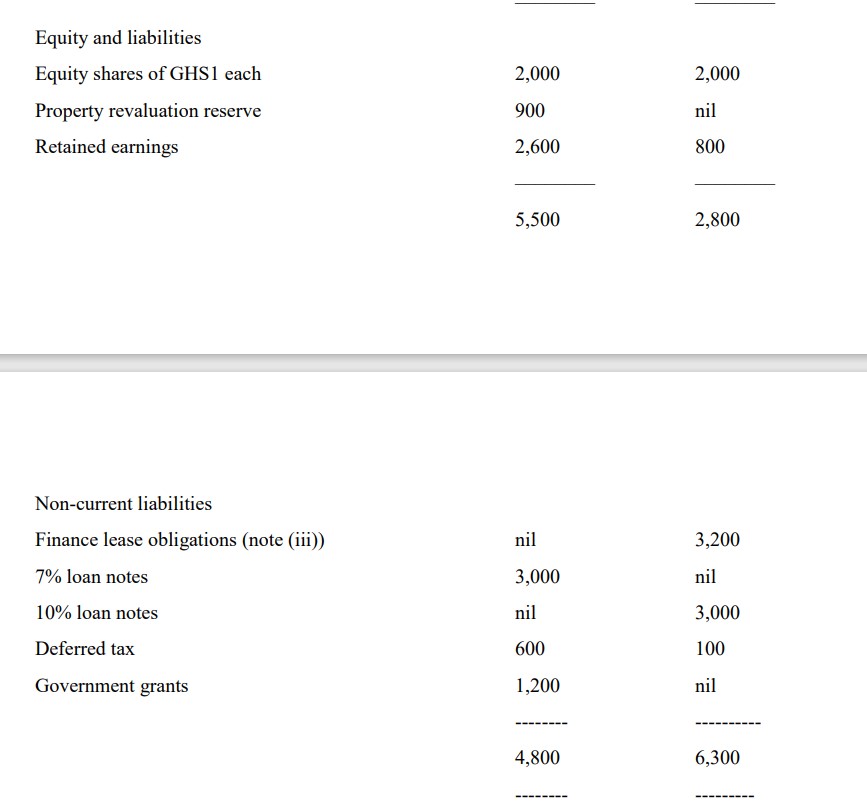

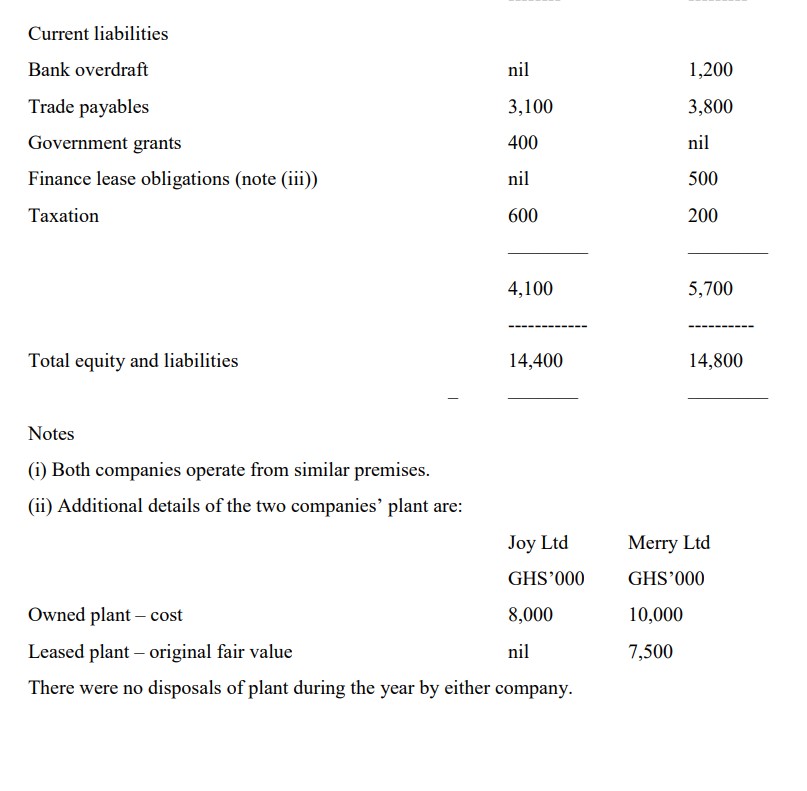

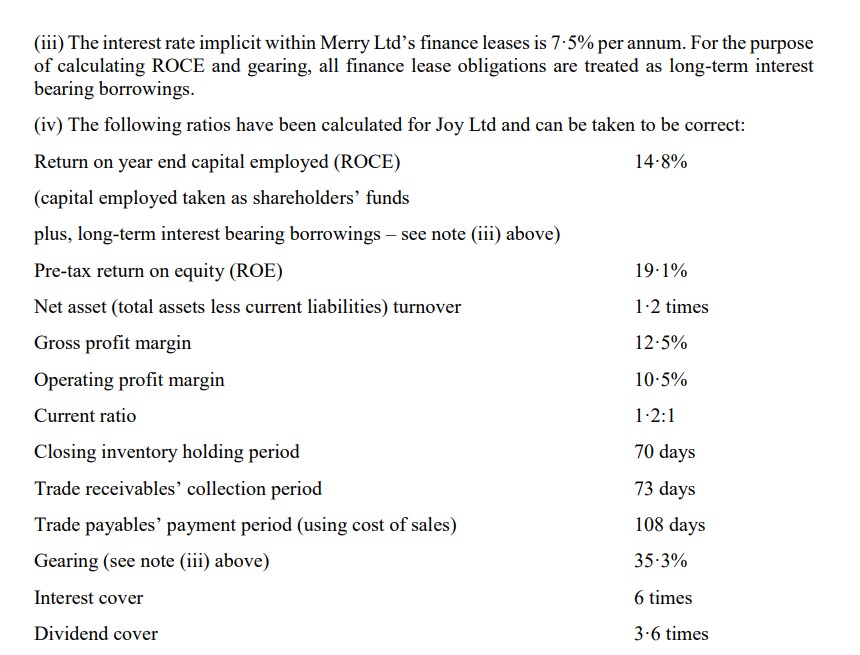

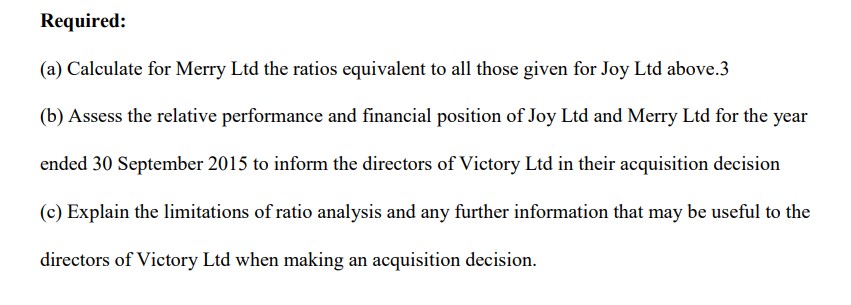

7. Victory Ltd is a public company that would like to acquire ( 100% of) a suitable private company. It has obtained the following draft financial statements for two companies, Joy Ltd and Merry Ltd. They operate in the same industry and their managements have indicated that they would be receptive to a takeover. \begin{tabular}{lll} Profit before tax & 1,050 & 1,400 \\ Income tax expense & (150) & 1,400) \\ Profit for the year & -900 & 7000 \\ Note: dividends paid during the year & -250 & -700 \\ \hline \end{tabular} Statements of financial position as at 30 September 2015 Assets Non-current assets Freehold factory (note (i)) Owned plant (note (ii)) Leased plant (note (ii)) 4,400 nil 5,0002,200 nil 5,300 9,400 7,500 Current assets Inventory Trade receivables 2,000 2,400 600 5,000 3,600 Bank Total assets 14,400 3,700 nil 7,300 14,800 Equity and liabilities Equity shares of GHS1 each Property revaluation reserve Retained earnings 2,0009002,6005,5002,000nil8002,800 Non-current liabilities Financeleaseobligations(note(iii))7%loannotes10%loannotesDeferredtaxGovernmentgrantsnil3,000nil6001,2004,8003,200nil3,000100nil6,300 (i) Both companies operate from similar premises. (ii) Additional details of the two companies' plant are: (iii) The interest rate implicit within Merry Ltd's finance leases is 75% per annum. For the purpose of calculatino ROCF and oearino all finance lease ohlioations are treated as lono-term interest Required: (a) Calculate for Merry Ltd the ratios equivalent to all those given for Joy Ltd above.3 (b) Assess the relative performance and financial position of Joy Ltd and Merry Ltd for the year ended 30 September 2015 to inform the directors of Victory Ltd in their acquisition decision (c) Explain the limitations of ratio analysis and any further information that may be useful to the directors of Victory Ltd when making an acquisition decision

7. Victory Ltd is a public company that would like to acquire ( 100% of) a suitable private company. It has obtained the following draft financial statements for two companies, Joy Ltd and Merry Ltd. They operate in the same industry and their managements have indicated that they would be receptive to a takeover. \begin{tabular}{lll} Profit before tax & 1,050 & 1,400 \\ Income tax expense & (150) & 1,400) \\ Profit for the year & -900 & 7000 \\ Note: dividends paid during the year & -250 & -700 \\ \hline \end{tabular} Statements of financial position as at 30 September 2015 Assets Non-current assets Freehold factory (note (i)) Owned plant (note (ii)) Leased plant (note (ii)) 4,400 nil 5,0002,200 nil 5,300 9,400 7,500 Current assets Inventory Trade receivables 2,000 2,400 600 5,000 3,600 Bank Total assets 14,400 3,700 nil 7,300 14,800 Equity and liabilities Equity shares of GHS1 each Property revaluation reserve Retained earnings 2,0009002,6005,5002,000nil8002,800 Non-current liabilities Financeleaseobligations(note(iii))7%loannotes10%loannotesDeferredtaxGovernmentgrantsnil3,000nil6001,2004,8003,200nil3,000100nil6,300 (i) Both companies operate from similar premises. (ii) Additional details of the two companies' plant are: (iii) The interest rate implicit within Merry Ltd's finance leases is 75% per annum. For the purpose of calculatino ROCF and oearino all finance lease ohlioations are treated as lono-term interest Required: (a) Calculate for Merry Ltd the ratios equivalent to all those given for Joy Ltd above.3 (b) Assess the relative performance and financial position of Joy Ltd and Merry Ltd for the year ended 30 September 2015 to inform the directors of Victory Ltd in their acquisition decision (c) Explain the limitations of ratio analysis and any further information that may be useful to the directors of Victory Ltd when making an acquisition decision Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started