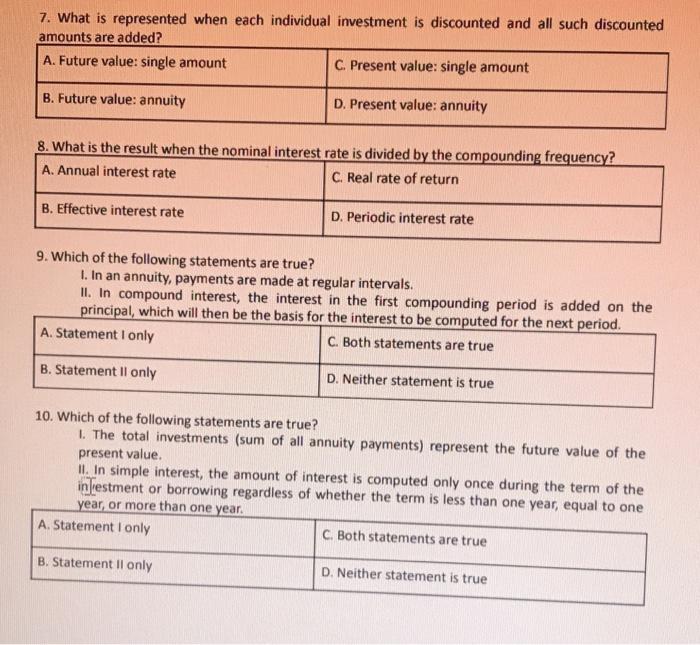

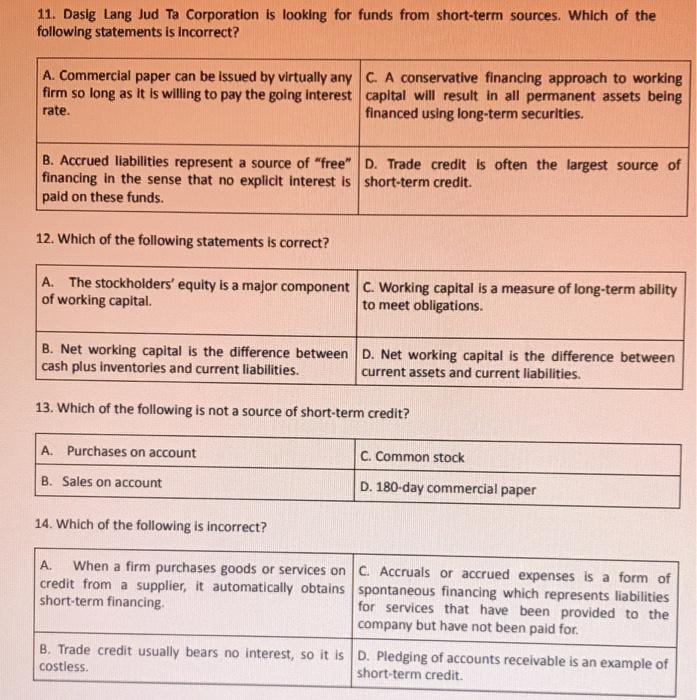

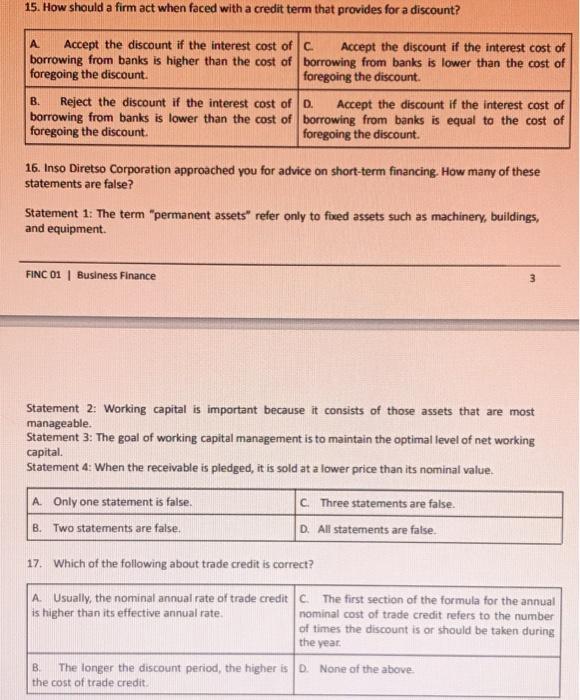

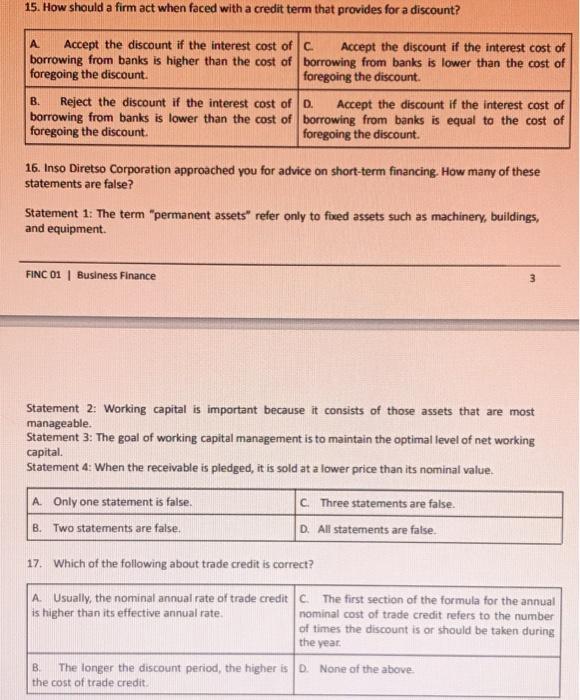

7. What is represented when each individual investment is discounted and all such discounted amounts are added? A. Future value: single amount C. Present value: single amount B. Future value: annuity D. Present value: annuity 8. What is the result when the nominal interest rate is divided by the compounding frequency? A. Annual interest rate C. Real rate of return B. Effective interest rate D. Periodic interest rate 9. Which of the following statements are true? I. In an annuity, payments are made at regular intervals. II. In compound interest, the interest in the first compounding period is added on the principal, which will then be the basis for the interest to be computed for the next period. A. Statement I only C. Both statements are true B. Statement Il only D. Neither statement is true 10. Which of the following statements are true? 1. The total investments (sum of all annuity payments) represent the future value of the present value. II. In simple interest, the amount of interest is computed only once during the term of the inliestment or borrowing regardless of whether the term is less than one year, equal to one year, or more than one year. A. Statement I only C. Both statements are true B. Statement ll only D. Neither statement is true 11. Dasig Lang Jud Ta Corporation is looking for funds from short-term sources. Which of the following statements is incorrect? A. Commercial paper can be issued by virtually any C. A conservative financing approach to working firm so long as it is willing to pay the going interest capital will result in all permanent assets being rate. financed using long-term securities. B. Accrued liabilities represent a source of "free" D. Trade credit is often the largest source of financing in the sense that no explicit interest is short-term credit. paid on these funds. 12. Which of the following statements is correct? A. The stockholders' equity is a major component C. Working capital is a measure of long-term ability of working capital to meet obligations. B. Net working capital is the difference between D. Net working capital is the difference between cash plus inventories and current liabilities. current assets and current liabilities. 13. Which of the following is not a source of short-term credit? A. Purchases on account C. Common stock B. Sales on account D. 180-day commercial paper 14. Which of the following is incorrect? A. When a firm purchases goods or services on C. Accruals or accrued expenses is a form of credit from a supplier, it automatically obtains spontaneous financing which represents liabilities short-term financing for services that have been provided to the company but have not been paid for. B. Trade credit usually bears no interest, so it is D. Pledging of accounts receivable is an example of costless. short-term credit 15. How should a firm act when faced with a credit term that provides for a discount? A Accept the discount if the interest cost of C. Accept the discount if the interest cost of borrowing from banks is higher than the cost of borrowing from banks is lower than the cost of foregoing the discount. foregoing the discount. B. Reject the discount if the interest cost of D. Accept the discount if the interest cost of borrowing from banks is lower than the cost of borrowing from banks is equal to the cost of foregoing the discount. foregoing the discount. 16. Inso Diretso Corporation approached you for advice on short-term financing. How many of these statements are false? Statement 1: The term "permanent assets" refer only to fixed assets such as machinery, buildings, and equipment FINC 01 | Business Finance Statement 2: Working capital is important because it consists of those assets that are most manageable. Statement 3: The goal of working capital management is to maintain the optimal level of net working capital. Statement 4: When the receivable is pledged, it is sold at a lower price than its nominal value. A. Only one statement is false, B. Two statements are false. C Three statements are false. D. All statements are false. 17. Which of the following about trade credit is correct? A. Usually, the nominal annual rate of trade credit c. The first section of the formula for the annual is higher than its effective annual rate. nominal cost of trade credit refers to the number of times the discount is or should be taken during the year . The longer the discount period, the higher is D. None of the above the cost of trade credit