Answered step by step

Verified Expert Solution

Question

1 Approved Answer

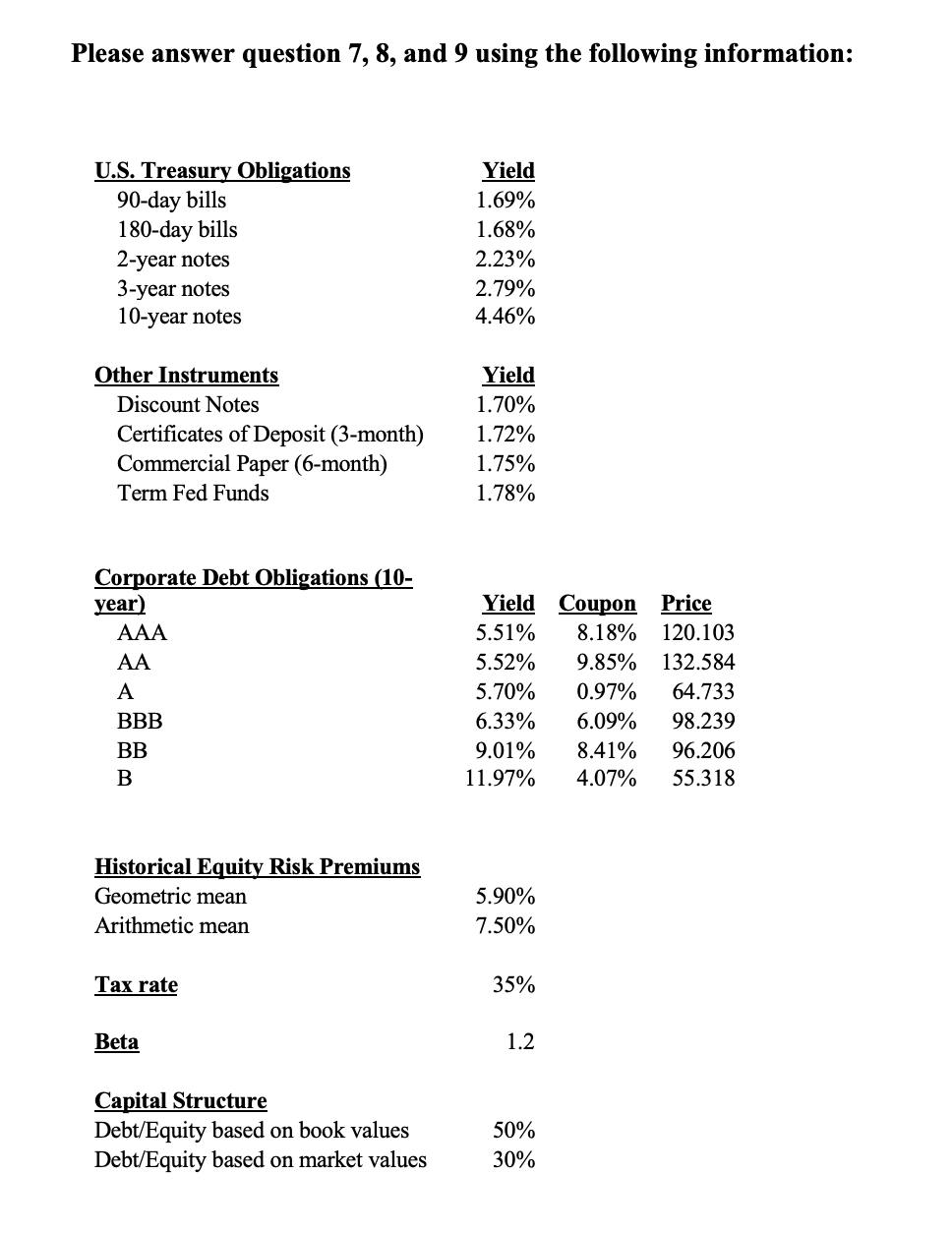

7. What is the cost of equity? 8. What is the weight of equity in WACC calculations? 9. What is the WACC assuming that the

7. What is the cost of equity?

8. What is the weight of equity in WACC calculations?

9. What is the WACC assuming that the firm as A credit rating?

Please answer question 7, 8, and 9 using the following information: U.S. Treasury Obligations 90-day bills 180-day bills 2-year notes 3-year notes 10-year notes Yield 1.69% 1.68% 2.23% 2.79% 4.46% Other Instruments Discount Notes Certificates of Deposit (3-month) Commercial Paper (6-month) Term Fed Funds Yield 1.70% 1.72% 1.75% 1.78% Corporate Debt Obligations (10- year) AAA AA A BBB BB Yield Coupon Price 5.51% 8.18% 120.103 5.52% 9.85% 132.584 5.70% 0.97% 64.733 6.33% 6.09% 98.239 9.01% 8.41% 96.206 11.97% 4.07% 55.318 B Historical Equity Risk Premiums Geometric mean Arithmetic mean 5.90% 7.50% Tax rate 35% Beta 1.2 Capital Structure Debt/Equity based on book values Debt/Equity based on market values 50% 30% Please answer question 7, 8, and 9 using the following information: U.S. Treasury Obligations 90-day bills 180-day bills 2-year notes 3-year notes 10-year notes Yield 1.69% 1.68% 2.23% 2.79% 4.46% Other Instruments Discount Notes Certificates of Deposit (3-month) Commercial Paper (6-month) Term Fed Funds Yield 1.70% 1.72% 1.75% 1.78% Corporate Debt Obligations (10- year) AAA AA A BBB BB Yield Coupon Price 5.51% 8.18% 120.103 5.52% 9.85% 132.584 5.70% 0.97% 64.733 6.33% 6.09% 98.239 9.01% 8.41% 96.206 11.97% 4.07% 55.318 B Historical Equity Risk Premiums Geometric mean Arithmetic mean 5.90% 7.50% Tax rate 35% Beta 1.2 Capital Structure Debt/Equity based on book values Debt/Equity based on market values 50% 30%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started