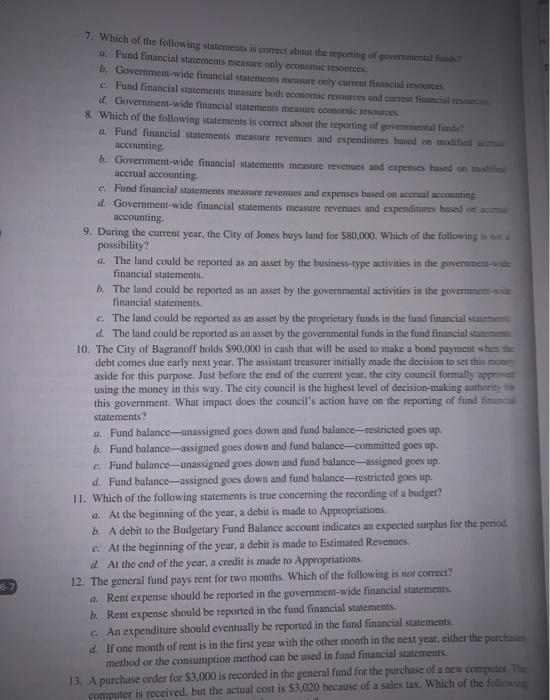

7. Which of the following statements incorrect about the reporting of governmental funds a. Fund financial statements measure only economic resources . Government-wide financial statements measure only content financial e Fund financial statements measure both economic resources and current financial d. Government-wide financial statements measure economic resource 8. Which of the following statements is correct about the reporting of povemental funds a. Fund financial statements measure revenues and expenditures hased on modified accounting b. Government-wide financial statements measure revenues and expenses based on mod accrual accounting c. Fund financial statements measure revenues and expenses based on accrual accounting d. Government-wide financial statements measure revenues and expenditures based on a accounting 9. During the current year, the City of Jones buys land for $80,000. Which of the following is possibility? a. The land could be reported as an asset by the business-type activities in the government financial statements. h. The land could be reported as an asset by the governmental activities in the govermeme financial statements. c. The land could be reported as an asset by the proprietary funds in the fund financial state d. The land could be reported as an asset by the governmental funds in the fund financial stateme 10. The City of Bagranoff holds $90,000 in cash that will be used to make a bond payment whes debt comes due early next year. The assistant treasurer initially made the decision to set this aside for this purpose. Just before the end of the current year, the city council formally pro using the money in this way. The city council is the highest level of decision-making mothority this government. What impact does the council's action have on the reporting of fund fin statements? a. Fund balance-unassigned goes down and fund balance-restricted goes up. b. Fund balance assigned goes down and fund balance-committed goes up. c Fund balance-unassigned goes down and fund balance assigned goes up. d. Fund balance-assigned goes down and fund balance-restricted goes up. 11. Which of the following statements is true concerning the recording of a budget? a. At the beginning of the year, a debit is made to Appropriations b. A debit to the Budgetary Fund Balance account indicates an expected surplus for the period c. At the beginning of the year, a debit is made to Estimated Revenues. d. At the end of the year, a credit is made to Appropriations. 12. The general fund pays rent for two months. Which of the following is not correct? a. Rent expense should be reported in the government-wide financial statements. b. Rent expense should be reported in the fund financial statements c. An expenditure should eventually be reported in the fund financial statements d. If one month of rent is in the first year with the other month in the next year, either the purchase method or the consumption method can be used in fund financial statements 13. A purchase order for $3.000 is recorded in the general fund for the purchase of a new computer. The computer is received, but the actual cost is $3,020 because of a sales tax. Which of the follow 6-7