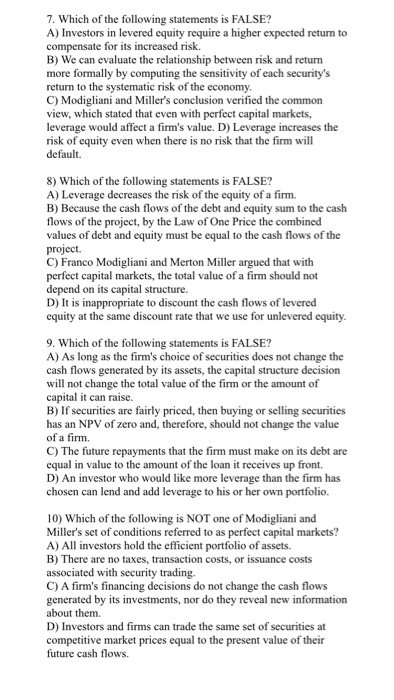

7. Which of the following statements is FALSE? A) Investors in levered equity require a higher expected return to compensate for its increased risk. B) We can evaluate the relationship between risk and return more formally by computing the sensitivity of each security's return to the systematic risk of the economy. C) Modigliani and Miller's conclusion verified the common view, which stated that even with perfect capital markets, leverage would affect a firm's value. D) Leverage increases the risk of equity even when there is no risk that the firm will default. 8) Which of the following statements is FALSE? A) Leverage decreases the risk of the equity of a firm. B) Because the cash flows of the debt and equity sum to the cash flows of the project, by the Law of One Price the combined values of debt and equity must be equal to the cash flows of the project. C) Franco Modigliani and Merton Miller argued that with perfect capital markets, the total value of a firm should not depend on its capital structure. D) It is inappropriate to discount the cash flows of levered equity at the same discount rate that we use for unlevered equity. 9. Which of the following statements is FALSE? A) As long as the firm's choice of securities does not change the cash flows generated by its assets, the capital structure decision will not change the total value of the firm or the amount of capital it can raise. B) If securities are fairly priced, then buying or selling securities has an NPV of zero and, therefore, should not change the value of a firm. C) The future repayments that the firm must make on its debt are equal in value to the amount of the loan it receives up front. D) An investor who would like more leverage than the firm has chosen can lend and add leverage to his or her own portfolio. 10) Which of the following is NOT one of Modigliani and Miller's set of conditions referred to as perfect capital markets? A) All investors hold the efficient portfolio of assets. B) There are no taxes, transaction costs, or issuance costs associated with security trading. C) A firm's financing decisions do not change the cash flows generated by its investments, nor do they reveal new information about them. D) Investors and firms can trade the same set of securities at competitive market prices equal to the present value of their future cash flows