Answered step by step

Verified Expert Solution

Question

1 Approved Answer

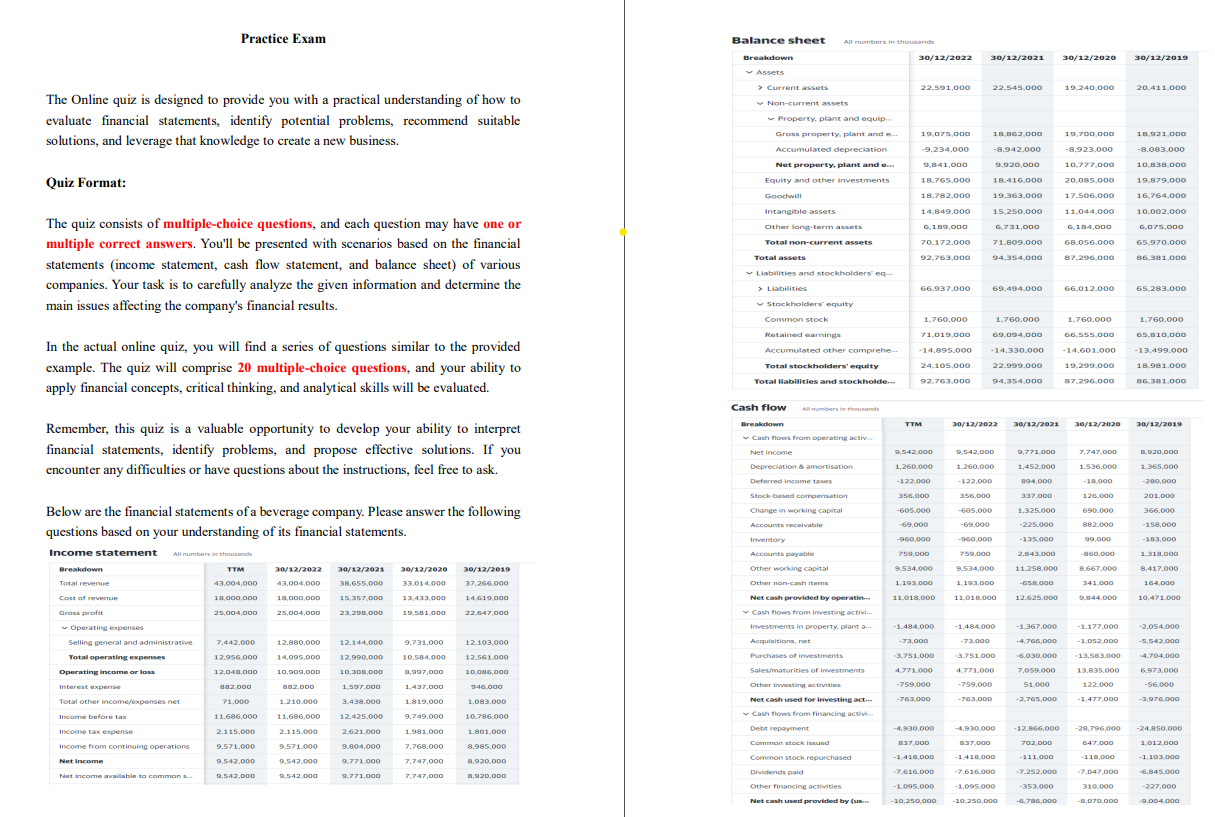

7 . Which of the subsequent strategies could be adopted by this company to tackle the aforementioned issue? a . Outsourcing b . Optimizing the

Which of the subsequent strategies could be adopted by this company to tackle the

aforementioned issue?

a Outsourcing

b Optimizing the capital structure

c Embracing an assetlight approach

d Pursuing diversification

Please identify the primary challenge that this company might be facing:

a Insufficient cash flow to shareholdersb. Sluggish revenue growth postpandemic

c Significant capital expenditures

d Reduced gross profit margin

What might be the rationale for this company having a higher proportion of debt

compared to equity?

a Facilitating substantial capital expenditure

b Enhancing return on equity ROE

c Boosting revenue growth

d Supporting research and development R&D initiatives

Based on the information provided in the financial statements, which of the

following major activities contribute significantly to this company's revenue

generation?

a Capital expenditure investments

b Research and Development R&D activities

c Marketing and brand strategy

d Cost reduction and low selling pricing strategy

What might have been the motive behind the company's financing activities

between and as indicated by the cash flow statement?

a Boosting shareholders return

b Increasing debt and liability

c Improving earnings per share EPS

d Improving future growth

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started