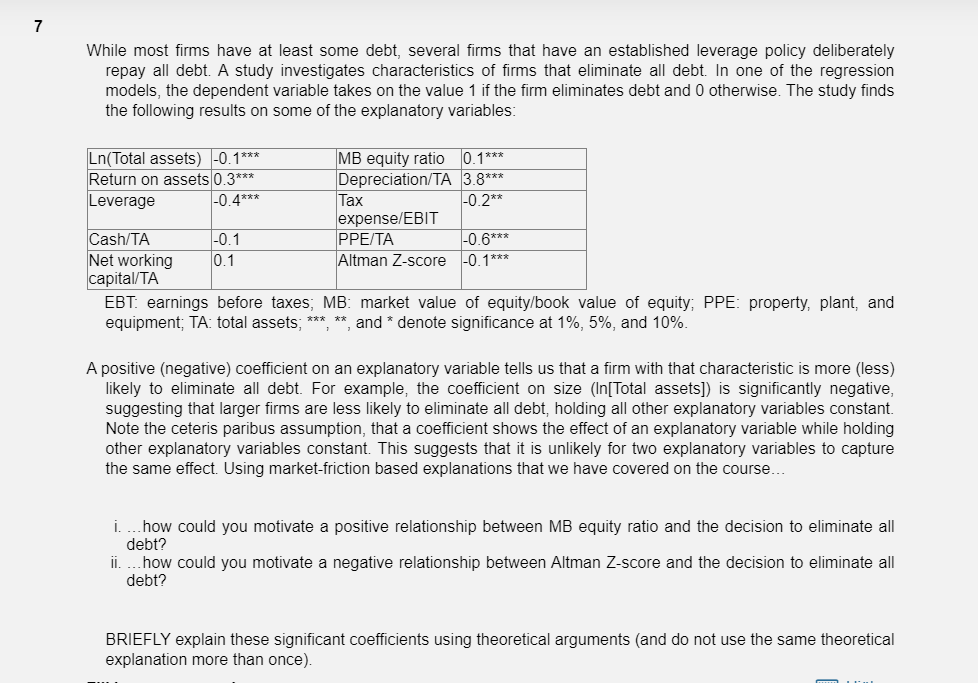

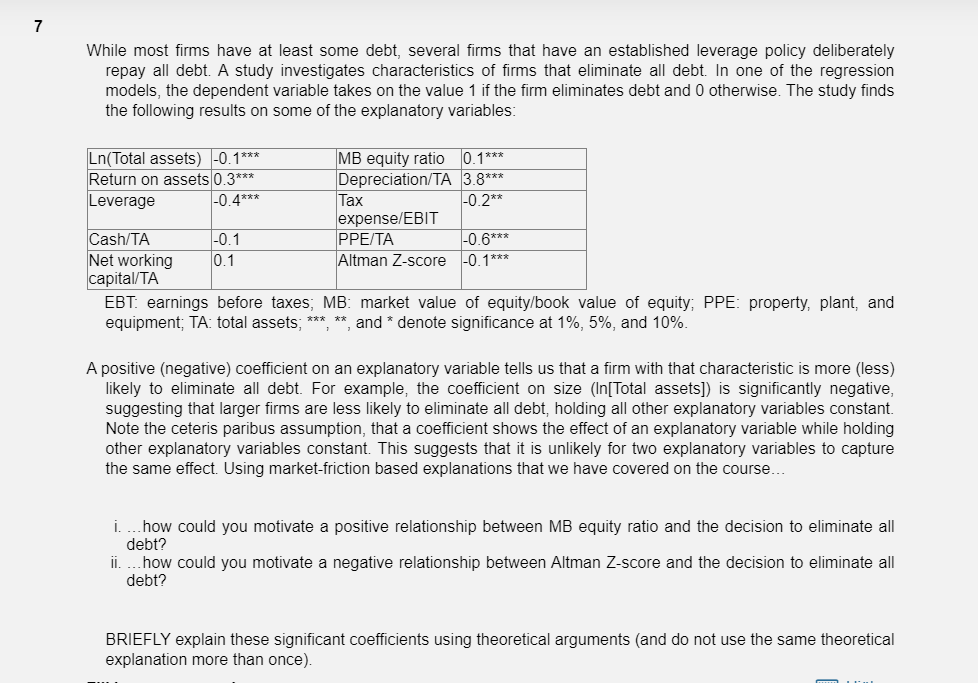

7 While most firms have at least some debt, several firms that have an established leverage policy deliberately repay all debt. A study investigates characteristics of firms that eliminate all debt. In one of the regression models, the dependent variable takes on the value 1 if the firm eliminates debt and otherwise. The study finds the following results on some of the explanatory variables: Ln(Total assets) -0.1*** MB equity ratio 0.1*** Return on assets 0.3*** Depreciation/TA 3.8*** Leverage -0.4*** Tax -0.2** expense/EBIT Cash/TA -0.1 PPE/TA -0.6*** Net working 0.1 Altman Z-score -0.1*** capital/TA EBT: earnings before taxes, MB: market value of equity/book value of equity; PPE: property, plant, and equipment; TA: total assets; **, and * denote significance at 1%, 5%, and 10%. A positive (negative) coefficient on an explanatory variable tells us that a firm with that characteristic is more (less) likely to eliminate all debt. For example, the coefficient on size (In[Total assets]) is significantly negative, suggesting that larger firms are less likely to eliminate all debt, holding all other explanatory variables constant. Note the ceteris paribus assumption, that a coefficient shows the effect of an explanatory variable while holding other explanatory variables constant. This suggests that it is unlikely for two explanatory variables to capture the same effect. Using market-friction based explanations that we have covered on the course... i. how could you motivate a positive relationship between MB equity ratio and the decision to eliminate all debt? how could you motivate a negative relationship between Altman Z-score and the decision to eliminate all debt? ii. BRIEFLY explain these significant coefficients using theoretical arguments (and do not use the same theoretical explanation more than once). 7 While most firms have at least some debt, several firms that have an established leverage policy deliberately repay all debt. A study investigates characteristics of firms that eliminate all debt. In one of the regression models, the dependent variable takes on the value 1 if the firm eliminates debt and otherwise. The study finds the following results on some of the explanatory variables: Ln(Total assets) -0.1*** MB equity ratio 0.1*** Return on assets 0.3*** Depreciation/TA 3.8*** Leverage -0.4*** Tax -0.2** expense/EBIT Cash/TA -0.1 PPE/TA -0.6*** Net working 0.1 Altman Z-score -0.1*** capital/TA EBT: earnings before taxes, MB: market value of equity/book value of equity; PPE: property, plant, and equipment; TA: total assets; **, and * denote significance at 1%, 5%, and 10%. A positive (negative) coefficient on an explanatory variable tells us that a firm with that characteristic is more (less) likely to eliminate all debt. For example, the coefficient on size (In[Total assets]) is significantly negative, suggesting that larger firms are less likely to eliminate all debt, holding all other explanatory variables constant. Note the ceteris paribus assumption, that a coefficient shows the effect of an explanatory variable while holding other explanatory variables constant. This suggests that it is unlikely for two explanatory variables to capture the same effect. Using market-friction based explanations that we have covered on the course... i. how could you motivate a positive relationship between MB equity ratio and the decision to eliminate all debt? how could you motivate a negative relationship between Altman Z-score and the decision to eliminate all debt? ii. BRIEFLY explain these significant coefficients using theoretical arguments (and do not use the same theoretical explanation more than once)