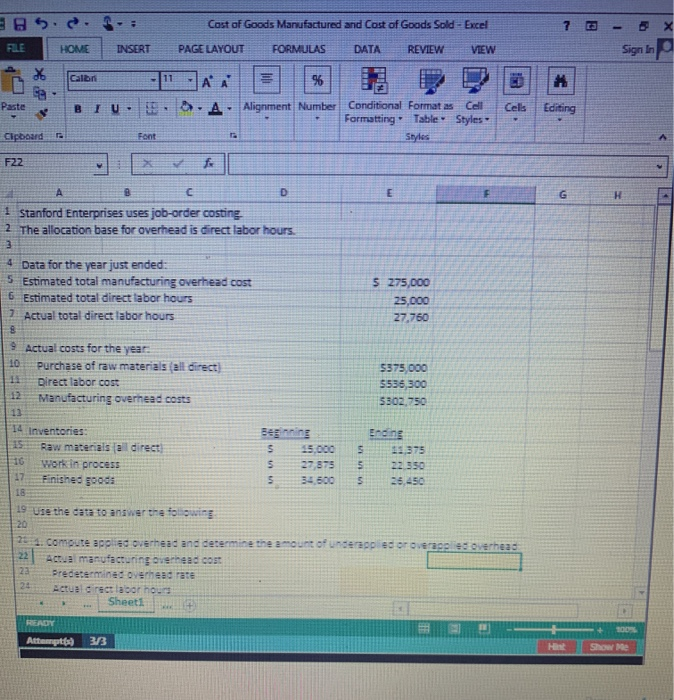

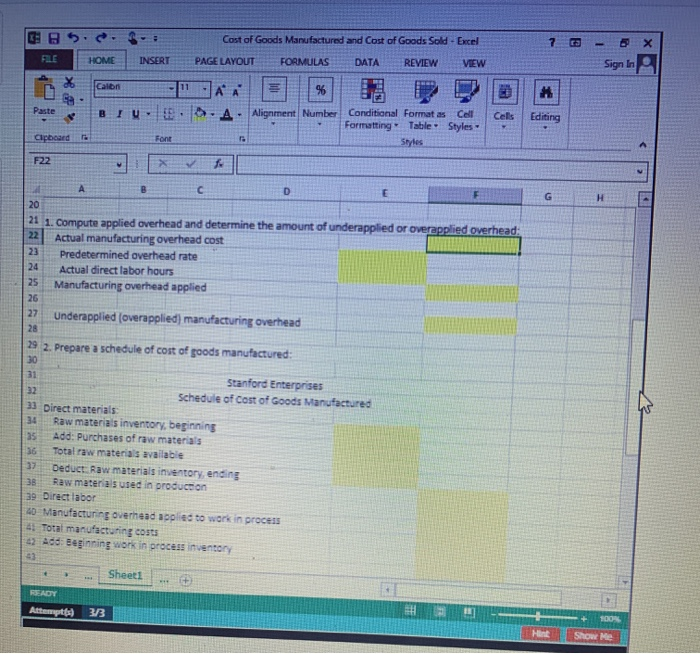

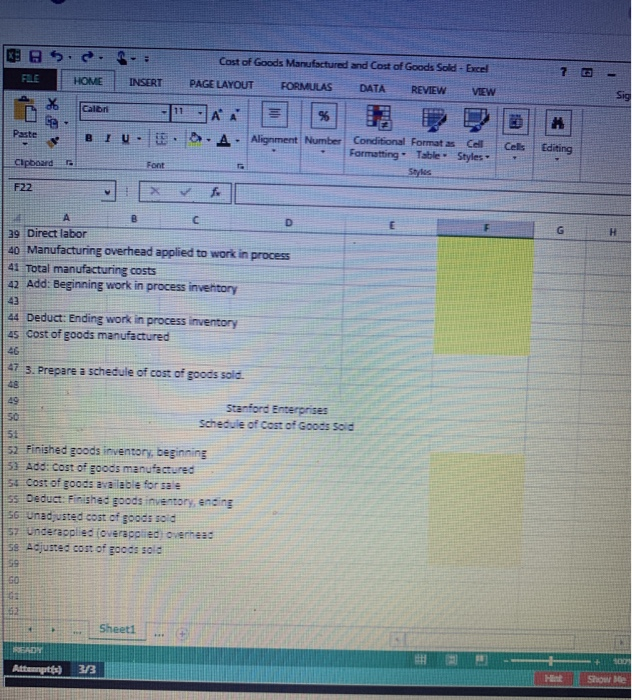

7 - X Cost of Goods Manufactured and Cost of Goods Sold - Excel PAGE LAYOUT FORMULAS DATA REVIEW VIEW FILE HOME INSERT Sign In % Calban 11 A A Paste BIU Alignment Number Cels Editing Conditional Format as Cell Formatting Table Styles Styles Clipboard Fant F22 f E F H A 8 c D 1 Stanford Enterprises uses job-order costing 2 The allocation base for overhead is direct labor hours. 4 Data for the year just ended: 5 Estimated total manufacturing overhead cost $ 275,000 6 Estimated total direct labor hours 25,000 7 Actual total direct labor hours 27.760 8 9 Actual costs for the year 10 Purchase of raw materials fall direct) 5375, 000 Direct labor cost 5536,300 12 Manufacturing overhead costs 5302.750 12 14 Inventories: Ending Raw materials (al direct 5 15.000 S 19375 16 Work in process 5 27.575 5 22.350 17 Finished goods 5 34.500 5 26,450 18 19 Use the data to answer the following: 20 20. 1. compute applied overhead and determine the amount of underopied or overage overhead Actual manufacturing overhead cost 23 Predetermined overhead Tate 24 Actual direct labor hour Sheet1 READY 00 Attempt 3/3 H Show Me Cost of Goods Manufactured and Cost of Goods Sold - Excel 7 ca HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In X Calon 11 A A % Paste BIU. A. Alignment Number Cels Editing Conditional Format as Cell Formatting Table Styles Styles Clipboard Font F22 G H D E F 20 21 1. Compute applied overhead and determine the amount of underapplied or overapplied overhead: 22 Actual manufacturing overhead cost 23 Predetermined overhead rate 24 Actual direct labor hours 25 Manufacturing overhead applied 26 27 Underapplied (overapplied) manufacturing overhead 28 29 2. Prepare a schedule of cost of goods manufactured: 30 31 Stanford Enterprises 32 Schedule of cost of Goods Manufactured 33 Direct materials 34 Raw materials inventory beginning 35 Add: Purchases of raw materials 36 Total raw materials available Deduct. Raw materials inventory, ending 38 Raw materials used in production 39 Direct labor 40 Manufacturing overhead applied to work in process 41 Total manufacturing costs 43 0 Beginning work in process inventory 43 Sheet1 *** READY Attempt 3/3 100 Mint Show Me 3 Cost of Goods Manufactured and Cost of Goods Sold - Excel FLE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Calon 11 A A % # Paste BIU. Cells Alignment Number Conditional Format as Cal Formatting Table Styles Styles Editing Clipboard Font F22 fo D G H A B c 39 Direct labor 40 Manufacturing overhead applied to work in process 41 Total manufacturing costs 42 Add: Beginning work in process inventory 43 44 Deduct: Ending work in process inventory 45 Cost of goods manufactured 47 3. Prepare a schedule of cost of goods sold Stanford Enterprises 50 Schedule of Cost of Goods Sold 57 52 Finished goods inventory, beginning 5) Add cost of goods manufactured 5: Cost of goods available for sale ss Deduct: Finished goods inventory ending 56 unadjusted cost of goods sold 57 Underapplied foverapplied overhead 59 Adjusted cost of goods sold 59 50 Sheet1 SADN SOD Attempts) 313 HE Show