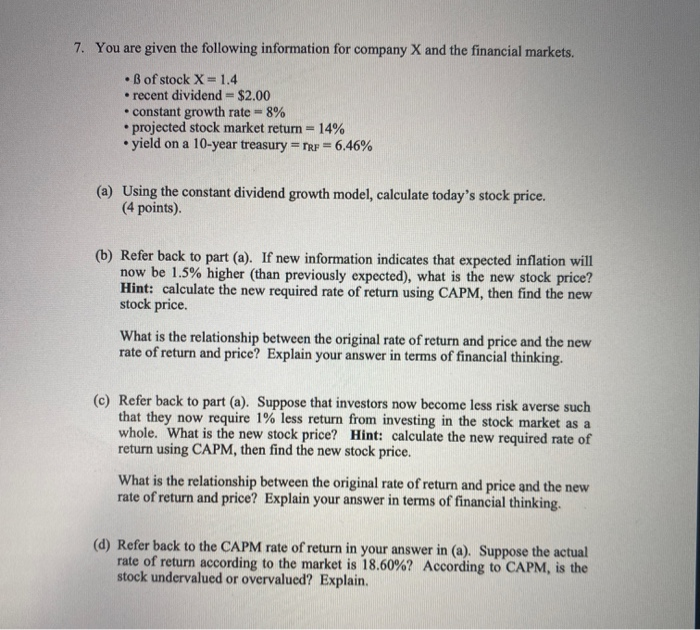

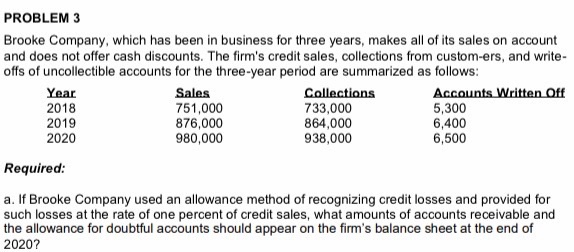

7. You are given the following information for company X and the financial markets. . B of stock X=1.4 recent dividend = $2.00 .constant growth rate = 8% projected stock market return = 14% yield on a 10-year treasury = Tre = = 6.46% . . (a) Using the constant dividend growth model, calculate today's stock price. (4 points) (b) Refer back to part (a). If new information indicates that expected inflation will now be 1.5% higher than previously expected), what is the new stock price? Hint: calculate the new required rate of return using CAPM, then find the new stock price. What is the relationship between the original rate of return and price and the new rate of return and price? Explain your answer in terms of financial thinking. c) Refer back to part (a). Suppose that investors now become less risk averse such that they now require 1% less return from investing in the stock market as a whole. What is the new stock price? Hint: calculate the new required rate of return using CAPM, then find the new stock price. What is the relationship between the original rate of return and price and the new rate of return and price? Explain your answer in terms of financial thinking. (d) Refer back to the CAPM rate of return in your answer in (a). Suppose the actual rate of return according to the market is 18.60%? According to CAPM, is the stock undervalued or overvalued? Explain. PROBLEM 3 Brooke Company, which has been in business for three years, makes all of its sales on account and does not offer cash discounts. The firm's credit sales, collections from custom-ers, and write- offs of uncollectible accounts for the three-year period are summarized as follows: Year Sales Collections Accounts Written Off 2018 751,000 733,000 5,300 2019 876,000 864,000 6,400 2020 980,000 938,000 6,500 Required: a. If Brooke Company used an allowance method of recognizing credit losses and provided for such losses at the rate of one percent of credit sales, what amounts of accounts receivable and the allowance for doubtful accounts should appear on the firm's balance sheet at the end of 2020