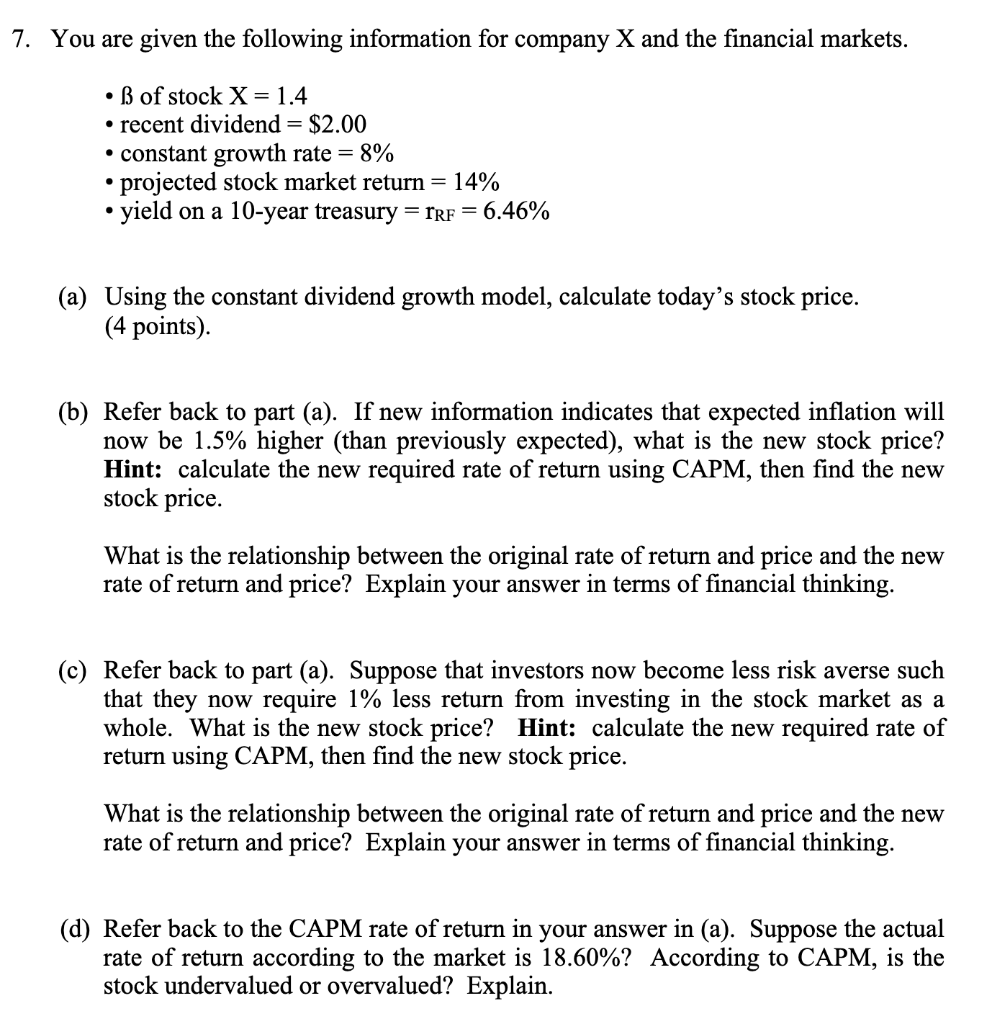

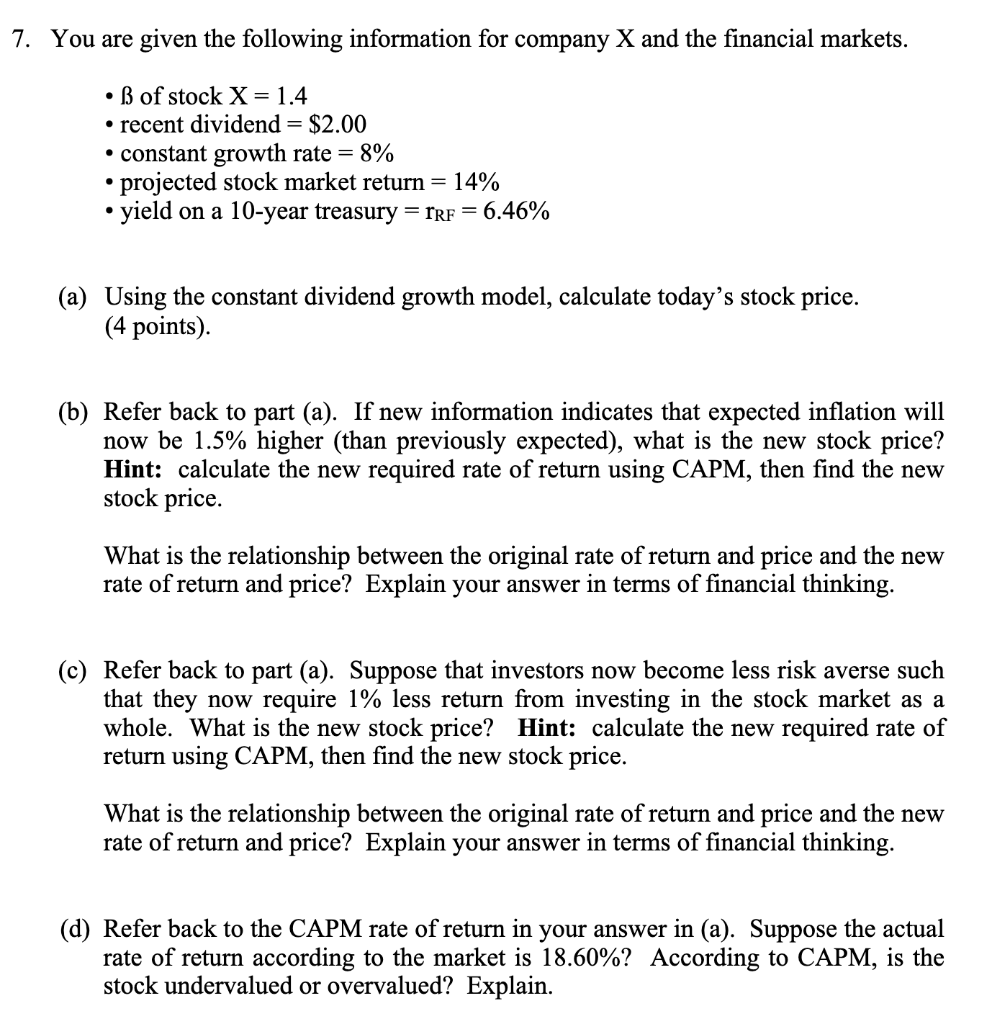

7. You are given the following information for company X and the financial markets. B of stock X= 1.4 recent dividend = $2.00 constant growth rate = 8% projected stock market return = 14% yield on a 10-year treasury =rRF = 6.46% . (a) Using the constant dividend growth model, calculate today's stock price. (4 points). (b) Refer back to part (a). If new information indicates that expected inflation will now be 1.5% higher (than previously expected), what is the new stock price? Hint: calculate the new required rate of return using CAPM, then find the new stock price. What is the relationship between the original rate of return and price and the new rate of return and price? Explain your answer in terms of financial thinking. (c) Refer back to part (a). Suppose that investors now become less risk averse such that they now require 1% less return from investing in the stock market as a whole. What is the new stock price? Hint: calculate the new required rate of return using CAPM, then find the new stock price. What is the relationship between the original rate of return and price and the new rate of return and price? Explain your answer in terms of financial thinking. (d) Refer back to the CAPM rate of return in your answer in (a). Suppose the actual rate of return according to the market is 18.60%? According to CAPM, is the stock undervalued or overvalued? Explain. 7. You are given the following information for company X and the financial markets. B of stock X= 1.4 recent dividend = $2.00 constant growth rate = 8% projected stock market return = 14% yield on a 10-year treasury =rRF = 6.46% . (a) Using the constant dividend growth model, calculate today's stock price. (4 points). (b) Refer back to part (a). If new information indicates that expected inflation will now be 1.5% higher (than previously expected), what is the new stock price? Hint: calculate the new required rate of return using CAPM, then find the new stock price. What is the relationship between the original rate of return and price and the new rate of return and price? Explain your answer in terms of financial thinking. (c) Refer back to part (a). Suppose that investors now become less risk averse such that they now require 1% less return from investing in the stock market as a whole. What is the new stock price? Hint: calculate the new required rate of return using CAPM, then find the new stock price. What is the relationship between the original rate of return and price and the new rate of return and price? Explain your answer in terms of financial thinking. (d) Refer back to the CAPM rate of return in your answer in (a). Suppose the actual rate of return according to the market is 18.60%? According to CAPM, is the stock undervalued or overvalued? Explain